Insights

Four strategies to reduce liquidity management stress

Share this article

Liquidity management, in the context of a currency overlay or hedge, is an issue that periodically resurfaces.

Investors with currency hedging programs are often confronted with positive or negative cash flows when currency forwards are rolled from one settlement date to the next.

For most institutional investors who are typically near fully invested and hold minimal cash, positive or negative cash flows, the result of a realized gain or loss, can pose a challenge. The growing allocation to private assets, which lack the liquidity of traditional stocks and bonds, exacerbates the issue. As a result, large cash flows — especially outflows — can create significant stress for these investors, impacting their overall liquidity management.

In this brief article, we detail different approaches that can help investors manage the liquidity challenges associated with their currency programs more effectively. We will explore four key strategies that investors can utilize to optimize their liquidity management:

- Stagger or ladder settlement dates

- Roll contracts early

- HRR – Historical rate rollover

- High threshold credit support annex (CSA)

1. Stagger or ladder settlement dates

Staggering, or laddering, currency forwards is a strategy where an investor enters into forward contracts with multiple settlement dates, rather than relying on a single settlement date. Historically, many investors used one settlement date, which resulted in large, concentrated cash flows. The primary objective of staggering forwards is to smooth out these cash flows over time, reducing liquidity pressure.

For instance, if an investor has a $300 million portfolio that needs to be hedged, they can stagger the notional exposures evenly over three, six, or even 12 months. As the near-term forward approaches its settlement date, it can be rolled forward by another three, six, or 12 months. Generally, bank counterparties require collateral for currency forwards with tenors exceeding 12 months. Therefore, for investors looking to avoid collateralization, it is generally preferable to use forward contracts with tenors shorter than 12 months.

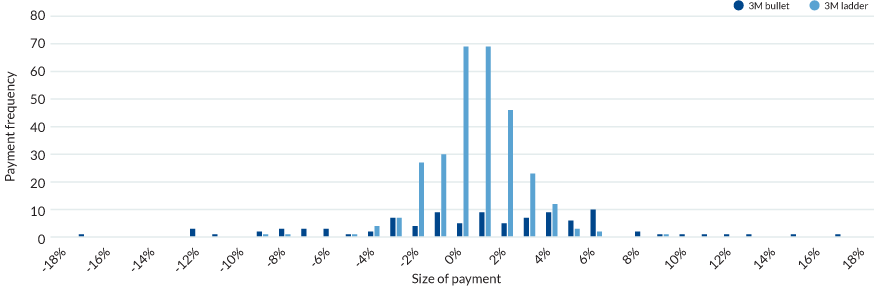

In Figure 1, we compare the payment frequency and size, expressed as percentages, for an Australian investor hedging US Dollars using two strategies:

- 3-month bullet forward approach (same settlement date and amount)

- 3-month laddered forward approach (different settlement dates and amounts)

The payment sizes are significantly larger with the 3-month bullet forward than with the laddered strategy. However, payment frequency is higher with the laddered approach compared to the 3-month bullet forward.

Figure 1 | PAYMENT FREQUENCY AND SIZE OF 3M FORWARD CONTRACTS FOR A SAMPLE AUDUSD PORTFOLIO – HYPOTHETICAL

This chart, with hypothetical data, shows the payment frequency and the size of payments on 3-month forward contracts for a sample AUDUSD portfolio. Payment sizes are larger with 3-month bullet forward contracts. Payment frequency is higher with 3-month laddered contracts.

2. Roll contracts early

Managing the roll cycle and rolling contracts early can also help investors better manage their cash flows. If an investor lacks immediate liquidity and needs time to raise cash to cover potential losses, they can opt for longer-term contracts, such as six or twelve months, but choose to roll them early.

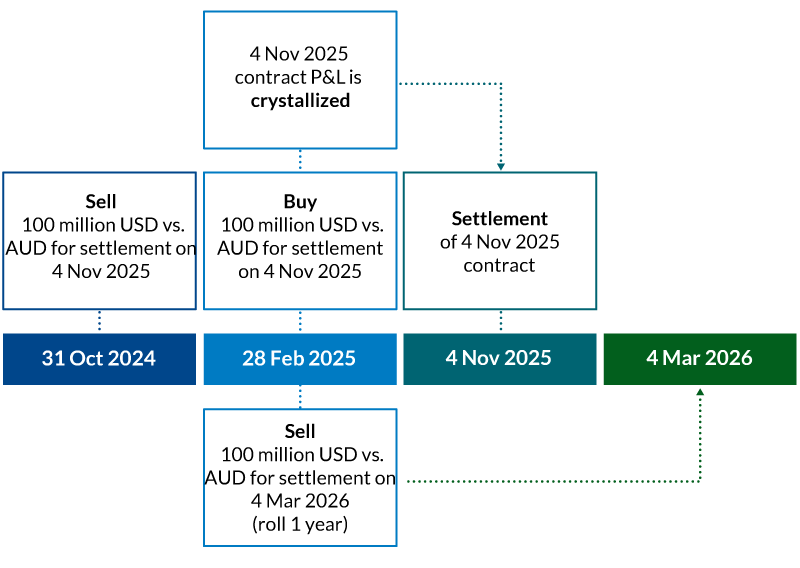

Instead of waiting until the currency forward approaches its settlement date, the investor can roll the contract ahead of time to crystallize any profit or loss. This can be done at any point before settlement. In many cases, investors choose to roll their contracts one to three months early, depending on their liquidity needs and cash flow requirements.

