Insights

Mesirow Currency Management | 4Q2024 Commentary

Share this article

US dollar outperforms other G10 currencies in 4Q2024

The US dollar handily outperformed the rest of the G10 currencies in Q4, driven by positive data, the Republican clean sweep, and year-end safe-haven buying as the market readied for a Trump presidency. Recent employment prints showed a supportive labor market with non-farm payrolls higher than consensus at 227K vs. 220K expected. Inflation held relatively steady with headline and core CPI for November printing at 2.7% YoY and 3.3%, respectively.

While the Fed delivered two rate cuts totaling 50 bps, the hawkish update to dot plot projections in their most recent meeting reduced the number of cuts in 2025 to two, in contrast to dovish cuts by the ECB and SNB in December.

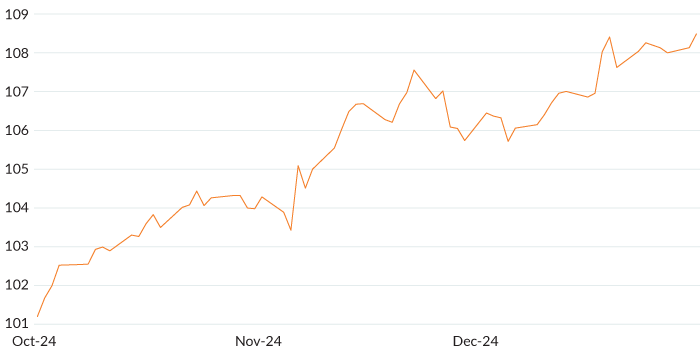

FIGURE 1: DXY – 4Q2024

Figure 1 shows a line chart of the US dollar index falling or appreciating between the periods of October 2024 and December 2024.

Source: Bloomberg

EUR | Euro was a middling performer within the G10 in Q4, with the ECB ending the year on a dovish note. The ECB cut rates by 50bps over the quarter, as the inflation outlook became more favorable while economic and political uncertainty remained. In their most recent statement, the ECB removed language that the central bank would “keep policy rates sufficiently restrictive for as long as necessary,” interpreted by the market as a dovish shift. Headline inflation for November was revised to 2.2% YoY, slightly below consensus of 2.3%. The collapse of the French government in early December added to the political instability within the Eurozone.

GBP | Sterling was a relatively high performer within the G10 in Q4. The BoE cut rates by 25bps in November as expected, although the budget release at the end of October was seen as inflationary. Although GDP contracted 0.1% MoM in October, preliminary December composite PMI remained expansionary and average weekly earnings rose 5.2% YoY over three months in October, besting 4.6% expected. The BoE left rates unchanged in December at 4.75%, affirming a gradual policy approach with inflation starting to resolve and the labor market broadly in balance.

JPY | Yen landed in the lower third of the G10 in Q4, pressured early in the quarter as the ruling coalition lost their majority and Governor Ueda expressed that current environment did not require the bank to raise interest rates further.” By the end of November, national inflation data printed at 2.3% with Ueda adding that rate hikes were nearing. However, the BoJ left the policy rate at 025% at the December meeting. Yen remained under pressure as Ueda noted that he could not say whether the BoJ would have enough information by the next meeting as wage trends would not be clear until March or April.

CAD | Canadian dollar outperformed the majority of developed currencies save the strong US dollar in Q4. The BoC cut rates by a total of 100bps over the quarter while CPI numbers fluctuated around 2% YoY. Recent unemployment numbers ticked higher than expected to 6.8% while hourly wages sunk well below expectations at 3.9% YoY vs. 4.7% consensus. At the December meeting, Governor Macklem said that the central bank anticipated a more gradual approach to policy. Cananda’s finance minister resigned from the cabinet, as uncertainty increased under Trudeau.

AUD | Australian dollar broadly weakened in Q4, only outperforming the New Zealand dollar in the G10. Although the RBA kept its policy rate unchanged at 4.35%, the most recent statement had a more dovish tone with the central bank softening its forward guidance while failing to rule out a rate cut in the near term during the press conference. Additional pressure was felt on AUD as China’s stimulus hopes were disappointing and risk appetite soured into the end of the year.

