Insights

Stablecoins: Cryptocurrencies with a pegged price

Share this article

August 13, 2024 | By Mesirow Currency Management

Designed to overcome price volatility, could stablecoins become a mainstream medium of exchange?

Fans tout cryptocurrencies as a new medium of exchange, a digital currency to pay for goods and services. But cryptocurrencies are volatile, and people are reluctant to use them when prices change rapidly. Sellers are worried that a cryptocurrency might drop significantly in price right after they make a sale of a good or service, while buyers dread a big increase. Both can leave a transaction wishing they had waited for a better price.

Stablecoins, a type of cryptocurrency, offer a solution to the volatility of traditional cryptocurrencies. Stablecoins minimize volatility by fixing, or pegging, their value to that of another asset such as a currency or commodity. The peg is intended to assure buyers and sellers that the stablecoin’s value will be nearly the same before and after the transaction.

Types of stablecoins

Stablecoins can be pegged to a single asset or a combination of assets. Table 1 presents categories of stablecoins, how they maintain stability, and some examples of stablecoins within the category.

TABLE 1: STABLECOIN TYPES, BACKING, AND EXAMPLES

| Stablecoin category | Stability is maintained by | Examples |

| Currency-backed | Reserves of currencies such as the US dollar or euro | Tether, USD Coin |

| Commodity-backed | Reserves of commodities such as gold | PAX Gold, Tether Gold |

| Other cryptocurrencies | An algorithm that directs the purchase or sale of underlying cryptocurrencies | Dai, Frax |

| Unbacked | Computer programs that buy and sell the stablecoin to match demand and supply | TerraClassicUSD Destablecoin HAY |

Source: https://www.bis.org/publ/bppdf/bispap141.htm

Market value

Stablecoin market value is approximately $163.9 billion, or about 6.8% of total cryptocurrency value of $2.3 trillion (as of July 31, 2024).

There are 172 stablecoins, but the top five stablecoins represent 96.5% of the cryptocurrency category value (Table 2). Given the combined value of Tether and USDC, currency-backed stablecoins dominate the category.

TABLE 2: TOP FIVE STABLECOINS BY VALUE

| Stablecoin | Backing | Value | % of Stablecoin Value | ||

| Tether | USDT | Currencies, mostly US dollar | $114,523,658,219 | 69.9% | |

| USDC | USDC | USD | $33,105,539,764 | 20.2% | |

| DAI | DAI | Cryptocurrencies | $5,294,328,701 | 3.2% | |

| Ethena | USDE | Cryptocurrencies | $3,196,044,313 | 2.0% | |

| First Digital | FDUSD | USD | $2,016,626,996 | 1.2% | |

| 96.5% |

Note: Value is market capitalization, Source: coingecko.com July 31, 2024

Stablecoin uses

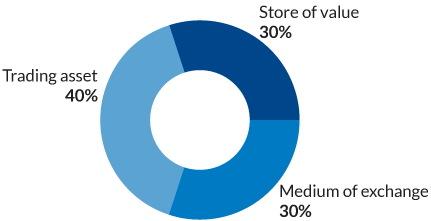

Figure 1 presents typical stablecoin uses. The largest category is as a trading asset. Some traders find the wild swings in cryptocurrency prices advantageous for achieving large profits, but the volatility of most cryptocurrencies hampers their use as a medium of exchange. The price stability of stablecoins makes them more useful for cryptosphere transactions like buying or selling tokens, digital representations of tangible and intangible things like art and intellectual property.

Stablecoins pegged to a currency such as the US dollar make them useful for investors who want the US dollar for a store of value. People who struggle with currency controls (say in China), high inflation (Argentina) or nations experiencing US-imposed sanctions (Russia) may find it difficult to own the US dollar. A USD-backed stablecoin can give buyers exposure to the US dollar that they might otherwise be unable to obtain.

FIGURE 1: STABLECOIN USE

Source: forbes.com

Stablecoins can also be useful for lending and borrowing, bridging the worlds of centralized and decentralized finance. Centralized finance involves organizations such as banks and brokerages that manage financial transactions. In decentralized finance, those organizations are replaced with transactions that are peer-to-peer. Investors can borrow funds from a centralized-world bank as stablecoin collateral and lend those funds in the decentralized finance world.

