Insights

Understanding currency quotes

Share this article

Demystifying codes and exchange rates

Currencies can be confusing, but they aren’t difficult to understand when you know the basics. To help clear up the confusion, Mesirow will post articles throughout 2025 that cover key topics about currency basics. This series will include explanations on how currencies are quoted (topic of this article), how countries manage their national currencies and the essentials of currency hedging.

Currencies, or foreign exchange, often reflect, and sometimes warn of, geopolitical and economic events. Understanding foreign exchange can offer valuable insights into global affairs.

Let’s dive in.

How currency quotes work

Consider this headline:

“Russian ruble falls from 92 to 98”

At first glance, this might seem backward. Shouldn’t it say the ruble rises from 92 to 98? Or falls from 98 to 92? The confusion arises from how currency exchange rates are quoted.

Let’s clarify.

Breaking down a currency quote

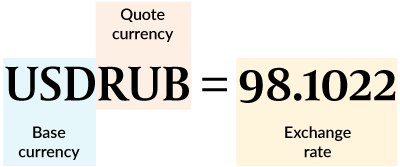

A currency quote typically has two components: the base currency, the quote currency and the exchange rate. These are identified using standardized three-letter codes established by the International Organization for Standardization (ISO). For example:

- USD: United States Dollar

- EUR: Euro

- JPY: Japanese Yen

These codes combine the two-letter ISO country code with the first letter of the currency name. For instance, US + D(ollar) = USD.

However, there are exceptions such as the Russian ruble. In 1998, Russia redenominated its currency, replacing 1,000 old rubles (RUR) with one new ruble (RUB). The ISO code was updated accordingly.

The exchange rate shows how much of the quote currency is equivalent to one unit of the base currency (Figure 1). For example, if the US dollar – Russian ruble exchange rate is 98.1022, it means 1 USD can be exchanged for 98.1022 rubles. Typically, exchange rates are quoted to four decimal places. However, exceptions exist—for instance some traders may use five places, and the Japanese yen is usually quoted to two decimal places. Media reports often drop the decimal portion for clarity.

FIGURE 1: COMPONENTS OF A CURRENCY QUOTE

Translation: One US dollar can be exchanged for 98.1022 Russian rubles

What do changes in exchange rates mean?

If an exchange rate increases, the base currency is said to be strengthening. If it decreases, the base currency is weakening. Because currency pairs reflect the relationship between two currencies, when one currency strengthens, the other weakens.

For example:

- If the Russian ruble exchange rate rises (e.g., from 92 to 98), the base currency – USD – strengthens relative to the RUB.

- And if the USD is strengthening, the RUB is weakening (again, from 92 to 98).

Why the ruble headline causes confusion

Let’s revisit the headline: “Russian ruble falls from 92 to 98.” On the surface, it may seem like the ruble is rising, but the confusion stems from a subtle detail.

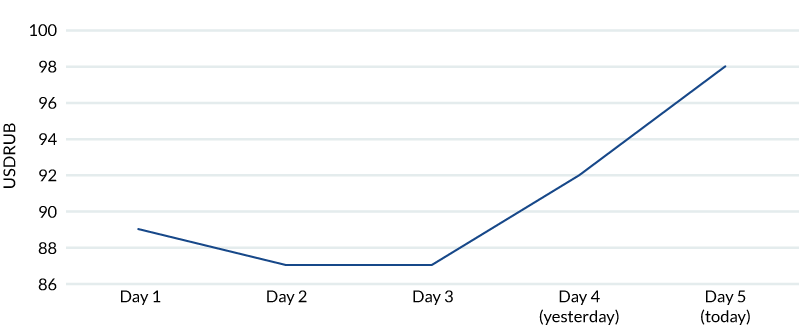

The journalist is indirectly writing about movements in the base currency – the US dollar – but is reporting on the quote currency, the ruble. Yesterday, a dollar was worth 92 rubles; today it’s worth 98 rubles. The US dollar is strengthening and, conversely, the Russian ruble is weakening (Table 1 and Figure 2); it’s the ruble weakness that the journalist wants you to note.

A clearer headline might read: “The dollar rises from 92 to 98 rubles.” The journalist might continue by describing why a stronger dollar / weaker ruble is important to Russian citizens and businesses: a weaker ruble means imports are more expensive, contributing to inflation.

TABLE 1: RUBLES PER US DOLLAR

| USDRUB Exchange rate | |

| Day 1 | 89 |

| Day 2 | 87 |

| Day 3 | 87 |

| Day 4 (yesterday) | 92 |

| Day 5 (today) | 98 |

Figure 2: RUBLES PER US DOLLAR

'The dollar rose from yesterday's rate of 92 to 98' and 'The ruble fell to 98 from yesterday's rate of 92' are equivalent statements.

Why it matters

Understanding currency quotes is the first step in navigating the confusing world of foreign exchange. By learning how exchange rates are presented and what they signify, you’ll gain a clearer view of the economic trends and market forces shaping currency values.

Check back for more insights as we explore the world of currencies and their role in the global economy.

Explore more currency insights

Four strategies to reduce liquidity management stress

Different approaches can help investors manage the liquidity challenges associated with their currency program.

Safe haven currency hedging

Why do US and Swiss pension funds use different currency risk strategies?

Spark

Our quarterly email featuring insights on markets, sectors and investing in what matters