CHF | Swiss franc was a middling performer in the G10 in Q4. While CHF received a boost from the escalation of Russian-Ukraine conflict, continued dovish rhetoric from the SNB weighed on the currency. The SNB cut rates again by 50bps in December to 0.5%, while the market expected 25bps. During the press conference, SNB President Schlegel noted more room left on rates and that the SNB could not exclude the possibility of negative interest rates in the future.

EM | Emerging market currencies were under pressure in Q4, as the MSCI EM Currency Index fell -3.6% over the quarter. Trump’s victory and the Republican clean sweep acted as a headwind for EM equities and currencies in the face of investor concerns about the impact of Trump’s proposed tariffs, particularly on China.

TABLE 1: USD-BASED AS OF DECEMBER 31, 2024

| FX Rate | Change 3M % | Change 1Y% | ||

| EUR-USD | 1.0355 | -7.22% | -6.26% | |

| GBP-USD | 1.2524 | -6.63% | -1.76% | |

| USD-JPY | 157.16 | -8.98% | -10.30% | |

| AUD-USD | 0.61915 | -10.75% | -9.26% | |

| USD-CAD | 1.4382 | -6.07% | -8.32% | |

| USD-CHF | 0.90625 | -6.92% | -7.13% | |

| Source: WM/Reuters | ||||

Currency for return

Mesirow Currency Management’s (MCM) Extended Markets Currency Alpha, Asian Markets Currency Alpha, Emerging Markets Currency Alpha and Systematic Macro strategy all enjoyed gains this quarter.

The Technical component of our strategies contributed gains during the fourth quarter, particularly our Equity Momentum and Interest Rate Trend models.

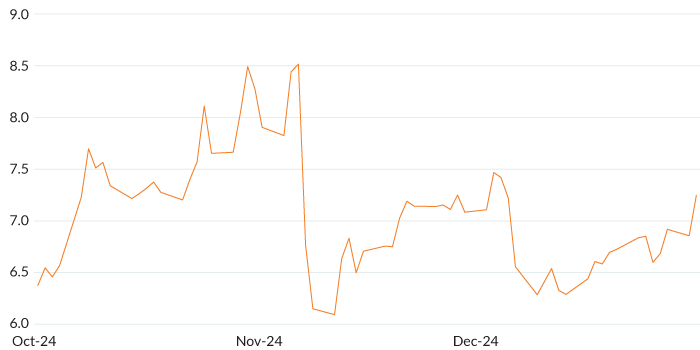

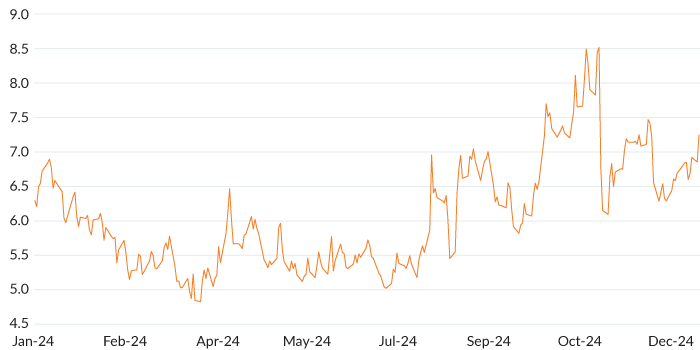

Global volatility rose between October and November, fell after the US election (Figure 2), but ended 2024 at higher levels then it started 2024 with (Figure 3).

FIGURE 2: MCM'S GLOBAL VOLATILITY INDICATOR1 | OCTOBER 2024 – DECEMBER 31, 2024

Figure 2 shows a line chart of MCM's Global Volatility Indicator between July 2024 and September, 2024. The GVI’s low is on July 12 (5.02) and reaches a high on August 29 (7.04).

Source: Mesirow

FIGURE 3: MCM'S GLOBAL VOLATILITY INDICATOR1 | JANUARY 2024 – DECEMBER 31, 2024

Figure 3 shows a line chart of MCM's Global Volatility Indicator between January 2024 and December 31, 2024. The GVI falls between January and April 2024 then rises through to the US election on November 5. The GVI falls November 6 – November 8 and then rises until the beginning of December.

