Insights

Safe haven currency hedging

Share this article

Why do US and Swiss pension funds use different currency risk strategies?

When natural disasters strike or danger looms, people seek safe havens. Investors behave similarly: During global turmoil, they transfer funds to stable countries such as Switzerland or the United States. This increases demand for Swiss francs and US dollars, causing these safe haven currencies to appreciate significantly.

As a result, Swiss and US investors face substantial losses in their international portfolios as the foreign currencies in which these investments are priced depreciate against strengthening domestic currencies.

Safe haven currency movements

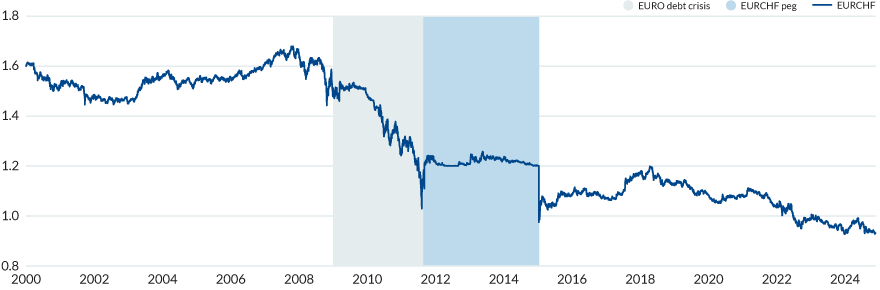

Figure 1 presents two instances of safe haven currency movements. In response to the multi-year European debt crisis, the euro declined steadily against the Swiss franc beginning in 2009 and then dropped sharply in August 2011. In 2015, the Swiss National Bank (SNB) discontinued the Swiss franc /euro peg, shocking investors and causing the euro to crash and the Swiss franc to soar.

FIGURE 1: SWISS FRANCS PER EURO

Source: Bloomberg

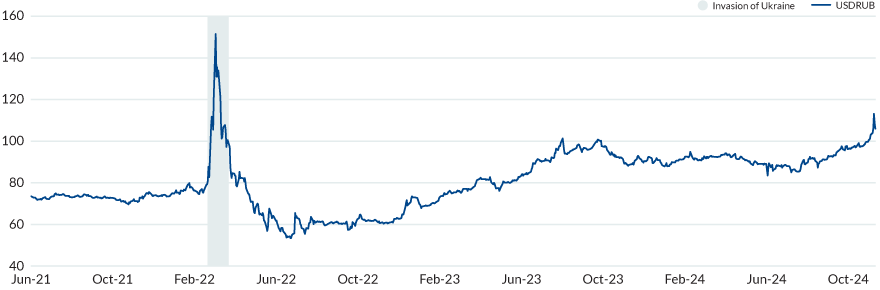

In Figure 2, the Russian invasion of Ukraine on 24 February 2022 led investors to dump Russian rubles and buy US dollars. The ruble recovered briefly but succumbed to a strong upward move in the dollar that began in June 2022. That move was in response to a Russian war economy troubled by a tight labor market, high interest rates and rising inflation.

FIGURE 2: RUSSIAN RUBLES PER DOLLAR

Source: Bloomberg

What explains the difference in Swiss and US currency strategies?

Currency Fluctuations

Investors in safe haven currency countries, such as Switzerland and the US, often experience declines in their international investments due to the gradual depreciation of foreign currencies or sudden currency fluctuations. Swiss investors usually hedge this currency risk, while US investors choose not to.

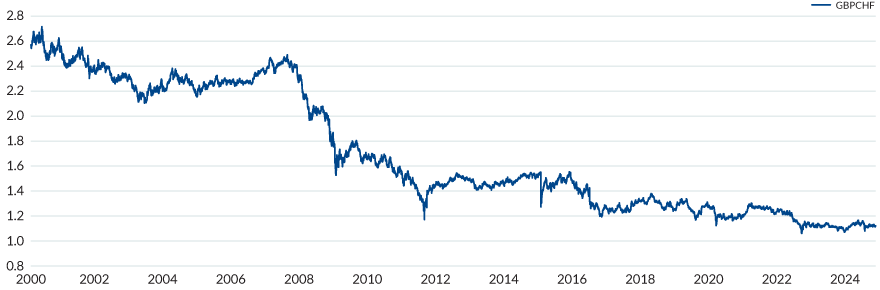

Figure 3 presents the downward trend of the British pound against the Swiss franc, a movement spanning almost 25 years. The consistent increase in the franc means that the value of the currency component of British assets in Swiss portfolios has steadily moved lower; hedging that currency risk would, in most periods, have contributed to better investment performance.

