Insights

Strategic Fixed Income | 2Q2024 Commentary

Share this article

Market commentary

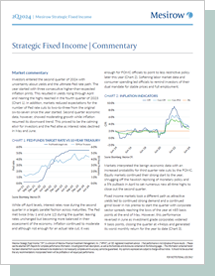

Investors entered the second quarter of 2024 with uncertainty about yields and the ultimate Fed rate path. The year started with three consecutive higher-than-expected inflation prints. This resulted in yields rising through April and nearing the highs reached in the fourth quarter of 2023. In addition, markets reduced expectations for the number of Fed rate cuts to two-to-three from the original six-to-seven since the year started. Second quarter economic data, however, showed moderating growth while inflation resumed its downward trend. This proved to be the calming elixir for investors and the Fed alike as interest rates declined in May and June.

Spark

Our quarterly email featuring insights on markets, sectors and investing in what matters