High Yield Management

Above-average income potential

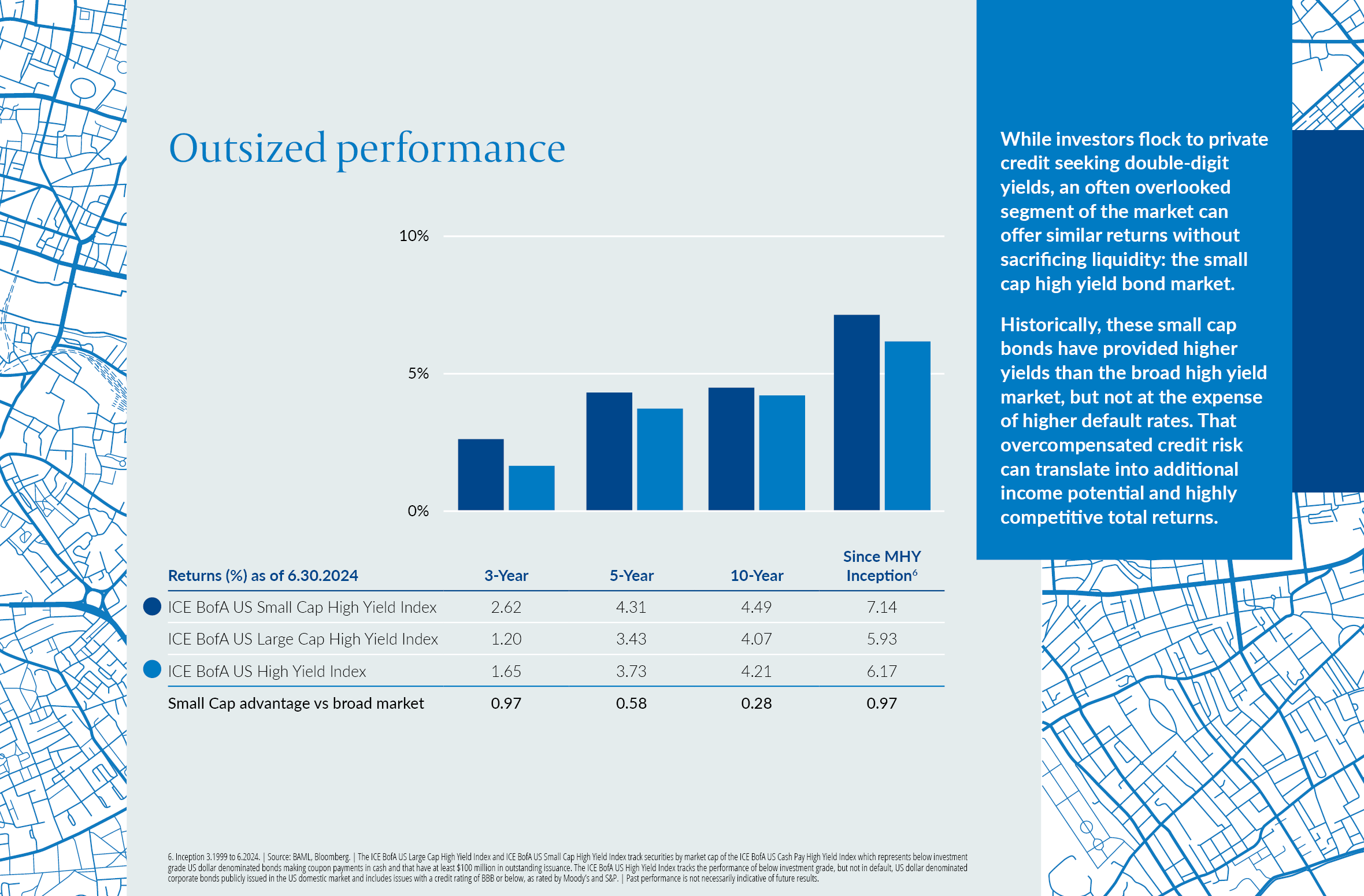

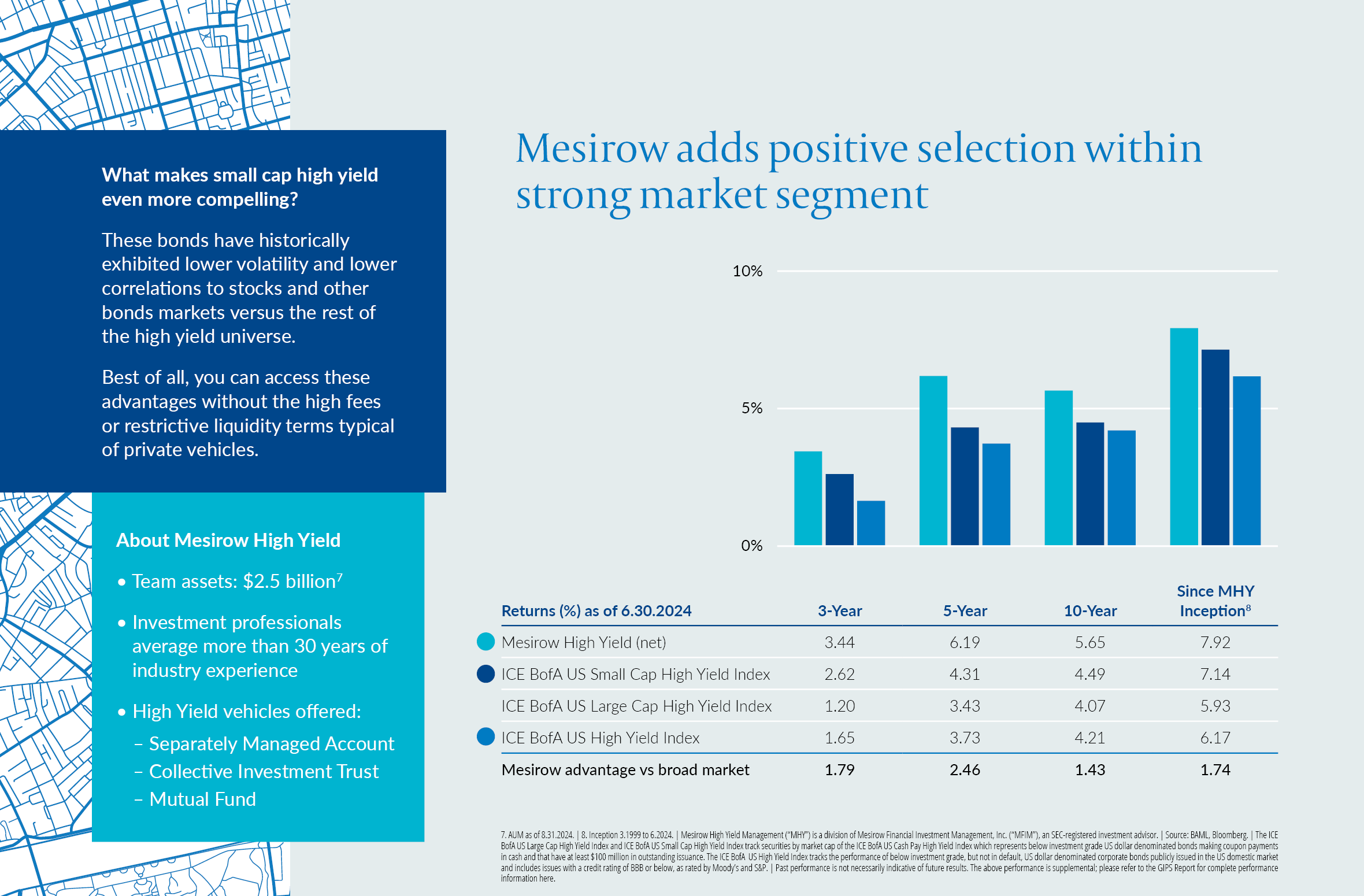

Our clients gain above-average income potential and repeatable opportunities to earn alpha given our ability to develop a proprietary information advantage in smaller high yield names. Our philosophy is grounded on the belief that industry selection, especially the avoidance of bubble industries from their inception, is a primary alpha driver.

Our specialists and strategies are:

“We believe that our strategy which includes investing in small issues, is the most direct way to capitalize on local informational advantages in the lucrative realm of credit (where a disciplined approach can systematically add value) while simultaneously ‘selling’ liquidity to parties who systematically overvalue it.”

Robert Sydow, Chief Investment Officer, Portfolio Manager, Mesirow High Yield Management

Mesirow High Yield

For 25 years we have helped clients reap the high yield market’s enormous potential for return, while managing risk.

Strategies

Investment focus: Below investment grade corporate securities

Market capitalization: Emphasis on small-to-mid sized capitalization companies

Number of holdings: 75-125

Position weight: 1-2%

Benchmark: Bloomberg US Corporate High Yield Index

Vehicles: Separate account | Mutual fund | Collective investment trust

Portfolio Managers: Robert Sydow, Kevin Buckle, CFA, and Jim Lisko

Inception: 3.1.1999

Investment focus: Syndicated leveraged loans issued by corporate borrowers, which includes both first and second lien loans

Number of holdings: 60-100

Position weight: 1-2%

Benchmark: Credit Suisse Leveraged Loan Index

Vehicles: Separate account | Commingled limited partnership

Portfolio Managers: Robert Sydow, Kevin Buckle, CFA, and Jim Lisko

Inception: 8.2.2007

Insights

Keep up-to-date

Our latest observations on trends, opportunities and events taking place in the fixed income markets.

Senior leaders

Explore

The information contained herein should not be construed as a recommendation to purchase or sell any particular security or investment vehicle offered by Mesirow . The information included has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. Any opinions expressed are subject to change without notice. Mesirow Financial Investment Management, Inc. and its affiliated companies and/or individuals may, from time to time, own, have long or short positions in, or options on, or act as a market maker in, any securities discussed herein and may also perform financial advisory or investment banking services for those companies. A complete list of composites can be made available upon request. Information is provided in US dollar denominations.

It should not be assumed that any recommendations incorporated herein will be profitable or will equal past performance. Any stated performance results include the reinvestment of dividends and other earnings. The Mesirow name and logo are registered service marks of Mesirow Financial Holdings, Inc. Investment management services offered by Mesirow Financial Investment Management, Inc., an SEC-registered investment advisor. Securities offered through Mesirow Financial, Inc. member FINRA and SIPC.