Insights

US debt is headed to unimaginable levels

Share this article

June 20, 2024 | By Mesirow Currency Management

National debt worries

It’s easy to be complacent about the US debt level. Since 1990, debt crises have erupted periodically (1995–6, 2011, 2013, 2021, 2023), with intense media coverage and dire predictions of economic consequences. Sometimes the crises partially shut down the government and once led to a credit downgrade (2011). But each time the crisis was resolved and forgotten.

THE NATIONAL DEBT CLOCK – MARCH 1989

Source: Wikimedia Commons

According to Phillip Sewell, the Director of the Congressional Budget Office (CBO, a nonpartisan federal agency that provides budget and economic information to Congress), the next crisis might not be so easy to dismiss.

Mr. Sewell said the US risks a market reaction like Britain’s in 2022, when then-prime minister Liz Truss proposed a package of unfunded tax cuts and energy price guarantees. Investors demanded a premium to hold British assets, unsettling the bond market and causing the British pound to weaken. The turmoil was too much for the prime minister; she resigned after just seven weeks in office.

Where is the debt level now?

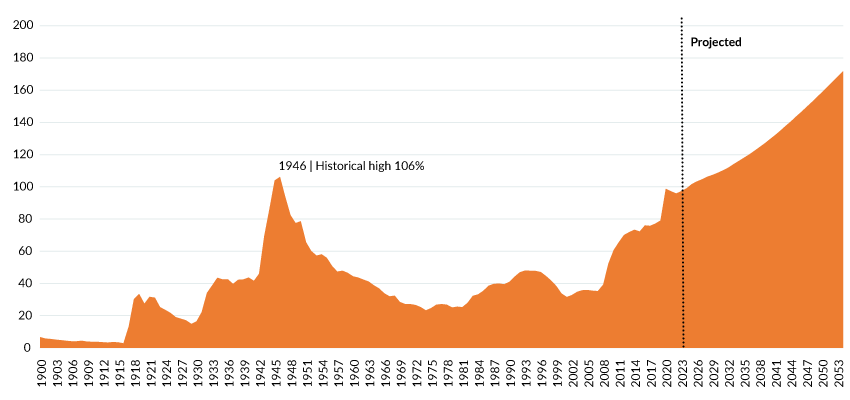

The US debt level, measured as a percentage of GDP to make it comparable across time periods, is historically high and headed to unimaginable levels.

According to the CBO, the debt held by the public at the end of 2023 was 97.3% of gross domestic product. The CBO estimates that debt will increase to 116% of GDP by 2034 and to 171.7% of GDP by 2054. Those values dwarf debt held during and directly after World War II – 106% of GDP – when the US borrowed heavily to finance that conflict.

