Insights

Hidden gems: The compelling case for small cap high yield

Share this article

The small cap high yield market is not as well known or closely followed as the “traditional” market of bigger high yield issues — that’s exactly why small issues may offer high yield investors much more of what they are looking for: overcompensated credit risk, diversification and lower default rates.

This analysis uncovers compelling opportunities in small cap high yield, revealing unexpected insights in a sector often overshadowed by its traditional and large cap counterparts. Our research, which yielded some unexpected insights, details how small cap high yield presents significant opportunities for investors.

- More income | Small cap bonds trade on average 121bps wide vs large cap bonds2

- Lower default rate | Small cap bonds have experienced a 16% lower average annual default rate than large bonds over the last two decades (3.8% vs 4.5%)3

- Lower volatility | Large cap bonds are much more volatile on a week-to-week basis vs small cap bonds (the respective annualized standard deviations of returns are 8.24% and 4.88%)4

- Lower correlations | Small cap bonds have lower correlation to the S&P 500 and Bloomberg Aggregate5

Small cap high yield investors have benefitted from these factors for many years. So why is no one paying attention? We have our theories. But first, let’s see if the data backs up our assertions.

More income

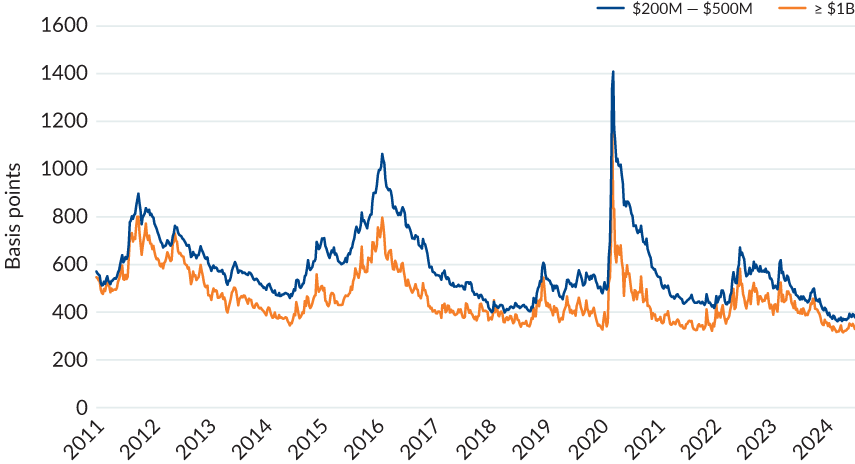

As shown in Chart 1 below, small cap bonds trade on average 121bps wide vs large cap bonds, which is not all that surprising.

Large household names are generally associated with more data transparency via equity research, news coverage and research from industry consultants. Such transparency applies to large issuers’ high yield bonds, too – analysts have access to a wealth of standardized data that makes pricing them much easier.

LARGE BOND ISSUES VS SMALL BOND ISSUES SPREAD*

*Spread -to-worst. Source: Credit Suisse, HY Index Weekly Data 1.7.2011-7.19.2024. Past performance is not necessarily indicative of future results.

Mesirow High Yield Management is a division of Mesirow Financial Investment Management, Inc., an SEC-registered investment advisor. | Past performance is not indicative of future results. Please see the disclosures at the end for important information and the GIPS Report that is also included. | 1. Throughout this paper, we use the size of the bond issue as a generally accurate proxy for the size of the issuing firm. This is commonly done because firm size, measured by sales, profits, or market capitalization, is dynamic what is a small firm one year may become a mid-size firm in the near future. And the market capitalization of private companies cannot be observed. Issue sizes, on the other hand, remain constant, so averages across long periods have meaning. | 2. Credit Suisse HY Index Weekly Data 2011–6.2024. | 3. JPM, Bloomberg 1999–2021. | 4. Credit Suisse HY Index Weekly Data 2011–6.2024. | 5. BAML, Bloomberg, eVestment 1996–6.2024.

Spark

Our quarterly email featuring insights on markets, sectors and investing in what matters