Five key financial planning ideas for young families

Share this article

Financial planning is a crucial aspect of family life. From managing day-to-day expenses to preparing for major life events, families must navigate a complex landscape of financial decisions. It is easy for the demands of daily life to take precedence — from coordinating schedules for extracurricular activities, to planning birthday parties, or even simply planning a weeknight dinner. This article addresses five key financial planning topics that should be prioritized when trying to accomplish financial goals on top of day-to-day demands.

1. Discussing finances as a family

The first step in financial planning for families starts with having a conversation. Discussing money is not always the easiest and most comfortable topic, but regular discussions can help align priorities, identify potential challenges and foster a sense of shared responsibility.

To kickstart your financial planning discussion, it's essential to gather all pertinent financial information and create a family balance sheet. Items to include are:

- Account statements: checking and savings, 401ks, taxable investment accounts, etc.

- Asset valuations: home value, investment properties, etc.

- Debts: mortgage balance, student loan balance, car loans, etc.

- Expenses: day to day living expenses, mortgage payment (or rent), property taxes, day care, etc.

Going through this exercise at least once a year and putting pen to paper is incredibly valuable. It allows you to track progress and make sure both partners are on the same page.

In conjunction with creating a balance sheet, families should openly discuss their short-, medium-, and long-term goals. The key to financial planning is prioritizing your goals. We can’t achieve all our goals at once but breaking them down into time periods and prioritizing them makes achieving them a lot more tangible.

2. Estate planning

Estate planning is not just for the “rich.” Estate planning involves creating a plan for the distribution of assets and properties after one's passing. It's a critical component of financial planning that ensures the smooth transfer of wealth and minimizes potential conflicts among heirs. Families should consider drafting essential documents such as wills, trusts, and powers of attorney to outline their wishes and protect their loved ones' interests. By proactively addressing estate planning matters, families can provide peace of mind and clarity for the future.

Here are the most important estate planning items for young families to consider:

- Accounting titling and beneficiary designations: Ensuring that accounts are titled in an optimal manner allows for easier transfer of assets should something happen to the account owner. Along the same lines, periodically checking that the beneficiary(ies) listed on retirement account assets are as chosen secures that assets get passed on according to the account owners desires.

- A will: This is a legal document that outlines how a person’s assets will be distributed upon their death. Importantly, a will names an executor (who is going to oversee that what the will says actually gets done!) and a guardian for your minor child(ren).

- Powers of Attorney (POA): A durable power of attorney for property or health care allows an individual to appoint an agent to handle their financial/health care affairs in the event of incapacity.

3. Insurance planning

Insurance plays a vital role in mitigating financial risks and protecting against unexpected events. Families should assess their insurance needs across various areas, including health, life, property and liability. Adequate coverage can safeguard against medical expenses, property damage, legal liabilities, and loss of income due to disability or death. By reviewing insurance policies regularly and adjusting coverage as needed, families can ensure comprehensive protection for themselves and their assets.

Life insurance is an important component for families to consider when evaluating their financial plans. Understanding the types of policies available is key when evaluating what makes sense for a family’s needs:

What is life insurance? Insurance on your life! Meaning if you pass away, the insurance company pays your beneficiary (usually the surviving spouse) an agreed upon lump sum.

- There are several different kinds of life insurance:

- Term insurance: This is the lowest cost life insurance; you pay a level annual premium for a fixed death benefit. The term expires after a set number of years (i.e. 20-year term). Term insurance = renting insurance for a stated period of time.

- Whole life insurance: Compared to term insurance, these policies result in a larger premium for the same amount of death benefit; however, these policies build up a cash value over time and may be permanent.

- Term insurance: This is the lowest cost life insurance; you pay a level annual premium for a fixed death benefit. The term expires after a set number of years (i.e. 20-year term). Term insurance = renting insurance for a stated period of time.

- Things to consider when buying term insurance:

- If one spouse is earning more money, they should consider having greater levels of coverage in the event something happens.

- “Matching” the term to outstanding liabilities i.e. mortgage, college, childcare.

- Many employers offer group policies — this is the first place to go for your life insurance coverage. Coverage is usually 1-2x your salary at little to no cost.

4. Saving for college

A 529 plan is a state-sponsored savings vehicle designed specifically to address qualified education expenses. Every 529 plan has one account owner, often a parent or grandparent, and one designated beneficiary.

- State tax benefits: Numerous states, including Illinois, extend state tax benefits for contributions made to 529 plans. For instance, Illinois offers a state tax deduction for contributions made to an Illinois-sponsored 529 plan, with limits set at $10,000 for single taxpayers and $20,000 for those filing joint returns.

