Insights

Currency Outlook 2025

Share this article

January 21, 2025 | By Uto Shinohara, CFA

Introduction

Inflation had been on a productive trajectory lower since peaking in the US in mid-2022. However, the inflation fight was harder to win than expected as lingering CPI led the Fed to pause, keeping rates high-for-longer to combat its stickiness.

This, and the Republican clean sweep in the US election, led to the US dollar outperforming the rest of the G10 currencies in 2024. As Trump begins his second term and geopolitical uncertainty continues this coming year, policy ramifications and global instability will keep investors vigilant in 2025.

The Fed’s inflation fight

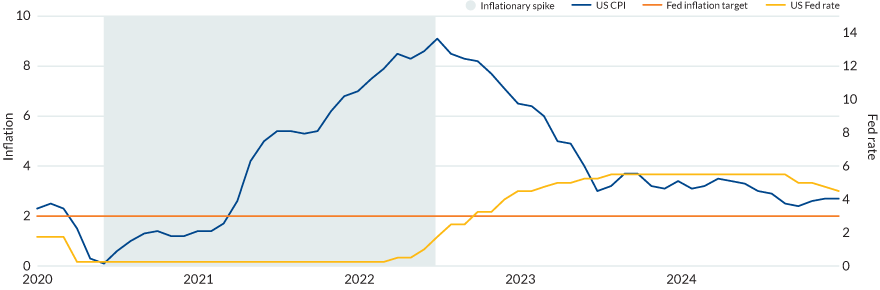

With US inflation falling substantially in 2023 towards 3%, the market pivoted its focus away from inflation and more towards the labor markets, assuming that the inflation fight was being won and that the path lower would continue in 2024. However, progress stalled as the path lower became a slow grind (Figure 1), with the most recent inflation print before year-end coming in at 2.7%, above the Fed’s long-run target of 2%.

FIGURE 1: US CPI YoY VS. FED RATE, JANUARY 2020 VS. DECEMBER 2024

Figure 1 shows US inflation YoY 2020 - 2024 vs. the Fed rate. The Fed’s inflation target is 2%. An inflationary spike occurs between June 2020 and June 2022, reaching a high of 9.1% then falling to 3% in June 2023 and ending 2024 at 2.7%. The Fed begins to raise rates in March 2022, raising to 0.5% in March 2022, reaching a high of 5.5% in July 2023, pausing into September 2023, then ending at 4.5%

Source: Bloomberg, Mesirow

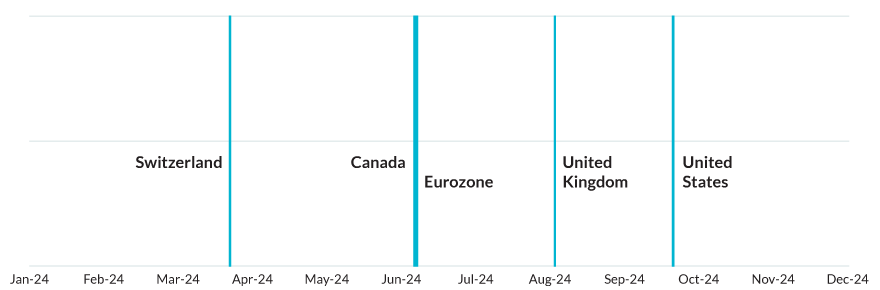

The Fed response was to pause, with a later start to its cutting cycle (September 18, 2024) than most other central banks (Figure 2).

FIGURE 2: CENTRAL BANKS, INITIAL RATE CUTS, 2024

Figure 2 shows the initial rate cuts by various global central banks in 2024. Switzerland: March 22, Canada: June 5, Eurozone: June 6, UK: August 1, US: September 18.

Source: Bloomberg, Mesirow

With the Fed following the high-for-longer playbook, the dollar found support over the first half of 2024 before labor concerns came more into focus, capped by the large negative data revision released during the summer. The dollar was under pressure in Q3, with falling yields responding to the cooling labor market.

