How to donate with intention: Donor-advised funds versus private foundations

Share this article

When planning how to donate to charitable causes, it is important to be aware of all of the tax implications. Two strategies often used by individuals and families are donor-advised funds (DAFs) and private foundations; each has unique costs and tax advantages.

Donor-advised funds (“DAF”s)

DAFs allow you to gift cash, appreciated securities, or other assets directly into a fund, then help choose which charitable organizations the fund makes grants to. DAFs are relatively easy to set up and inexpensive to maintain. You have the ability to make donations from the fund and are not subject to minimum annual donations. DAFs are also characterized with low startup costs, tax deductions and minimal time commitments.

DAFs have notable tax advantages where an individual’s adjusted gross income (AGI) can be reduced by as much as 60% for cash donations or 30% for appreciated assets, compared to just 30% and 20%, respectively, for foundations.3 This can be incredibly useful in years with a large tax bill, as you can donate a large sum to a DAF, which can spread the actual donations to charities over several years.

One key limitation of DAFs is that the donation must be made to a 501(c)(3) public charity such as Make-Wish America, religious organizations, or educational institutions. DAFs cannot donate to individual causes or charities that are not characterized as a 501(c)(3)6. More about DAFs.

Private foundations

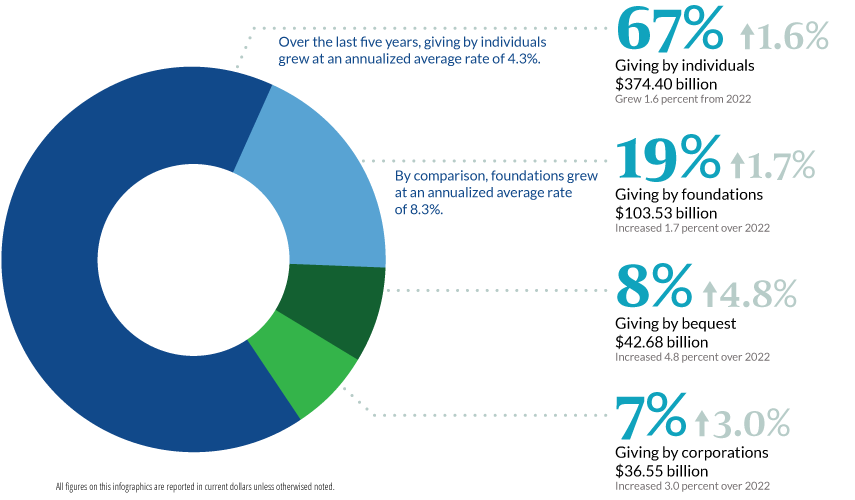

As seen by the chart below provided by the Giving USA 2021 Annual Report5, foundations made up 19% of charitable giving in 2020. They are also the fastest growing source of giving for the year, growing 17% year-over-year. Private foundations can be a tax advantageous vehicle for you to donate to the causes that mean the most to you and your family.

Source: Giving USA 2024 Annual Report | * All figures on this infographics are reported in current dollars unless otherwised noted.

Private foundations have several pros and cons compared to a DAF. Foundations are often associated with a ‘prestige’ element where wealthy individuals create a fund with a specific goal of donating to charitable causes that mean the most to them. Foundations can make grants with fewer restrictions compared to a DAF to help ensure that donations are aligned with the donor. A private foundation is designed to last in perpetuity with a requirement to donate 5% of net assets annually3.

However, foundations can be incredibly expensive to organize and operate. You should consider hiring legal and accounting professionals to handle startup and ongoing regulatory and compliance matters like bookkeeping, tax preparation and corporate filings. If the net assets of the foundation are not high enough, these expenses can quickly deteriorate the corpus of the fund and make the foundation unfeasible.

Which is right for you?