FIGURE 3: SWISS FRANCS PER BRITISH POUND

Source: Bloomberg

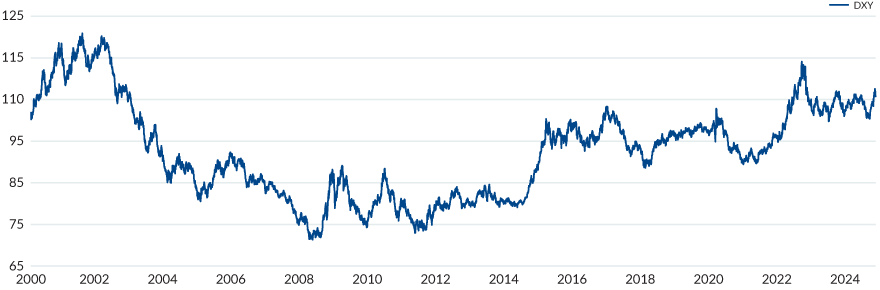

The US dollar experiences more cyclical behavior (Figure 4) compared to the Swiss franc.

FIGURE 4: US DOLLAR INDEX

Source: Bloomberg.

DXY is an index that represents the price of the US dollar compared to a basket of currencies including the British pound, Canadian dollar, euro, Japanese yen, Swedish krona and Swiss franc.

While the dollar can move sharply up or down against a particular currency, such as the Russian ruble (Figure 2), it is less susceptible to sharp currency fluctuations when measured against a basket of currencies.

Domestic market size

Swiss investors have a small domestic market for investment, and so a large percentage of investments – about half of their assets in 2023 – are in international assets. Complementa, a consultant firm supporting institutional investors, estimates that Swiss pension funds hedge about two-thirds of their currency exposure.

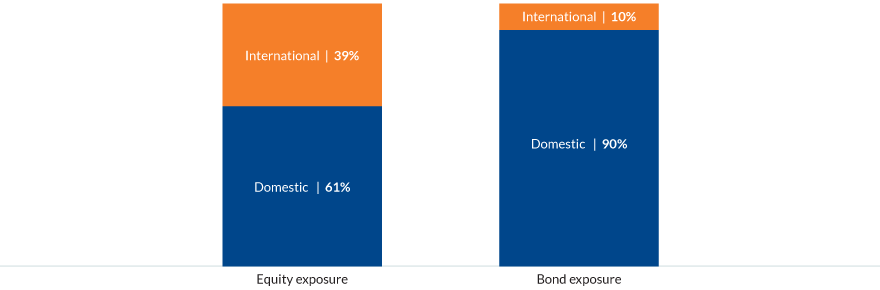

US investors, on the other hand, have a massive domestic market in which to invest; the depth and breadth of US assets lessens the need to invest internationally. Approximately 61% of US pension fund equity exposure is domestic and approximately 90% of US pension fund bond exposure is domestic (Table 1, Figure 5). With equities and bonds comprising 80% of pension portfolios, it’s easy to understand why currency hedging may not be a high priority for US fund managers.

TABLE 1: US PENSION FUND EXPOSURES, 2023

| Equity exposure | Bond exposure | |

| Domestic | 61% | 90% |

| International | 31% | 10% |

FIGURE 5: US PENSION FUND EXPOSURES, 2023

Source: Thinking Ahead Institute, https://www.thinkingaheadinstitute.org/content/uploads/2024/02/GPAS-2024.pdf

Lower exposure to currency volatility reduces pressure to hedge currency risk. However, taking advantage of short-term currency swings and episodic volatility can deliver incremental returns and improve a portfolio’s risk-return profile.

Risk and Regulations

Regulations also influence Swiss pension funds’ sensitivity to risk. That’s because a federal law and an ordinance ensure that every employer has a pension fund (or participates in a joint pension scheme) guaranteeing minimum benefits. These pension fund regulatory requirements can promote a desire to reduce risks, including those contributed by currency fluctuations.

In the US, a pension scheme, for most people, is limited to a federal pension (social security), pension funds for some workers (union, government and military employees) and personal investment plans such as 401(k)s and individual retirement accounts (IRAs). Pension funds are governed by regulations but minimum benefits for private pension funds are not guaranteed. Public pension funds are regulated at the state and local levels, and requirements vary. The lack of guaranteed minimum benefits may cause US pension fund managers to view currency risk with less concern compared to their Swiss counterparts.

Central bank interventions

From September 2011 to January 2015, the SNB pegged the franc to the euro to improve the competitiveness of Swiss exports to European customers. The central bank held the exchange rate steady at 1.2 Swiss francs to the euro (Figure 1), essentially hedging euro currency risk for Swiss pension funds and exporters for free. The unexpected withdrawal of the peg on 15 January 2015 shocked the currency markets, caused the franc to rise sharply and left Swiss pension fund managers with long-lasting memories of an exceptionally unpleasant event. Given this experience and the uncertainty of future central bank currency intervention, Swiss investors are inclined to hedge currency risk.