In the past year, yields acted as a reliable reflection of Fed expectations. 10Y yields tracked the US dollar index consistently throughout the year, moving in sync across both USD-positive and USD-negative periods (Figure 3). Throughout the many news events and cycles in 2024, FX market behavior often distilled down to central bank expectations, with the dollar reacting to the Fed.

FIGURE 3: DOLLAR INDEX VS. 10Y TREASURY YIELDS, 2024

Figure 3 tracks the US dollar index and 10-year yields for 2024. The two data sets, when charted, are in sync. When the DXY falls April through end of September 2024 10-year yields fall, and when the DXY gains strength 10-year yields do, as well.

Source: Bloomberg, Mesirow

The US election and the US dollar index (DXY)

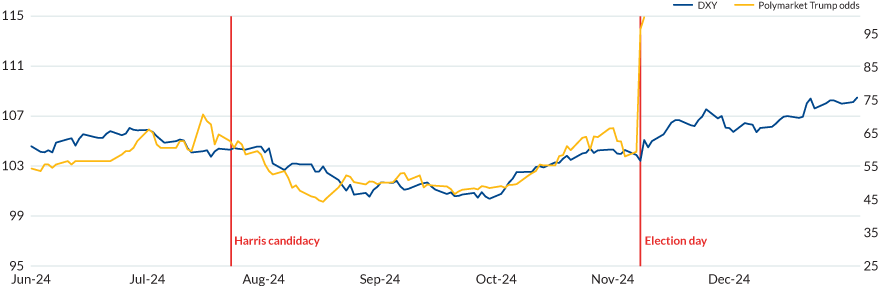

Leading into the election in November, a Trump victory was considered dollar-positive based on presumed policy changes and the dollar response to those policies. Tariffs can reduce supply and raise inflation, prompting the Fed to keep rates higher. Corporate tax cuts can support equities, leading to more investment flows into the United States.

The US election outcome became a popular bet on the prediction markets. As the election approached, the dollar moves were in sync with the odds of a Trump victory. The US dollar index and Trump’s odds per Polymarket tracked remarkably well in the months leading up to the election (Figure 4).

When Kamala Harris became the democratic candidate over the summer after Joe Biden exited the race, Trump’s odds began to lower, and the dollar followed suit. As Trump’s odds improved in the early fall, so did the dollar, appreciating into the election. The Republican clean sweep propelled the dollar even higher, and it rode that wave into year-end.

FIGURE 4: DXY VS. TRUMP ODDS, (JUNE 2024 - DECEMBER 2024)

Figure 4 presents the US dollar index vs. Trump’s odds per Polymarket. The two data sets are in sync. When the DXY falls after Harris’ candidacy is announced, Trump’s odds fall, and when Trump’s odds rise in September 2024, the US dollar index rises. The DXY continues on an upward path through December 2024.

Source: Bloomberg, Mesirow

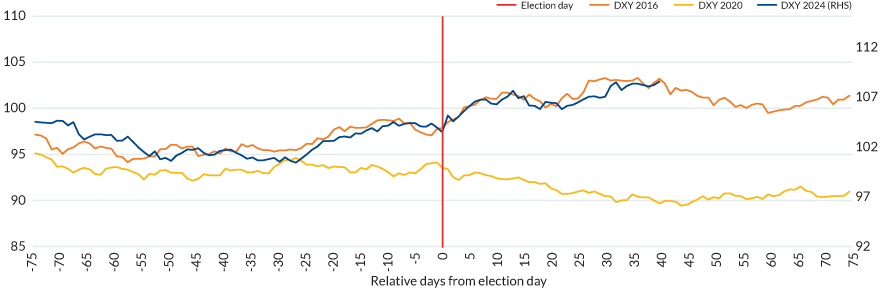

The US dollar path surrounding Trump’s 2016 victory has been repeated in the movements surrounding the 2024 election. Charting seventy-five days prior to and then after Election Day for the past three election cycles, 2016 and 2024 are staggeringly similar from before the election through the end of the year (Figure 5).

