Insights

Rapid payments speed money through the financial system; economic growth follows

Share this article

September 10, 2024 | By Mesirow Currency Management

Billions of dollars in transaction savings and economic output. Rapid payment systems pay off.

Will developed countries follow the instant payment lead of developing countries?

When it comes to data, FedNow is a FedNo

FedNow, the Federal Reserve’s rapid (or instant) payment system, celebrated its first anniversary in July 2024. While boasting more than 900 participating financial institutions, an extraordinary increase from the 35 institutions that FedNow launched with in 2023, the company is unwilling to disclose the number or value of transactions it processed in its first year.

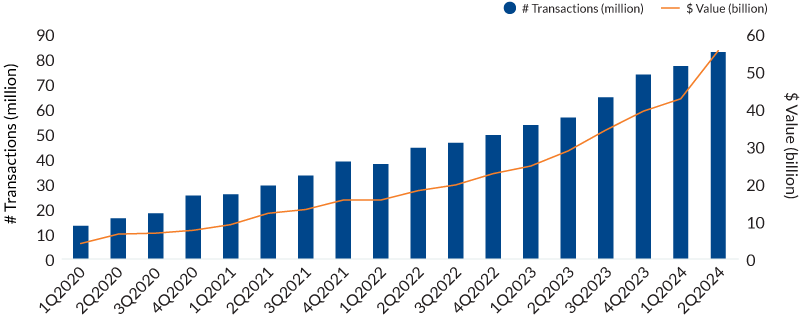

If payment data from RTP, FedNow’s domestic competitor, are an indication, transactions and volumes are low (Figure 1). That’s unfortunate because instant payments can reduce transaction costs and increase economic activity that contributes meaningfully to gross domestic product.

FIGURE 1: RTP TRANSACTIONS AND VALUES 2020 to 2023

Figure 1 is a combo column and line chart that shows RTP transactions and values from 2020 - 2023. In the first quarter of 2020, RTP did 13 million transactions worth $4 billion and in the 2nd quarter of 2024 RTP did 82 million transactions worth $55 billion US dollars. Source: americanactionforum.org/insight/six-months-of-fednow/

Rapid payments allow businesses and consumers to send or receive funds immediately or within a few seconds, any time or day. Instant payment accounts are held at commercial banks and credit unions in checking accounts or mobile apps. Rapid payment systems integrate with accounts and other financial applications to easily transfer money to merchants or people. Payment is made with fewer intermediaries, speeding the delivery with lower processing and transfer fees.

Lower costs and faster payments mean money is quickly available for investment and consumption, boosting GDP.

Can we get in on this?

Rapid payment systems are enormously popular in Asia and Brazil. India leads the world in rapid payments, handling 129.3 billion transactions – 48.6% of global rapid payments – in 2023. Brazil, second to India, processed 14% of global payments and boasted 78% year-on-year growth.

Other nations have recognized the benefits from instant payment systems and have moved aggressively to build the infrastructure, market the system, and encourage (and sometimes insist on) participation.

Rapid payments are growing in other areas besides Asia and South America. In the Nordic nations instant payments account for an estimated 50 per cent of the total volume of account-to-account transfers in Norway and Denmark. Easy sign up, wide merchant acceptance, integration with other payment and financial applications, and proven track record of reliability and efficiency have spurred rapid payment growth.

TABLE 1: INSTANT PAYMENTS (billions of transactions)

| Country | 2021 | 2022 | 2023 | 2026 | 2028 |

| Australia | 0.97 | 1.3 | 1.4 | 2.4 | 2.8 |

| Brazil | 8.7 | 29.2 | 37.4 | 82.4 | 115.8 |

| China | 18.5 | 17.6 | 17.2 | 33.2 | 29.7 |

| India | 48.6 | 89.5 | 129.3 | 206.2 | 248 |

| UK | 3.4 | 4.0 | 4.6 | 5.8 | 6.3 |

| US | 1.8 | 2.8 | 3.5 | 8.9 | 13.9 |

Sources: ACI World PrimeTime for Real-Time global payments reports, (all years except 2026), Year 2026: cebr.com/wp-content/uploads/2022/04/Real-Time-Report_v8.pdf. | |||||

Nations that have large populations, cash-dominant economies, low credit usage and poor financial inclusion are ideal candidates for real-time payment systems. Nations with these characteristics often make it easy to sign up, incenting unbanked or underbanked citizens to participate with no-cost accounts. Nations promoting instant payments offer additional encouragement by distributing financial aid only via instant payment accounts.