FIGURE 1: US DEBT HELD BY THE PUBLIC, PERCENT OF GDP

Source: cbo.gov

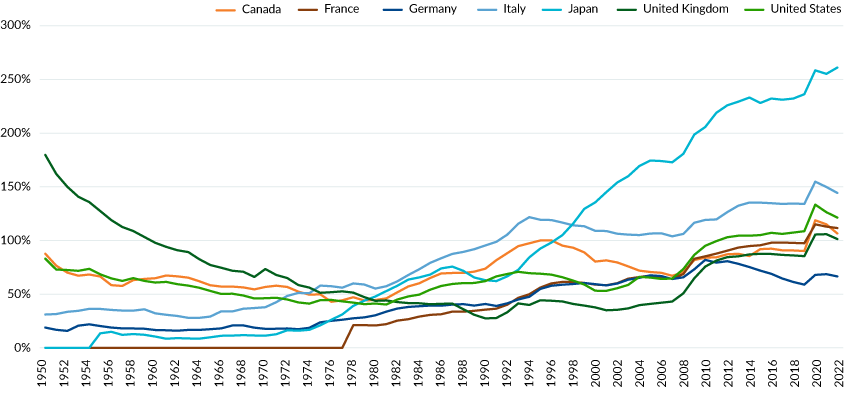

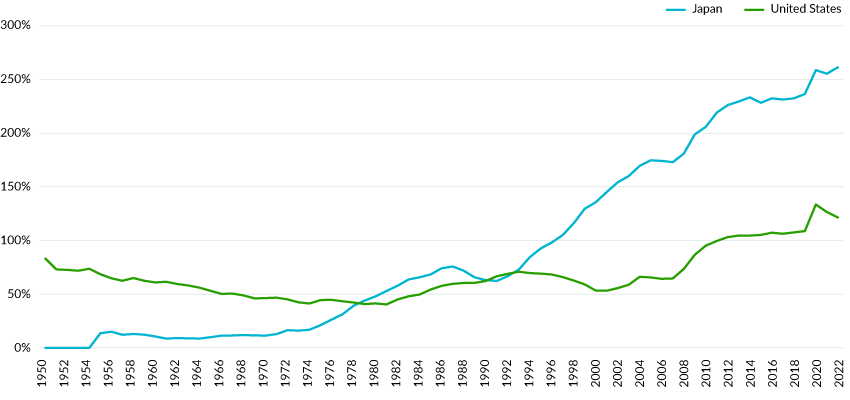

US debt levels are roughly comparable to those of other nations except Japan, a nation that has borrowed extraordinary amounts at near-zero rates with only some repercussions (Figures 2 and 3).

Japan can borrow from its citizens who are willing to hold government debt at rock-bottom interest rates. The central bank contributes to the situation by buying massive quantities of bonds; it owns about one-half of all sovereign bonds.

FIGURE 2: GENERAL GOVERNMENT DEBT TO GDP

Source: imf.org

FIGURE 3: GENERAL GOVERNMENT DEBT TO GDP - US AND JAPAN

Source: imf.org

Japan’s debt level isn’t without cost. Japanese bonds have only an upper grade medium rating, and Japan will spend 22% of its current fiscal year budget on interest payments. With a rapidly aging society that will demand more care and larger pension amounts, the debt servicing costs are likely to become prohibitive and constrain debt issuance.

TABLE 1: CREDIT RATINGS AND LONG-TERM CREDIT RATING CATEGORIES

| Country | S&P | Moody's | Fitch |

| Japan | A+ | A1 | A |

| US | AA+ | Aaa (negative outlook) | AA+ |

| Category | S&P | Moody's | Fitch |

| Prime | AAA | Aaa | AAA |

| AA+ | Aa1 | AA+ | |

| High grade | AA | Aa2 | AA |

| AA- | Aa3 | AA- | |

| A+ | A1 | A+ | |

| Upper medium grade | A | A2 | A |

| A- | A3 | A- |

Source: Trading Economics; Fitch; wolfstreet.com

Few signs of strain

The United States hasn’t experienced much pain for its large and growing debt. Moody’s rates the US’s long-term debt as prime (but with a negative outlook), its highest rating. S&P and Fitch ratings are one level lower (Table 1).

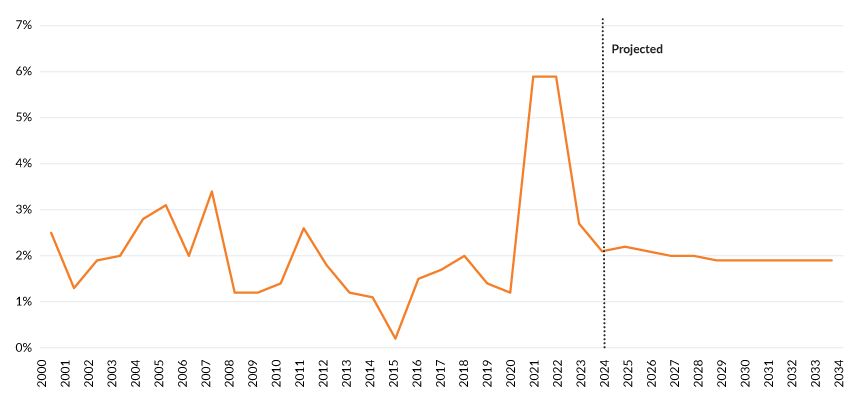

Inflation levels are moderating; the CBO doesn’t expect personal consumption expenditures inflation to exceed the Federal Reserve’s long-term 2.0% goal for the next decade.