The US central bank, the Federal Reserve, does not target exchange rates for the US dollar. That doesn’t mean the Federal Reserve has not, or will not, intervene in the currency markets; it has done so on numerous occasions. US pension fund managers, while recognizing that the US central bank could intervene in the currency markets, generally do not expect it. That makes it easier to ignore the potential for outsized currency risks caused by central bank actions.

So you’re saying...

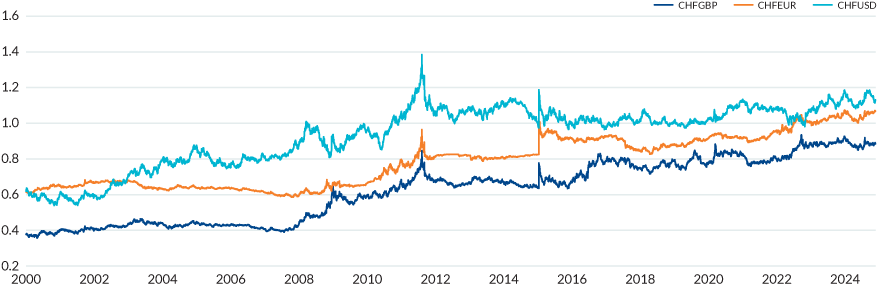

US and Swiss pension fund managers face different currency risk situations. The Swiss franc trends upward against many currencies (Figure 6), exerting consistent downward pressure on the value of international investments denominated in weaker foreign currencies.

For Swiss pension fund managers, hedging this currency risk is prudent. Furthermore, portfolios with significant exposure to currency risk, retirement regulations guaranteeing minimum payouts and an unpredictable central bank encourage hedging. Consequently, it’s not surprising that Swiss pension fund managers hedge currency risk in their portfolios.

FIGURE 6: VARIOUS CURRENCIES PER SWISS FRANC

Source: Bloomberg

US pension fund managers confront a different set of challenges. The US dollar is cyclical so that sometimes strong foreign currencies increase the value of international holdings while periods of weak foreign currencies do the opposite. Because the future is unpredictable, knowing when to hedge can be difficult.

Additionally, US portfolios have large holdings of equities and bonds denominated in dollars, reducing the need for hedging. The Federal Reserve is less adventuresome than its Swiss counterpart, easing concerns about unexpected currency interventions. And pension fund regulations don’t require a guaranteed minimum retirement income, further reducing the pressure to hedge. For these reasons hedging currency risk in US portfolios is less urgent.

Still, US managers could benefit from currency hedging. A primary, but basic rationale for hedging would be that while the dollar is cyclical, the cycles can be lengthy; the current upward trend of the dollar began in the spring of 2011, over thirteen years ago. In hindsight, it would have been beneficial for US managers to have hedged this currency risk.

Saying what should have been done based on perfect knowledge is unfair. But even in an unpredictable future, currency hedging can help US managers reduce overall portfolio risk and increase return from two strategies.

The first involves hedging the ancillary currency risk of international investments and replacing it with exposure to currencies that are more likely to diversify the portfolio or enhance investment performance.

An investor who buys a Japanese stock has exposure to changes in Japanese yen. An analysis of factors that contribute to currency return or risk reduction might indicate that yen is unlikely to contribute positively to these objectives. If currency exposure is desirable, then it would be prudent to hedge yen and replace it with a currency that would be more likely to improve portfolio performance.

The second strategy involves hedging the currency risk and reallocating it to higher expected return assets that have the same portfolio risk as the unhedged currencies. Portfolio risk remains unchanged, but the likelihood of better returns increases.

Advantages of hedging currency risk

Investors are constantly seeking more investment opportunities, and international assets offer attractive returns. As investors increase their allocations to international assets, their exposure to currency effects will also rise. This increased currency exposure means that investors can benefit from a currency risk management program.

The program can enhance returns through exposure to selected currencies that are expected to improve the currency contribution to investment performance. Alternatively, the program can improve portfolio efficiency by redeploying the risk saved from the currency hedge to higher return-seeking assets, such as equities, private equity or real estate. This approach allows investors to achieve a greater rate of return with the same level of risk as their original policy, resulting in improved efficiency and risk-adjusted returns.

Explore more currency insights

BRICS finds a way to thwart the West

New technology is giving BRICS an advantage in the competitive cross-border payments race.

US debt is headed to unimaginable levels

Since 1990, debt crises have erupted periodically, but the next one may not be so easy to dismiss. Is a financial reckoning coming?

Spark

Our quarterly email featuring insights on markets, sectors and investing in what matters