Where does all the money go?

National economic benefits are substantial and result from three features of rapid payment systems.

1 | The first is reductions in payment transaction costs when paper-based transaction systems like checks and cash are dominant payment forms. Paper payments have a higher unit cost compared to electronic payments because paper requires more manual effort to process.

Countries like Brazil that have a high percentage of paper-based transactions (65% of the payment mix in 2021 according to Centre for Economics and Business, a consultant) stand to benefit from lower transaction costs compared with nations with a low percentage of paper payments (only 21% of the US payment mix in 2021 was paper based).

2 | The second economic benefit is the reduction in payment float. Float is the time – sometimes several days – that money sits in the financial system after the payer sends funds but before the recipient gets the money.

In traditional payment systems, float allows time to deal with the transaction instructions and make the payment. In a rapid payment transaction those processes occur instantaneously or in a few seconds, resulting in an irrevocable transfer of funds or a rejection. Eliminating float means money is immediately ready for additional investment or consumption.

3 | Failed transactions are the third area for cost improvement. Payments fail because of incorrect payment details, manual mistakes, and failures in payment processing. Failed payments costs include penalties such as overdraft fees, costs to fix the failure and the loss of business from customers who have their accounts closed or who leave to find better payment options.

Instant payments can potentially drive these costs to zero because of better infrastructure that can ensure correct payment details, funds availability and automation that eliminates human error.

Enormous potential for savings - if you’re into cash

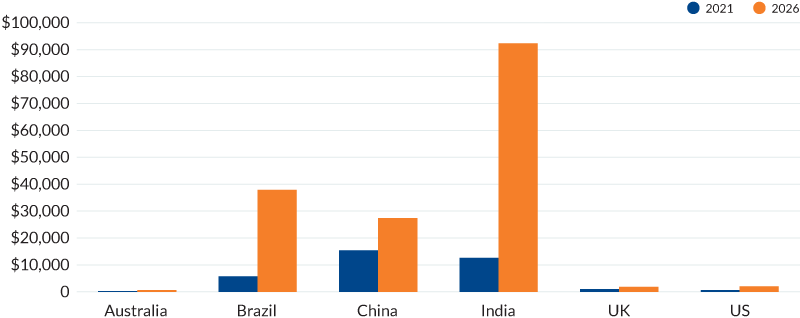

Table 2 and Figure 2 present these savings for the real-time payment leaders (India, Brazil, China) and developed countries that have modest real-time payment systems (Australia, United Kingdom, United States). The savings potential for India, Brazil and China in 2026 is substantial, approaching $158 billion. The savings are huge because they’re paper-based nations with plans to shift a large percentage of their payment mix to an instant electronic system.

The developed nations show disappointing potential savings of just $4.4 billion. The low saving figure is two-fold: first, these developed nations have a smaller percentage of paper-based payments and two, they’re slow to move to real-time payments.

TABLE 2: REAL-TIME PAYMENTS SAVINGS, 2021 AND ESTIMATED 2026, $MILLION

| Country | 2021 | 2026 (estimated) |

| Australia | $205 | $628 |

| Brazil | $5,692 | $37,890 |

| China | $15,379 | $27,389 |

| India | $12,607 | $92,374 |

| UK | $950 | $1,787 |

| US | $648 | $1,985 |

Source: cebr.com/wp-content/uploads/2022/04/Real-Time-Report_v8.pdf | ||

FIGURE 2: REAL-TIME PAYMENTS SAVINGS, 2021 AND ESTIMATED 2026, $MILLION

Source: cebr.com/wp-content/uploads/2022/04/Real-Time-Report_v8.pdf

Money lost in inefficient transactions, float, and failed transactions is money that can’t be used for investment or more beneficial consumption (more beneficial than paying late fees from a failed transaction, for instance), two important components of GDP. And from a tax perspective, moving from an informal cash economy supporting illegal activities or unreported income to a digital economy means more tax revenue. That’s strong motivation for governments to advance real-time payment systems.