FIGURE 4: OVERALL INFLATION, PERCENT

Source: cbo.gov

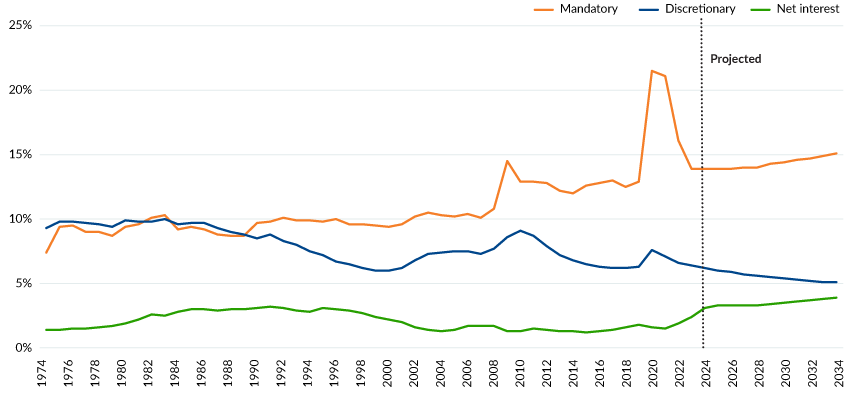

Interest payments are a warning, but so far ignored. The CBO reckons that interest payments will rise to 3.9% of GDP in 2034, an increase of 144% compared to the 2020 level.

Discretionary spending, which includes defense outlays, will decline to 5.1%. And mandatory spending, the category that includes entitlement programs like Medicare and Social Security, will equal 15% of GDP in 2034. Those programs are expected to have financing shortfalls in the mid-2030s; an easy funding solution would be to borrow to cover the shortfall, thereby increasing the pressure on interest payments.

FIGURE 5: MANDATORY AND DISCRETIONARY SPENDING AND INTEREST, PERCENT

Source: cbo.gov

Inflation protection hedges, such as gold, could be a warning that the nation’s finances are amiss. Gold has risen from about $1,650 per troy ounce in mid-October 2022 to about $2300 in mid-June 2024. Analysts and reporters attribute the jump in price to concern about world and economic events such as the Ukraine war and the downturn in the Chinese economy. Mounting global debt is also mentioned as a contributory cause for the increase in the precious metal’s price.

Excessive debt could cause the value of the dollar to decline. But the dollar index is at 105 (as of June 2024), not too far off its October 2023 high of 107. Bitcoin, a substitute for dollars for investors worried about currency debasement, might suggest some concern about the US currency. The cryptocurrency is around $71,000, close to its all-time high.

Bond vigilantes

Bond vigilantes, a term coined by economist Ed Yardeni in the 1980s that described investors that demanded a higher yield to hold government debt, could corral government spending by selling bonds. That selling pressure would increase government costs to issue debt, adding to interest payments.

Vigilantes, given some credit for forcing Congress to create a balanced budget in the 1990s, are quiet now.

What can be done to reduce US debt?

Reducing spending or increasing income are easy remedies to identify. The International Monetary Fund estimates that the US needs to lower spending or increase taxes by about 4% of GDP by 2029 to stabilize debt. That could involve painful adjustment for some government fund recipients.

Improved economics could be another solution. Those improvements could include increased productivity, say from artificial intelligence enhancements. If inflation can be managed, lower interest rates could help reduce interest payments.

Shifting the payment burden to creditors could be an unpopular solution. Future spending programs by the Biden administration and tax cuts or handcuffing the Federal Reserve proposed by Donald Trump are actions that could raise interest rates and harm real-term returns. Higher interest rates would reduce the value of the creditors’ bond holdings, angering domestic and foreign investors such as central banks that use the US dollar as their major reserve holding.

Warnings about fiscal calamities are always followed by the question: When will it happen? No one knows.

The situation is like a dam that holds ever higher water levels: It might spring leaks that indicate pending doom, giving enough time to make repairs. Or it could fail suddenly and catastrophically.

Explore more currency insights

Cryptocurrencies and Tokenization

Distributed ledger technology fosters digitization of just about everything.

Can a US rapid payment system take off?

The benefits of rapid payments (financial inclusion, connectivity, shelter from economic sanctions) have many nations interested in establishing a rapid payments system.

Spark

Our quarterly email featuring insights on markets, sectors and investing in what matters