Stablecoins might find a particularly strong use case in cross-border transactions. Because the price is stable and the relationship to an underlying asset can be determined, stablecoins eliminate the need for currency transactions, reducing cost by eliminating the intermediaries involved in exchanging currencies.

Tether

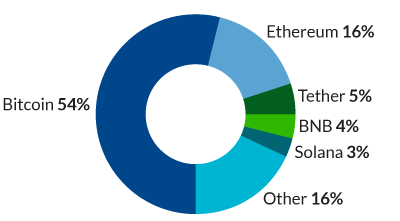

Tether, the first currency-backed stablecoin, is also one of the more popular cryptocurrencies – it accounts for about 5% of the cryptocurrency market (figure 2).

FIGURE 2: TOP 5 CRYPTOCURRENCIES

Source: coingecko.com July 31, 2024

Given its popularity, Tether’s US treasury holdings, used to support its 1 to 1 US dollar peg, rival those of some foreign nations. The process of issuing and redeeming USDT stablecoins is as follows:

Step 1: A user deposits currency into Tether's bank account

Step 2: Tether issues tokens (USDT) and sends them to the user’s wallet address (user’s deposited amount less fees)

Step 3: Tether tokens (USDT) can then be used by user’s for transactions, traded, or stored for later use

If the user decides to redeem their USDT into currency, then

Step 4: The user deposits USDT into their Tether account

Step 5: Tether removes those coins (USDT) from circulation

Tether is the only party that can take Tether coins into or out of circulation.

Stablecoin problems

Stablecoins might become the dominant form of money, but so far there’s no sign of an everyday digital currency. Stablecoins are a small segment of cryptocurrencies, and cryptocurrencies are an even smaller portion of total net private wealth - less than 0.5% of $454.4 trillion in 2022.

For stablecoins popularity to increase, users need to trust that the asset backing a stablecoin is liquid, high quality and audited. Stablecoins struggle to achieve these characteristics. The Bank for International Settlements (BIS) reported that, at the end of September 2023, the largest currency- and commodity-backed coins published information about the reserves backing the coins, but information for crypto-backed coins was opaque.

Few stablecoins publish their asset backing information daily; reporting is more commonly monthly, quarterly and even semi-annually. Infrequent updates to information about underlying assets make it difficult to assess real-time backing quality. The adequacy of reserves is questionable, too: Currency-backed stablecoins hold debt instruments that may be liquid and easily redeemable for cash in normal financial conditions but may be difficult to exchange for par during market panics. And from published data, BIS could not always decide whether the asset backing had been verified or audited by an independent certified public accountant.

Even stablecoins stability is in question. BIS reported that of the 68 stablecoins that it evaluated, no stablecoin was able to maintain their closing prices in parity with their peg. Currency-backed stablecoins were best at maintaining a close peg; stablecoins backed by other cryptocurrencies experienced the largest deviations in tracking their peg.

Other issues limit stablecoin popularity. Stablecoins are designed to reduce volatility, but some traders might prefer riskier cryptocurrency assets if they're looking for speculative profits. Those volatile cryptocurrencies can offer higher returns than stablecoins. Others don’t want to use stablecoins because they’re pegged to centralized assets such as currencies and commodities. They prefer a decentralized option instead. Most worrisome, stablecoins can – and have – failed.

With improvements, stablecoins could make transactions less costly and more efficient, could offer a stable store of value, and could use their price stability to make it easier to trade other cryptocurrencies. But the world of digital money is in flux, and stablecoins – and cryptocurrencies in general - must compete against instant payment systems and central bank digital currencies if they intend to become a popular medium of exchange. It's all about the assets backing stablecoins – those with transparent, liquid, and audited backings stand the best chance of becoming a mainstream means of payment.

Explore more currency insights

Tokenized gold

Tokenized gold works by digitizing ownership of physical gold, making it tradeable on a distributed ledger. Will investors rush to this 21st century treasure?

US debt is headed to unimaginable levels

Since 1990, debt crises have erupted periodically, but the next one may not be so easy to dismiss. Is a financial reckoning coming?

Spark

Our quarterly email featuring insights on markets, sectors and investing in what matters