- Tax-free growth: Assets within 529 plans enjoy the benefit of tax-free growth, allowing contributions to accumulate without incurring taxes on earnings.

- Tax-free withdrawals: Perhaps most notably, 529 plans permit tax-free withdrawals of both principal and earnings when utilized for qualified education expenses. This feature serves as a significant advantage for families seeking to fund educational endeavors without incurring tax liabilities.

- Beneficiary Flexibility: Owners of 529 plans possess the flexibility to reassign beneficiaries within the same family without triggering any gift tax consequences. This versatility enables families to adapt to changing circumstances while maintaining the tax advantages associated with the plan.

Importantly, anyone can contribute to a child’s 529 plan, so if grandparents want to give gifts to their grandkids, this is a great place to do it!

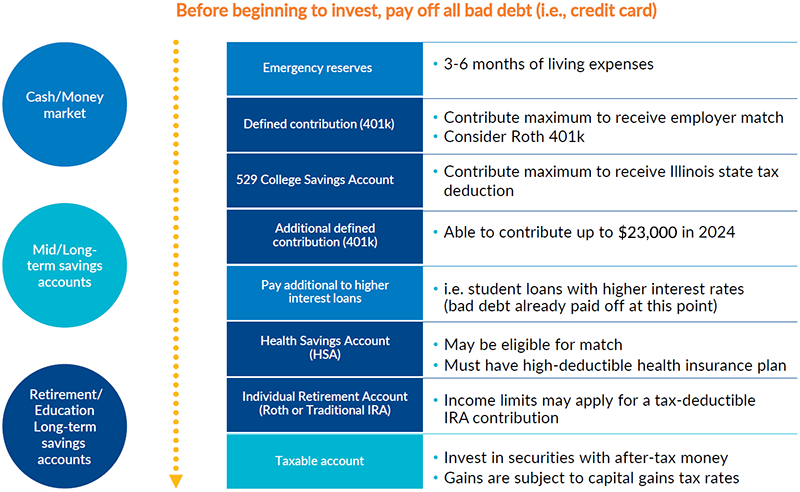

5. How to prioritize savings

With numerous financial goals competing for attention, prioritizing savings can be challenging. Families should evaluate their objectives and allocate resources based on their importance and urgency. Essential considerations include building an emergency fund to cover unexpected expenses, paying off high-interest debt to reduce financial strain, and investing for long-term growth. By establishing clear priorities and adopting a disciplined approach to saving, families can make meaningful progress towards their financial goals while maintaining financial stability.

This chart below is an example of how/where to start:

Conclusion

Financial planning is never one size fits all. By addressing these key considerations proactively, families can strengthen their financial well-beings, protect their loved ones, and work towards a more secure future. Through collaborative decision-making and a commitment to financial responsibility, families can navigate the complexities of financial planning with confidence and clarity.

Collaborating with a financial advisor enables your family to define its objectives and assess its financial standing to successfully achieve your goals. This partnership not only empowers you to make informed decisions but also grants you the freedom to cherish the most fulfilling aspects of family life without the burden of financial worries.

Published January 2025

Connect with an advisor

Mesirow does not provide legal or tax advice. Past performance is not indicative of future results. The views expressed above are as of the date given, may change as market or other conditions change, and may differ from views express by other Mesirow associates. This is not a solicitation to buy or sell the securities mentioned. Do not use this information as the sole basis for investment decisions, it is not intended as advice designed to meet the particular needs of an individual investor. Information herein has been obtained from sources which Mesirow believes to be reliable, we do not guarantee its accuracy and such information may be incomplete and/or condensed. All opinions and estimates included herein are subject to change without notice. This communication may contain privileged and/or confidential information. It is intended solely for the use of the addressee. If you are not the intended recipient, you are strictly prohibited from disclosing, copying, distributing or using any of the information. If you receive this communication in error, please contact the sender immediately and destroy the material in its entirety, whether electronic or hard copy. This material is for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security.

Mesirow refers to Mesirow Financial Holdings, Inc. and its divisions, subsidiaries and affiliates. The Mesirow name and logo are registered service marks of Mesirow Financial Holdings, Inc. ©2025, Mesirow Financial Holdings, Inc. All rights reserved. Any opinions expressed are subject to change without notice. Past performance is not indicative of future results. Advisory Fees are described in Mesirow Financial Investment Management, Inc.’s Form ADV Part 2A. Advisory services offered through Mesirow Financial Investment Management, Inc. an SEC registered investment advisor. Securities offered by Mesirow Financial, Inc. member FINRA and SIPC.