Figure 2 | ROLL CONTRACT TIMELINE – HYPOTHETICAL

Figure 2 shows a hypothetical roll contract timeline. On 31 October 2024, an investor can sell 100 million USD/AUD for setllement on 4 November 2025. On 28 February 2025, an investor can buy 100 million USD/AUD for settlement on 4 November 2025, sell 100 million USD/AUD for settlement on 4 March 2026 (rolling the contract one year), and the 4 November 2025 profit and loss is crystallized. On 4 November 2025 settlement occurs.

3. HRR – Historical rate rollover

The Historical Rate Rollover (HRR) approach involves rolling an existing currency forward while maintaining the original contract rate, rather than using the current market rate. This strategy helps delay the realization of gains or losses, offering more flexibility and improving cash flow management.

There are, however, some important considerations with HRRs. Not all bank counterparties offer this option, and there is typically an additional cost, as it is akin to a counterparty extending credit by allowing the delay of a loss. Investors should be cautious of this approach. Deferred losses can accumulate significantly if market conditions move unfavorably.

4. High Threshold Credit Support Annex (CSA)

For investors looking to hedge highly illiquid assets with long-dated forwards (greater than 12 months), where collateral may be required by the bank counterparty, a high threshold Credit Support Annex (CSA) can offer a potential solution. The CSA defines the terms of collateral exchange between the investor and the bank, and in this case, the threshold for collateral posting would be set relatively high.

By negotiating high thresholds with multiple bank counterparties and diversifying exposure, an investor may avoid the need to post collateral if the profit or loss stays within the negotiated limits. This approach can provide added flexibility to manage the investor’s liquidity.

There are several considerations when using a high threshold CSA. First, the bank counterparty must approve the investor from a creditworthiness perspective, and typically, only investors with strong credit profiles are eligible for this solution. Additionally, a high threshold CSA increases counterparty risk, particularly if the investor’s position is profitable, as the bank will not be required to post collateral. Lastly, there is an additional cost, as the bank is effectively providing a line of credit. This charge is generally agreed upon upfront and embedded in the price of the trade.

Summary

As investors seek more efficient ways to manage their liquidity and mitigate the stress of funding losses on their currency overlay, one of the approaches described above may prove useful. While this list of liquidity management strategies is not exhaustive, these are among the most commonly used methods. Other potential solutions include options or structured products. However, as with any financial instrument or strategy, it is critical to carefully evaluate both the advantages, disadvantages and associated risks before implementation.

| Strategy | Objective | Disadvantages |

| Staggered (ladder) settlement |

| Frequent payments |

| Roll contracts early |

| The base currency appreciates post roll and potential offsetting gains are delayed. |

| HRR – Historical rate rollover |

| Accumulating deferred losses |

| High Threshold Credit Support Annex (CSA) | Hedge illiquid assets through defined terms of collateral exchange | Approval by bank counterparty |

The information contained herein is intended for institutional clients, Eligible Contract Participants, Qualified Eligible Persons and Wholesale Clients only and is for informational purposes only.

Australian Investors: The information contained herein is intended for Wholesale Clients only and is for informational purposes only. This document is not a prospectus or product disclosure statement under the Corporations Act 2001 (Cth) (Corporations Act) and does not constitute a recommendation to acquire, an invitation to apply for, an offer to apply for or buy, an offer to arrange the issue or sale of, or an offer for issue or sale of, any securities or investment service in Australia, except as set out below. The strategy has not authorised nor taken any action to prepare or lodge with the Australian Securities & Investments Commission an Australian law compliant prospectus or product disclosure statement. Accordingly, this strategy and document may not be issued or distributed in Australia other than by way of or pursuant to an offer or invitation that does not need disclosure to investors under Part 6D.2 or Part 7.9 of the Corporations Act, whether by reason of the investor being a ‘wholesale client’ (as defined in section 761G of the Corporations Act and applicable regulations) or otherwise. This document does not constitute or involve a recommendation to acquire, an offer or invitation for issue or sale, an offer or invitation to arrange the issue or sale, or an issue or sale, of any strategy or investment service to a ‘retail client’ (as defined in section 761G of the Corporations Act and applicable regulations) in Australia.

