Insights

US Dollar: Currency Dynasty

Share this article

Dominant reserve currencies—those currencies that banks hold as reserves for use in international trade and finance—come and go. These currencies rise into prominence, spend about 90 to 100 years in the spotlight and decline into obscurity.1 The US dollar is the current dominant reserve currency: It rose in the first half of the 1900s and has maintained its position as the world’s most important currency for more than two decades into the new century.

WORLD RESERVE CURRENCIES SINCE 1450*

*modern day flag of country shown

The history of the dollar from World War I onwards is a story of a dynasty: power, benefits, and political and economic turmoil.

US dollar ascent

The US dollar’s ascent began during World War I when the United States became a crucial exporter for war materials and food, trade that was settled in US dollars. In the post-war period, the US provided substantial support—in dollars—for reconstruction. While dollar holdings in foreign central banks declined during the Great Depression, events near the end of the Second World War made the US dollar the supreme currency in the world.

That supremacy was based on decisions made at the United Nations Monetary and Financial Conference held at Mt Washington Hotel in Bretton Woods, New Hampshire in 1944. The conference was held to address the catastrophic outcomes of World War II and to prevent ‘beggar-thy-neighbor’ economic actions, such as currency devaluations and high tariffs, that benefited a nation at the expense of other countries.

Initially, the Bretton Woods structure of global commerce and finance—meaning how products were invoiced, investments priced, and international transactions settled—centered on the United States converting US dollars to gold at $35 per ounce, which was a de facto gold standard. Other nations would maintain their currencies at a fixed exchange rate solely with the dollar.

Because the dollar was the world’s only international currency (except for the British pound’s use in the British Empire and Commonwealth), foreign banks hoarded dollars. This had a beneficial effect for American firms and consumers who could print a $100 bill for a few cents but make other nations deliver $100 worth of goods and services to obtain it. Americans bought goods in dollars, avoiding currency conversion costs, and obtained loans—in dollars—for foreign investment. And because of the immense demand for dollars, there was little worry that the dollars would be presented for conversion into gold, thus protecting the American stockpile of the precious metal.

Nixon and a new economic policy

By the end of the 1950s, however, foreign nations’ economies had recovered from the war devastation, and their central banks held more dollars than the US held in gold reserves. Nations became nervous about the ability to convert their dollars to gold and, to avoid being the last one holding dollars, started presenting the US currency to the Treasury for gold.

Dollar to gold conversions increased until, unable to meet the demand, President Nixon suspended gold conversion in 1971. To minimize the damage to American prestige from cutting off gold sales, Nixon heralded a New Economic Policy by including tax cuts, a 90-day wage and price freeze, and a ten-percent surcharge on imports. Later, in exchange for ending the surcharge, the US and its trading partners negotiated new fixed exchange rates that reflected a significant devaluation of the dollar.2

The end of Bretton Woods

To increase his chances for reelection in 1972, Nixon pressured the Federal Reserve to run a loose monetary policy. Inflation increased,3 and rising prices reduced the buying power of the dollar and increased the strain on the recently negotiated exchange rates. Because exchange rates were fixed, the only way to release the strain was for foreign nations to inflate along with the United States. Speculation against the dollar became so great that foreign governments let their currencies float in March 1973, effectively ending the Bretton Woods system.4

Despite the global financial upheaval, the dollar was—and has remained—entrenched as the world’s dominant reserve currency. The end of the Bretton Woods gold standard and fixed exchange rates didn’t change the fact that American economic policy and its currency affected world trade, global investment, and the fortunes of other nations’ economies. But is the dollar’s decline inevitable? How long will the dollar remain the world’s dominant currency?

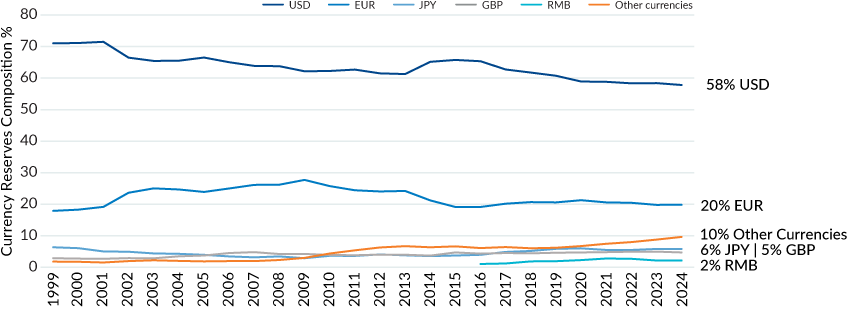

CURRENCY COMPOSITION OF OFFICIAL FOREIGN EXCHANGE RESERVES (%)

Source: International Monetary Fund Currency Composition of Official Foreign Exchange Reserves

Explore

Nothing lasts forever. Is the US dollar an exception?

Crises and competition challenges USD hegemony as the dominant foreign exchange reserve.

The central bank digital currency threat

Nations are rushing to launch CBDCs. Will the US be a leader or a laggard in the digital currency race?

1. https://www.midasgoldgroup.com/news/world-reserve-currencies-since-1450 | 2. Eichengreen, Barry, Exorbitant Privilege: The Rise and Fall of the Dollar and the Future of the International Monetary System, Oxford University, Press 2011, page 60. | 3. Eichengreen page 61. | 4. https://www.federalreservehistory.org/essays/bretton-woods-launched

Originally published February 2023, updated May 2025 | The information contained herein is for professional investors, institutional clients, Eligible Contract Participants and Qualified Eligible Persons, or the equivalent classification in the recipient’s jurisdiction, only and is for informational purposes only. Past performance is not an indication of future results. Actual results may be materially different from the results achieved historically.

Spark

Our quarterly email featuring insights on markets, sectors and investing in what matters