While both strategies allow up to grow your donations with minimal taxes, there are several differences to consider. In order to determine which strategy is best for you, it is important to be aware of the key differences between DAFs and private foundations:

Key differences

| Donor Advised Fund (DAF) | Private foundation | |

| Setup Costs | Minimal | Complex, requires Legal and Accounting |

| Management Fees | Typically less than 1% | Typically less than 1% |

| Administrative Responsibilities | None other than making periodic grants | Depending on size, regular board meetings, accounting, potentially hiring staff to maintain books |

| Typical Minimum Amount Recommended to Open | Typically $5,000 | Typically $250,000 |

| Value Used to Calculate Deduction for Noncash Donation | FMV for assets held for over one year | FMV for publicly traded securities; Cost basis for other appreciated assets |

| Tax Deduction for Cash as a Percent of Adjusted Gross Income | 60% | 30% |

| Tax Deduction for Securities as a Percent of Adjusted Gross Income | 30% | 20% |

| Annual Minimum Distributions | None | 5% of assets |

| Excise Tax | None | Typically 1.39% on Investment Income |

| Privacy | Donors and grantees can be kept confidential | Requires detailed tax returns which are public records |

| Fund Lifespan | Varies, many revert to the sponsor organization after the original donors or succeeding generations die | Can live in perpetuity with the board named successors |

| Grant Recipients | 501(c)(3) organizations only | 501(c)(3) organizations, individuals (in need or for scholarships, for example), other charitable intentions |

| Investment Options | Limited depending on sponsor organization | High degree of flexibility |

| Tax Filing | No annual tax filings | Form 990-PF filed annually |

Sources: Mesirow, IRS, NCFP, Moss Adams, Giving USA

When considering if setting up a private foundation or a donor-advised fund is consistent with your charitable goals, it is important to consider the pros and cons to both strategies and alternative options, such as giving directly to a charity that is aligned with your values. Please discuss each of these charitable strategies with your wealth advisor and other professional resources before making any material donations.

Published February 2024

Sources:

1. https://www.irs.gov/charities-non-profits/private-foundations/tax-on-net-investment-income

2. https://www.irs.gov/charities-non-profits/private-foundations/private-foundation-excise-taxes

3. https://www.ncfp.org/knowledge/how-do-donor-advised-funds-compare-with-private-foundations-and-other-vehicles/#:~:text=A%20private%20foundation%20is%20a,the%20sponsor%20organization%20must%20approve.

4. https://www.mossadams.com/articles/2021/10/donor-advised-funds-versus-private-foundations

5. https://store.givingusa.org/products/2021-annual-report?variant=39329211613263

6. https://www.irs.gov/charities-non-profits/charitable-organizations/the-restriction-of-political-campaign-intervention-by-section-501c3-tax-exempt-organizations

Connect with an advisor

Mesirow does not provide legal or tax advice. Past performance is not indicative of future results. The views expressed above are as of the date given, may change as market or other conditions change, and may differ from views express by other Mesirow associates. This is not a solicitation to buy or sell the securities mentioned. Do not use this information as the sole basis for investment decisions, it is not intended as advice designed to meet the particular needs of an individual investor. Information herein has been obtained from sources which Mesirow believes to be reliable, we do not guarantee its accuracy and such information may be incomplete and/or condensed. All opinions and estimates included herein are subject to change without notice. This communication may contain privileged and/or confidential information. It is intended solely for the use of the addressee. If you are not the intended recipient, you are strictly prohibited from disclosing, copying, distributing or using any of the information. If you receive this communication in error, please contact the sender immediately and destroy the material in its entirety, whether electronic or hard copy. This material is for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security.

Mesirow refers to Mesirow Financial Holdings, Inc. and its divisions, subsidiaries and affiliates. The Mesirow name and logo are registered service marks of Mesirow Financial Holdings, Inc. ©2025, Mesirow Financial Holdings, Inc. All rights reserved. Any opinions expressed are subject to change without notice. Past performance is not indicative of future results. Advisory Fees are described in Mesirow Financial Investment Management, Inc.’s Form ADV Part 2A. Advisory services offered through Mesirow Financial Investment Management, Inc. an SEC registered investment advisor. Securities offered by Mesirow Financial, Inc. member FINRA and SIPC.