FIGURE 5: DXY – PREVIOUS 3 ELECTION CYCLES, 2016 / 2020 / 2024

Figure 5 shows the DXY before and after election day from the past three elections. In the 40 days after the 2016 and 2024 elections, the DXY gains strength and charts a similar path. In the days after the 2020 election, the DXY falls.

Source: Bloomberg, Mesirow

Following the dollar direction subsequent to the 2016 election would imply an eventual tapering of US dollar strength in the first quarter of 2025. The dollar movements around Biden’s 2020 win were dissimilar from the Trump victories, helping to distinguish the difference from a seasonal or election period tendency.

Episodic safe-haven characteristics

While the US dollar is considered a safe-haven currency, its complexities can periodically steer dollar movements away from risk-on / risk-off market influences. Although uncertainty and volatility continued to play a large role in the dollar movements, their influence waned during the latter part of the past year. For a large portion of 2024, dollar movements were positively correlated with global FX volatility, as measured by the JP Morgan FX Volatility index (Figure 6).

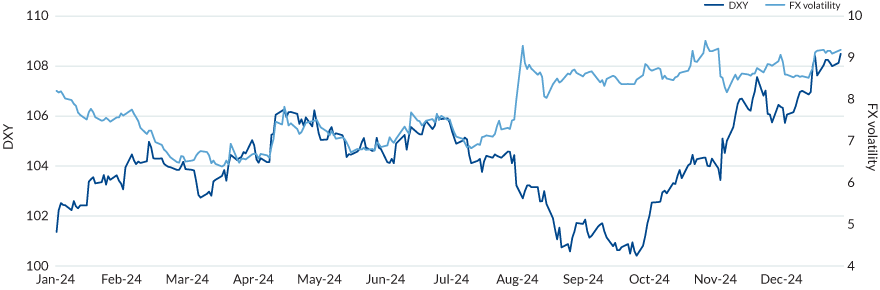

FIGURE 6: DXY VS. FX VOLATILITY, 2024

Figure 6 shows the US dollar index (DXY) vs. the JP Morgan FX Volatility index. The dollar gains strength as FX volatility increases (and vice-versa), beginning about the third week of March 2024 through mid-July 2024 (Harris announced as candidate); after which, global FX volatility increases as the dollar falls through the end of September 2024. The dollar then increases in the fourth quarter as FX volatility tracks sideways over the same period.

Source: Bloomberg, Mesirow

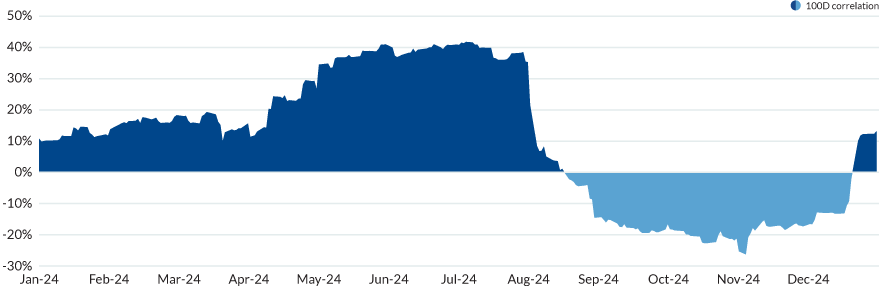

FIGURE 7: CORRELATION - DXY VS. FX VOLATILITY, 2024

However, the correlation turned negative towards the latter part of the summer months, only to return to positive over the last few weeks of the year (Figure 7).

Figure 7 shows the correlation between the US dollar index (DXY) vs. the JP Morgan FX Volatility index. They are positively correlated through mid-August, negatively correlated through to the third week of December, then moves back into positive territory.

Source: Bloomberg, Mesirow

Looking ahead to 2025

With Trump entering the White House, financial markets will be influenced by both fiscal and monetary policies in 2025, with FX markets and the US dollar reacting to policy repercussions. We will see if Trump’s tariff threats are fully realized or if were they merely a negotiating ploy. The Republican clean sweep implies that policy changes could meet less resistance.

The Fed tilted more hawkish in December, with the dot plot projections lowering to just two rate cuts in 2025. While better relative growth prospects in the US (along with stubborn inflation) support the hawkish tilt, how employment and the economy fare going forward will influence the Fed’s path this year, with Trump’s policies as a major influence.

