Insights

The powerful and wide-ranging effects of currency exchange rates

Share this article

For most people, currency exchange rates are numbers in small print buried in the business section of a newspaper or an app they check before an international trip. But given the potential effects those tiny numbers can have on the lives of people or the fortunes of nations, it would be fitting to list them on the front page next to the day’s forecast. Currency exchange rates can be like the weather, changing quickly and dramatically with outcomes ranging from pleasant and calm to stormy and unsettled.

Most people don’t typically deal with exchange rates. Instead, their transactions are in local currency – let's say the US dollar (USD). They’re paid in dollars, the rent or mortgage is in USD and the car payment is in the same currency. Those amounts can occasionally change, but they usually don’t fluctuate.

Currency exchange for traveling and Big Macs

It’s different for international travelers who need to exchange USD for the local currency. The occasional traveler buying small amounts of currency might not realize that the price of the local currency is different today than it was last month or last year. Frequent travelers, on the other hand, are likely much more aware of how currency exchange rates can change.

In late September 2024, a British pound cost $1.34 but in mid-January 2025 a pound cost just $1.22. The move down in the rate – a 9% decrease – shows that the size of currency changes can be significant. Currency exchange rates can make the price of the same item vastly different.

The Big Mac index

The Economist developed an exchange rate model to compare the cost of items from one country to the next; the underlying principle of the model is that exchange rates should adjust to keep prices the same across borders.

The model’s input is the price of a McDonald’s Big Mac.

Source: Getty images

If you bought a Big Mac in South Africa in March 2025 (latest data at writing) for 51.90 South African rand when the US dollar – rand exchange rate was 18.16 rand per dollar, you’d cheer because the converted cost would have been $2.85, far cheaper than the average Big Mac cost of $5.69 in the US. But your cheers would have changed to groans if you bought a Big Mac in Switzerland. In the land of watches and chocolate, you would have paid 7.10 Swiss francs or an equivalent $8.05.

Outrageous, you’d say – over $8 for a Big Mac!

Currency exchange and foreign assets

Not only can currency exchange rates be misaligned, but their fluctuation can result in gains and losses for holders of foreign assets. Owners of international equities buy their shares in local currency and hope to profit from rises in the local currency price of the stock. But changes in the exchange rate can also boost – or reduce – the profit.

The table below presents the situation where the price of a foreign equity was unchanged over the year, but the US investor still profited because of the change in the exchange rate.

| Local (Euro) equity price | Euro – dollar rate exchange | Equity dollar value | |

| Start of year | €20.00 | $1.10/€ | $22.00 |

| End of year | €20.00 | $1.21/€ | $24.20 |

| Change | 0.0% | 10% | $2.20 (10%) |

If the asset value is large enough, currency rate changes can have stunning effects. If you bought a French vacation home for €1,500,000, an equivalent $1,650,000, the exchange rate suddenly becomes an important benchmark. For not only is the value of your house based on location, location, location, but a penny change in the euro – USD rate changes the value of your home by $15,000. Suddenly you’re constantly checking your phone for the latest euro – US dollar conversion price or addictively watching CNBC for currency news.

Source: Getty images

Owning a foreign asset worth $1.65 million that’s extraordinarily sensitive to movements in a previously unwatched financial number that has nothing to do with the asset’s intrinsic characteristics – except the purchase price – will do that.

Polish Mortgage Holders

Changes in exchange rates can affect not only the value of a house but the mortgage too, much to the chagrin of many Polish mortgage holders. Homeowners took out mortgages denominated in Swiss francs because Swiss interest rates were one-third of those in Polish zlotys. Exchange rates were “predictable”, and the interest rates were so attractive that Swiss borrowing accounted for nearly 8 percent of Poland’s gross domestic product.

Source: Getty images

Polish homeowners became victims of an astonishing currency move when the Swiss National Bank, the nation’s central bank, removed a cap on its currency in mid-January 2015. The original intention of the cap was to keep the Swiss franc from rising in value and harming the nation’s exporters.

After years of supporting the cap, the central bank decided that further support would be too expensive and risky. Overnight, some Polish holders of Swiss franc denominated mortgages saw their monthly payments in Polish zloty soar by 20%.

Currency exchange in history

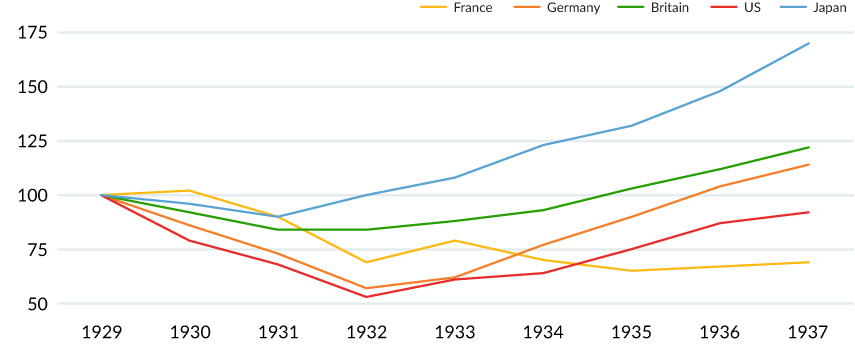

While dramatic and damaging to individuals and firms, manipulating a country’s exchange rate for achieving domestic economic aims is not unusual. In the Great Depression, international trade and finance collapsed after the stock market crash in the autumn of 1929, and countries took unilateral steps to help domestic manufacturers. Nations devalued their currencies to make their exports cheaper and imposed trade tariffs to make imports more expensive. These ‘beggar-thy-neighbor' policies were easy to copy, and as one nation after another undertook the same strategy, international trade almost ground to a halt, worsening the global crisis.