Canadian Investors: The information contained herein is intended for Permitted Clients only and is for informational purposes only. This confidential material pertains to the offering of the currency strategies described herein only in those jurisdictions and to those persons where and to whom they may be lawfully offered for sale, and only by persons permitted to sell such strategies. This material is not, and under no circumstances is to be construed as, an advertisement or a public offering of the strategies described herein in Canada. No securities commission or similar authority in Canada has reviewed or in any way passed upon this document or the merits of the strategies described herein, and any representation to the contrary is an offence.

Netherlands and Luxembourg Investors: The information contained herein is intended for Professional Clients as the term is defined by MiFID II and is for informational purposes only. Recipients that are classified under MiFID II as retail clients must opt up to Professional Clients before receiving any services from Mesirow Currency Management.

Japanese Investors: Mesirow Currency Management provides discretionary investment management services to managed accounts held on behalf of qualified investors only. MCM will not act as agent or intermediary in respect of the execution of a discretionary investment management agreement. Please note that this presentation is intended for educational purposes and solely for the addressee and may not be distributed.

Hong Kong Investors: The contents of this document have not been reviewed by any regulatory authority in Hong Kong. You are advised to exercise caution in relation to the contents of this document. You should obtain independent professional advice prior to considering or making any investment. The investment is not authorized under Section 104 of the Securities and Futures Ordinance of Hong Kong by the Securities and Futures Commission of Hong Kong. Accordingly, the distribution of this Presentation Material and discretionary management services in Hong Kong are restricted. This Presentation Material is only for the use of the addressee and may not be distributed, circulated or issued to any other person or entity.

South Korean Investors: Upon attaining a client, Mesirow Financial Investment Management, Inc. (“MFIM”) will apply for the appropriate licenses and retain the services of a local licensed intermediary (a Korean financial investment company). In the interim, MFIM will rely on and sub-delegate to Mesirow Advanced Strategies, Inc. (“MAS”).

Mesirow Currency Management (“MCM”) is a division of Mesirow Financial Investment Management, Inc. (“MFIM”) a SEC registered investment advisor, a CFTC registered commodity trading advisor and a member of the NFA and Mesirow Financial International UK, Ltd. (“MFIUK”), authorized and regulated by the FCA. The information contained herein is intended for institutional clients, Qualified Eligible Persons and Eligible Contract Participants or the equivalent classification in the recipient’s jurisdiction and is for informational purposes only. This information has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. Any opinions expressed are subject to change without notice. It should not be assumed that any recommendations incorporated herein will be profitable or will equal past performance. Mesirow Financial does not render tax or legal advice. Nothing contained herein constitutes an offer to sell or a solicitation of an offer to buy an interest in any Mesirow Financial investment vehicle(s). Any offer can only be made through the appropriate Offering Memorandum. The Memorandum contains important information concerning risk factors and other material aspects of the investment and should be read carefully before an investment decision is made.

Currency strategies are only suitable and appropriate for sophisticated investors that are able to lose all of their capital investment. This communication may contain privileged and/or confidential information. It is intended solely for the use of the addressee. If this information was received in error, you are strictly prohibited from disclosing, copying, distributing or using any of this information and are requested to contact the sender immediately and destroy the material in its entirety, whether electronic or hardcopy.

This communication may contain privileged and/or confidential information. It is intended solely for the use of the addressee. If this information was received in error, you are strictly prohibited from disclosing, copying, distributing or using any of this information and are requested to contact the sender immediately and destroy the material in its entirety, whether electronic or hardcopy.

Hypothetical performance information and results do not reflect actual trading or asset or fund advisory management and the results may not reflect the impact that material economic and market factors may have had. Hypothetical performance results have many inherent limitations, some of which are described herein. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results. Performance referenced herein for Currency Risk Management Overlay strategies prior to May 2004, the date that the Currency Risk Management team joined Mesirow Financial, occurred at prior firms.

Comparisons to any indices referenced herein are for illustrative purposes only and are not meant to imply that a strategy’s returns or volatility will be similar to the indices. The strategy is compared to the indices because they are widely used performance benchmarks.

Mesirow Financial refers to Mesirow Financial Holdings, Inc. and its divisions, subsidiaries and affiliates. The Mesirow Financial name and logo are registered service marks of Mesirow Financial Holdings, Inc., © 2025, Mesirow Financial Holdings, Inc. All rights reserved. Investment management services provided through Mesirow Financial Investment Management, Inc., a SEC registered investment advisor, a CFTC registered commodity trading advisor and member of the NFA, or Mesirow Financial International UK, Ltd. (“MFIUK”), authorized and regulated by the FCA, depending on the jurisdiction.

Spark

Our quarterly email featuring insights on markets, sectors and investing in what matters