It may be time to review your business's buy-sell agreement

Share this article

In June 2024, United States Supreme Court issued a decision which may have a significant impact on closely held businesses with certain buy-sell agreements.

What is a buy-sell agreement?

When two or more persons own a business, a buy-sell agreement serves a critical role in defining what happens to the business if an owner dies, becomes permanently disabled, retires or otherwise exits the business. In most cases, the agreement provides that the exiting owner’s interest will be bought out, providing them (or their family) with cash for the value of the exiting owner’s interest and the remaining owners retain control of the business. The agreement also prevents a stranger who the remaining owners do not know and who may not have any knowledge of or ability to contribute to the business, from stepping in as a new owner. This can happen if a spouse or children inherit a deceased owner’s interest or when a retiring owner sells their interest to an unknown third party.

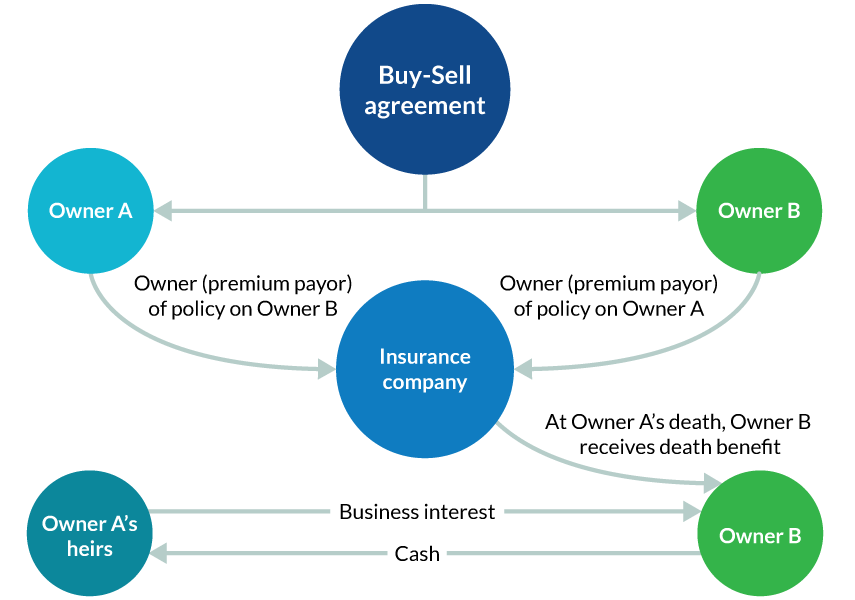

A buy-sell agreement can take different forms. A “cross-purchase” agreement involves an agreement between the owners which requires the remaining owners to purchase the interest of an exiting owner. Each of the remaining owners is financially responsible for the purchase of their pro rata share. If life insurance is used to fund the purchase after an owner’s death, each owner will be required to purchase a policy on the life of every other owner, which can become burdensome when there are several owners.