Others take a different view, claiming that those currency devaluations may have worsened economic problems at first, but countries that took themselves off the gold standard and let their currencies devalue experienced improvements in their financial conditions (Figure 1). Freedom from the gold standard allowed countries to take steps to inflate the money supply to stimulate demand.

FIGURE 1 – INDUSTRIAL PRODUCTION DURING THE GREAT DEPRESSION

Source: League of Nations, World production and prices 1937/38 page 44; 1929 index = 0

The Asian currency crisis

Like the Great Depression, the Asian currency crisis of 1997 involved unsupportable fixed exchange rates. But instead of being fixed, or pegged, to gold, these Asian nations’ currencies were pegged to the US dollar.

The central banks of these nations managed the value of their currencies so that they fluctuated up and down with the US currency.

The crisis began in July 1997 when speculators sold large amounts of Thai baht, believing the Thai central bank would be unable to defend the currency’s exchange rate. When that proved true and Thailand allowed the baht exchange rate to fluctuate, the contagion quickly spread throughout the region.

There were many causes of the crisis. Other nations besides Thailand maintained currency pegs to the US dollar. A runup in the value of the dollar beginning in mid-1995 caused these pegged currencies to rise in value, increasing the cost of exports, resulting in an export slowdown and worsening trade imbalances. The countries borrowed large amounts of foreign funds at interest rates that exposed corporations and individuals to high repayment costs when their currency exchange rates fell. Those borrowed funds made their way to the stock and property markets that ballooned in value and became overpriced.

The fallout from the crisis involved political, economic, and social aspects. President Suharto of Indonesia failed to contain widespread rioting that was sparked when hefty price increases followed the revalued rupiah, and was forced to resign after 30 years in power. A politically humiliating and costly $36 billion bailout from the International Monetary Fund was needed to resolve the crisis in the worst-hit nations.

Suharto, second President of the Republic of Indonesia, in 1993 at the start of his sixth term. | Source: Wikimedia Commons

Inflation rose dramatically, increasing to nearly 60 percent in Indonesia and 7.5 percent in South Korea. Increases in food prices were particularly hurtful to the poor who spent large parts of their income on that essential. High prices were compounded by increases in unemployment in the region, rising to 9.6 percent in the Philippines and 7.4 percent in South Korea. Real wages fell, dropping 21% in Thailand and 27% in Indonesia. The emotional turmoil from the crisis was so severe that suicides increased by over 10,000 in Hong Kong, South Korea and Japan.

How currency exchange might affect the US

Currency crises can seem long ago or far away, but it’s not unimaginable that the United States could suffer one. Burgeoning costs for social services like Medicare and Social Security and crushing interest payments from historic levels of debt could be the catalyst for a dollar crisis. In fiscal year 2025 to 31 January, the social programs have consumed 34 percent of government spending; net interest payments are another 13 percent of spending, just a few percent less than national defense outlays.

In a 30 January 2025 Wall Street Journal opinion, the House Budget Chairman Jodey Arrington estimates that by 2035 net interest payments will “...suck up almost a quarter of federal revenues, and about two-thirds of every dollar borrowed will go to finance the debt.” The Budget Chairman worries that higher debt will mean reduced economic growth.

Left unsaid is that unmanageable levels of debt could also result in severe inflation as the US borrows more to pay social program costs and net interest payments. Higher inflation would reduce the value of the US dollar and cause dollar exchange rates to fall gradually – or in frightening large drops.

Electrical circuits and currency exchange

Potential pitfalls for the US dollar show how currency exchange rates are like electrical circuits: running in the background, rarely thought about, essential for modern life. It's not until there’s a disruption that we notice them and worry.

Significant changes in currency exchange rates could reflect concern about economic and political conditions or disasters like armed conflict. Keeping an eye on currency trends and information can explain the ‘why’ of economic events that have life-altering consequences for people and nations.

Explore more currency insights

Understanding currency quotes

Learning how exchange rates are presented and what they signify can offer a clearer view of the economic trends and market forces shaping currency values.

Four strategies to reduce liquidity management stress

Different approaches can help investors manage the liquidity challenges associated with their currency program.

Safe haven currency hedging

Why do US and Swiss pension funds use different currency risk strategies?

Spark

Our quarterly email featuring insights on markets, sectors and investing in what matters