Source: Mesirow

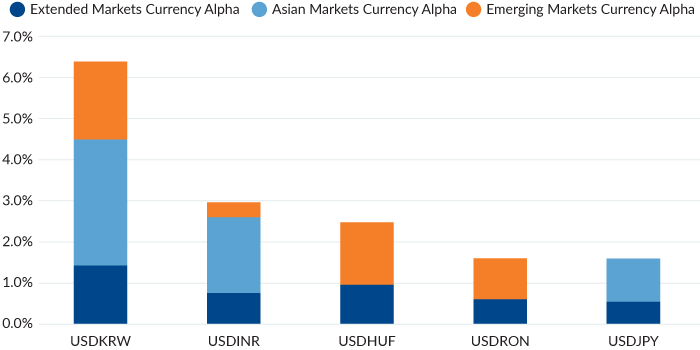

The strategy’s best performers were our long US dollar positions against the South Korean won and the Indian rupee (Figure 4).

FIGURE 4: TOP 5 PERFORMERS | OCTOBER – DECEMBER 31, 2024

Figure 4 shows the top 5 performing currency pairs for 4Q2024 was the USDKRW, USDINR, USDHUF, USDRON, USDJPY

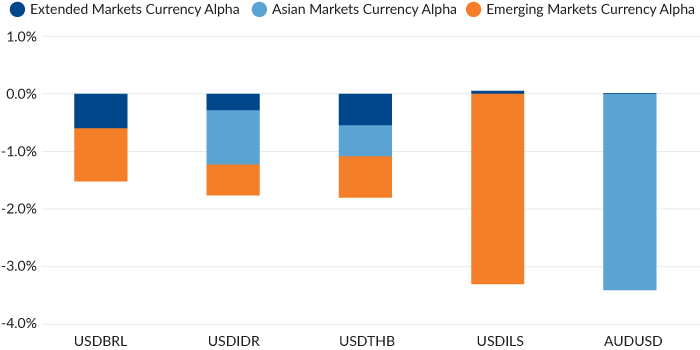

FIGURE 5: BOTTOM 5 PERFORMERS | OCTOBER – DECEMBER 31, 2024

Figure 5 shows the bottom 5 performing currency pairs for 4Q2024 was the USDBRL, USDIDR, USDTHB, USDILS, AUDUSD

Intelligent Multi-Strategy Currency Factor

MCM’s Intelligent Multi-Strategy Currency Factor detracted -0.61% (gross) of value in the fourth quarter, recovering in December after a challenging October to start the quarter. Losses in Euro and Sterling were partially offset by short Swiss franc positioning that benefited from the rising US dollar. Carry outperformed over the quarter, while both Momentum and Value detracted, resulting in the negative quarter. For the year, the strategy outperformed by 0.97%.

Latest MCM viewpoints

- Currency outlook 2025: Inflation and the Republican clean sweep in the US election led to the US dollar outperforming the rest of the G10 currencies in 2024. As Trump begins his second term and geopolitical uncertainty continues this coming year, policy ramifications and global instability will keep investors vigilant in 2025.

- Four strategies to reduce liquidity management stress: Identifying the appropriate liquidity management approach for a currency overlay is an important risk consideration not to overlook.

- Safe haven currency hedging: Why do US and Swiss pension funds use different currency risk strategies?

Contact us

To learn more about Mesirow Currency Management’s custom currency solutions, please contact Joe Hoffman, CEO Currency Management at joseph.hoffman@mesirow.com.

Explore currency solutions

Passive and Dynamic Risk Management

Customized solutions to manage unrewarded currency risk in international portfolios.

Currency for Return

Strategies that aim to profit from short and medium-term moves in the currency market.

Fiduciary FX

Trading solution for asset managers and owners with focus on reducing transaction costs, improving transparency and enhancing efficiency.

1. The GVI is an internal proprietary model utilizing one month at-the-money (ATM) volatility for G10 currencies, including crosses plus BIS liquidity report weightings.

Spark

Our quarterly email featuring insights on markets, sectors and investing in what matters