Instant payment systems can also add significantly to GDP. CEBR forecasts that the top five real-time payment markets – India, Brazil, China, Thailand and South Korea – will experience an economic impact from real-time payments equivalent to $131 billion of GDP in 2026. That’s equivalent to an increase in output of 0.43% of GDP or output of nine million workers in the five nations.

The 5 developed national leaders – US, UK, Canada, France and Germany – will experience an economic impact of just $14 billion in GDP in 2026, equivalent to 0.04% of combined GDP, an equivalent output from about 120,000 workers.

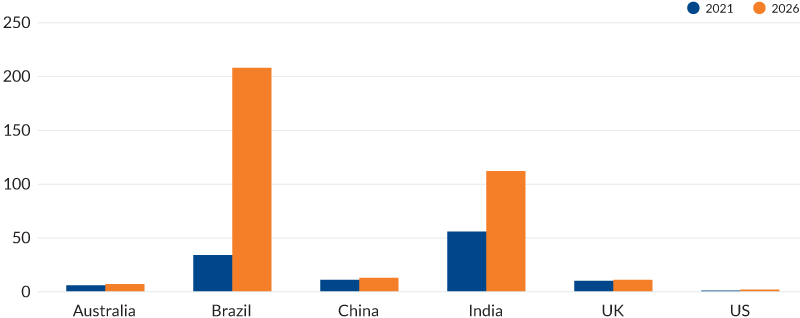

The GDP benefits (Table 3, Figure 3) result from an increase in real-time's share of the payment mix. In Brazil, CEBR expects the percentage of real-time payments to rise from 5.2% in 2021 to 34.3% in 2026. For India, the expected increase is from 31% to 71%. In the US, it’s just 1% to 4%; CEBR projects Australia to move from 5% to 10% and the UK 9% to 12%.

TABLE 3: CONTRIBUTIONS TO GDP FROM REAL-TIME PAYMENT IMPLEMENTATION, BASIS POINTS

| Country | 2021 | 2026 (estimated) |

| Australia | 6 | 7 |

| Brazil | 34 | 208 |

| China | 11 | 13 |

| India | 56 | 112 |

| UK | 10 | 11 |

| US | 1 | 2 |

Source: cebr.com/wp-content/uploads/2022/04/Real-Time-Report_v8.pdf | ||

FIGURE 3: CONTRIBUTIONS TO GDP FROM REAL-TIME PAYMENT IMPLEMENTATION, BASIS POINTS

Source: cebr.com/wp-content/uploads/2022/04/Real-Time-Report_v8.pdf

Developed nations lag in instant payment roll-out because credit and debit cards are tightly integrated in their payment processes; that integration will be costly to replace. And with a ‘if it ain’t broke don’t fix it’ mind set, developed nations are reluctant to try new payment processes. From the perspective of banks and credit unions, the immediacy of new payment systems complicates requirements to guard against money laundering and fraud, adding to the cost of implementing new systems. Liquidity management also plays a part. FedNow institutions will gladly receive funds on behalf of their customers but are less interested in sending funds because of the difficulty of managing cash reserves.

But even though developed nations aren’t transitioning from a payment mix where paper is dominant, there are still benefits to gain from moving to instant payments. CEBR reckons that if all 2026 transactions in the United States were real time, the US would enjoy a cost savings of $53.1 billion from increased processing efficiency, lower float time, and fewer failed transactions. And the contribution to GDP would not be insignificant: CEBR predicts $438.6 billion of additional economic output (1.7% of GDP) in 2026 if all US transactions were instant.

It’s not looking good, however

The outlook for FedNow seems somewhat bleak. FedNow is late with its real-time program, competes with an established domestic firm and is reluctant to lead the national effort to promote real-time payments. FedNow also has to be wary of foreign competitors who have a massive real-time payments head start, substantial know-how and global ambitions.

Explore more currency insights

Stablecoins: Cryptocurrencies with a pegged price

Designed to overcome price volatility and pegged to a single asset or combination of assets, stablecoins aim to become a mainstream medium of exchange.

US debt is headed to unimaginable levels

Since 1990, debt crises have erupted periodically, but the next one may not be so easy to dismiss. Is a financial reckoning coming?

Spark

Our quarterly email featuring insights on markets, sectors and investing in what matters