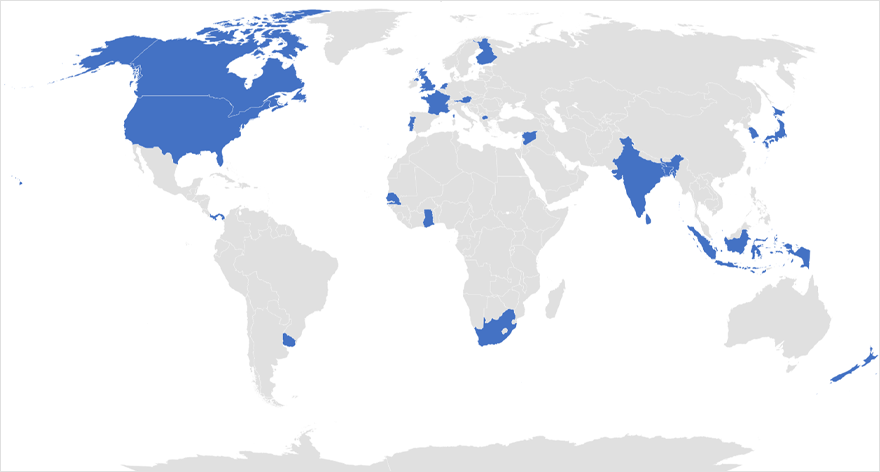

If 2024 acts as a blueprint for 2025, expect more political instability world-wide as incumbents are on watch. Incumbent leadership lost their governing foothold across multiple countries in multiple continents in 2024 (Figure 8), with the trend continuing in 2025 with Trudeau’s resignation in Canada and expected change to reach Germany later this year.

TABLE 1: INCUMBENT CHANGES, 2024*

| Austria | Indonesia | South Africa |

| Bangladesh | Japan | South Korea |

| Botswana | Netherlands | Sri Lanka |

| Canada | New Zealand | Syria |

| Finland | North Macedonia | United Kingdom |

| France | Panama | United States |

| Ghana | Portugal | Uruguay |

| India | Senegal |

FIGURE 8: INCUMBENT CHANGES, 2024*

Figure 8 shows a map of the world with the regions that had incumbent changes in 2024 highlighted.

Source: Mesirow, Microsoft

With Trump now in office, investors will continue to face uncertainty and market dislocations in the coming year. We recommend that institutions have a currency hedging policy firmly in place ahead of time to responsibly manage currency risk in their international portfolios.

From all of us at Mesirow Currency Management, may the coming year bring happiness and good health.

Explore more currency insights

Four strategies to reduce liquidity management stress

Different approaches can help investors manage the liquidity challenges associated with their currency program.

Safe haven currency hedging

Why do US and Swiss pension funds use different currency risk strategies?

*Incumbent sources:

https://www.visionofhumanity.org/2024-the-year-incumbent-governments-lost-power/

https://www.pewresearch.org/global/2024/12/11/global-elections-in-2024-what-we-learned-in-a-year-of-political-disruption/

https://apnews.com/article/global-elections-2024-incumbents-defeated-c80fbd4e667de86fe08aac025b333f95

https://abcnews.go.com/538/democrats-incumbent-parties-lost-elections-world/story?id=115972068

https://www.aspistrategist.org.au/in-2024-a-global-anti-incumbent-election-wave/

https://www.vox.com/2024-elections/383208/donald-trump-victory-kamala-harris-global-trend-incumbents

https://prospect.org/economy/2024-11-06-globally-predictable-result-election-inflation-trump/

The information contained herein is intended for institutional clients, Qualified Eligible Persons, Eligible Contract Participants, or the equivalent classification in the recipient’s jurisdiction, and is for informational purposes only. Nothing contained herein constitutes an offer to sell an interest in any Mesirow investment vehicle. It should not be assumed that any trading strategy incorporated herein will be profitable or will equal past performance.

Spark

Our quarterly email featuring insights on markets, sectors and investing in what matters