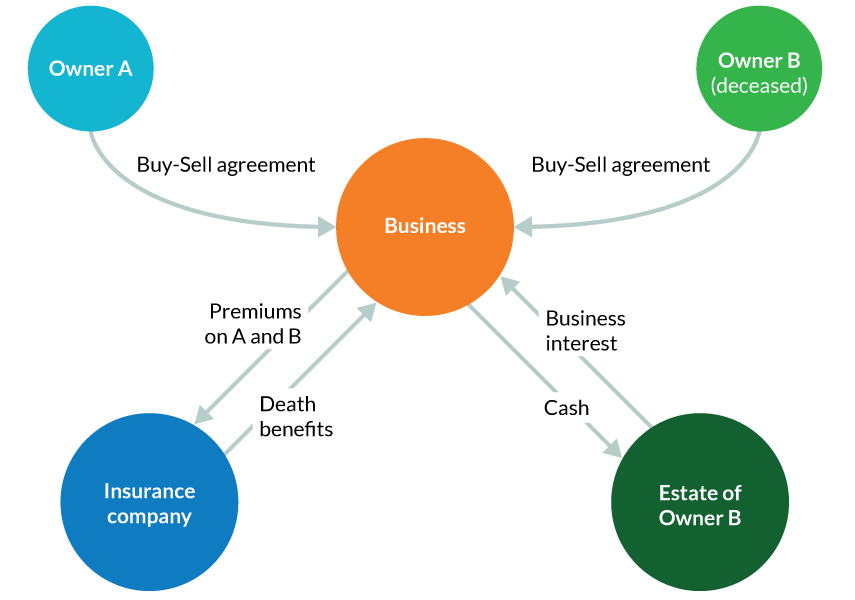

In contrast, a “redemption” buy-sell agreement provides that the business is required to purchase the exiting owner’s interest. Once the business purchases the interest, it effectively disappears as an outstanding ownership interest, leaving the remaining owners as the only owners and increasing their percentage ownership according to their pro rata interests.

How does the US supreme court decision affect buy-sell agreements?

The case is question is Connelly v. United States (U.S., No. 23-146, Opinion 6/6/24). This case involved the valuation of a business originally owned by two brothers. The owners entered into a “redemption” buy-sell agreement with the business that required the business to purchase the ownership interest of either brother if one of them died. The business purchased and owned life insurance on each brother, with the intention to use the proceeds to fund the purchase. One brother then died, the business purchased the shares from the deceased brother’s estate, his family received cash and the other brother was left as the sole owner of the business—which is exactly the purpose of a buy-sell agreement. However, in determining the value of the business for estate tax purposes, the US Supreme Court held that the obligation of a business entity to buy a deceased owner’s interest does not reduce the value of the entity or the value of the insurance proceeds received by the business to fund the buyout, contrary to a prior decision by the U.S. Court of Appeals in Estate of Blount v. Commissioner (428 F.3d 1338, 11th Cir. 2005) that many advisors considered settled law. This resulted in a substantial underpayment of estate tax by the deceased brother’s estate, caused by the redemption agreement.

What steps should business owners take?

If you have a redemption buy-sell agreement in place for your business, you should consider reviewing this agreement with your legal advisor to determine whether the Connelly decision impacts you and your business. You may also want to consider a more comprehensive review of the structure and funding of your agreement. Is it optimally structured for your current business entity? If you have funded the agreement with life insurance, has the value of the company increased beyond the death benefits originally purchased? If new owners such as family members or even family trusts have been brought in, have they been included in the agreement? (Remember: If an owner transfers their interest to a trust, the agreement may need to be modified to trigger upon the trust’s beneficiary’s death, because the trust itself as the owner will not “die”) The Connelly decision may provide a good opportunity to double check that you and your business are adequately protected.

Buy-sell agreements are a critical part of succession planning for business owners. Your Mesirow Wealth Advisor can assist you with including a buy-sell as part of your holistic business and personal financial and estate plans.

Published February 2025

Connect with an advisor

Mesirow does not provide legal or tax advice. Past performance is not indicative of future results. The views expressed above are as of the date given, may change as market or other conditions change, and may differ from views express by other Mesirow associates. This is not a solicitation to buy or sell the securities mentioned. Do not use this information as the sole basis for investment decisions, it is not intended as advice designed to meet the particular needs of an individual investor. Information herein has been obtained from sources which Mesirow believes to be reliable, we do not guarantee its accuracy and such information may be incomplete and/or condensed. All opinions and estimates included herein are subject to change without notice. This communication may contain privileged and/or confidential information. It is intended solely for the use of the addressee. If you are not the intended recipient, you are strictly prohibited from disclosing, copying, distributing or using any of the information. If you receive this communication in error, please contact the sender immediately and destroy the material in its entirety, whether electronic or hard copy. This material is for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security.

Mesirow refers to Mesirow Financial Holdings, Inc. and its divisions, subsidiaries and affiliates. The Mesirow name and logo are registered service marks of Mesirow Financial Holdings, Inc. ©2025, Mesirow Financial Holdings, Inc. All rights reserved. Any opinions expressed are subject to change without notice. Past performance is not indicative of future results. Advisory Fees are described in Mesirow Financial Investment Management, Inc.’s Form ADV Part 2A. Advisory services offered through Mesirow Financial Investment Management, Inc. an SEC registered investment advisor. Securities offered by Mesirow Financial, Inc. member FINRA and SIPC.