Insights

Presidential candidates entice voters with expensive tax breaks

Share this article

October 24, 2024 | By Mesirow Currency Management

Will tariffs and higher taxes be enough to pay for these benefits? Not even close.

Prioritizing the national debt

Everyone likes Halloween goodies, even taxpayers

The Committee for a Responsible Federal Budget, a nonpartisan group committed to educating the public about US fiscal matters, sent an October 3rd public letter to the presidential candidates urging them to prioritize the burgeoning national debt. The prospective presidents are certain to ignore the plea.

Instead, the candidates are handing out fiscal benefits to voters like homeowners passing out Halloween candy. It would reflect the nation’s situation if homeowners were burdened by crushing home mortgage debt and then took out second mortgages to fund a well-promoted, unbelievably extravagant trick-or-treat give away. That’s because the US debt level is ready to surpass its 1946 historic high with net interest payments of over $1 trillion dollars in 2025. The candidates propose to add to this burden by borrowing between $1.2 trillion and $7.5 trillion over ten years to pay for their campaign promises.

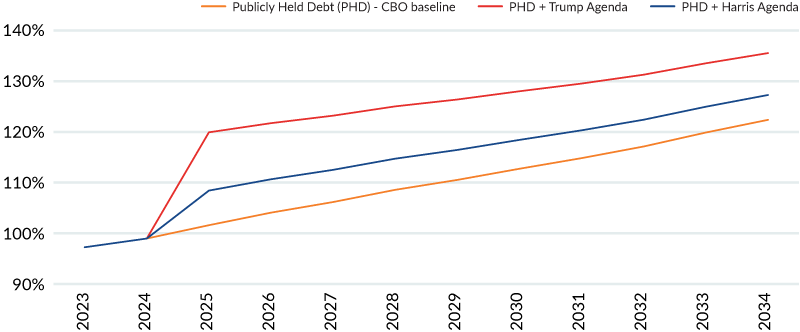

These staggering amounts will increase the Congressional Budget Office’s (a nonpartisan federal agency that provides budget and economic information to Congress) 10-year estimate of publicly held debt by five to 14 percentage points (Figure 1).

FIGURE 1: ESTIMATED COST OF PRESIDENTIAL CANDIDATE BUDGET PROPOSALS (% GDP)

Figure 1 presents 10-year estimates of the presidential candidates’ budgets on the US national debt

Sources: Congressional Budget Office (baseline) and Mesirow

Ten-year cost estimates of candidate campaign proposals

Size of the fiscal promises depends on whom you ask

The ten-year cost of the presidential hopefuls' pledged generosity is unknown. Campaign promises can be delayed, changed, or unfulfilled depending on the willingness of Congress to fund the promises. That willingness, in turn, can be affected by economic conditions, changing budget demands, and investor enthusiasm to hold more government debt. Still, cost estimates are useful for budget planning and investor assessment of future government finances.

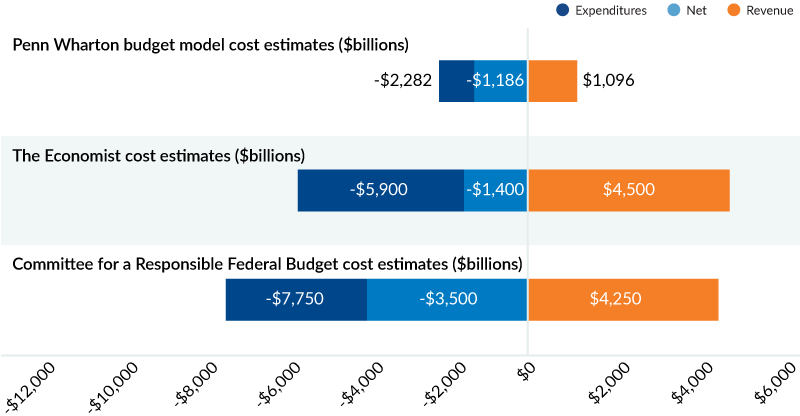

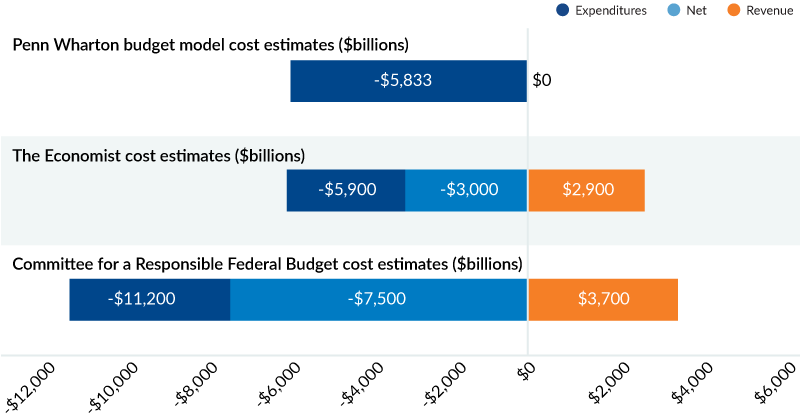

Besides the Committee for a Responsible Federal Budget (CRFB), Penn Wharton Business Model (a non-partisan research group that provides public policy fiscal analyses) and the Economist (a weekly newspaper in magazine format) provided budgetary cost estimates (Figures 2, 3, 4) based on each candidate’s campaign proposals.

FIGURE 2: VICE PRESIDENT HARRIS TEN-YEAR COST ESTIMATES OF CAMPAIGN PROPOSALS

Figure 2 presents three estimates of the 10-year cost of VP Harris’s campaign proposals.

FIGURE 3: FORMER PRESIDENT TRUMP TEN-YEAR COST ESTIMATES OF CAMPAIGN PROPOSALS

Figure 3 presents three estimates of the 10-year cost of former president Trump’s campaign proposals.

FIGURE 4: HARRIS V. TRUMP TEN-YEAR NET COST ESTIMATES OF CAMPAIGN PROPOSALS

Figure 4 presents a net comparison of three estimates of the 10-year cost of the Harris and Trump campaigns.

Note: The CRFB value is the midrange of a high – low series of estimates. | Sources: 1. https://www.crfb.org/papers/fiscal-impact-harris-and-trump-campaign-plans | 2. https://www.economist.com/finance-and-economics/2024/09/05/america-has-a-huge-deficit-which-candidate-would-make-it-worse | 3. https://budgetmodel.wharton.upenn.edu/issues/2024/8/26/trump-campaign-policy-proposals-2024 | 4. https://budgetmodel.wharton.upenn.edu/issues/2024/8/26/harris-campaign-policy-proposals-2024

Each analysis is based on assumptions that have material effects in determining the net budget impact. For example, CRFB includes tariff revenue in former President Trump’s fiscal analysis, but PWBM ignores that revenue source. PWBM reasons that the tariffs could be offset by retaliatory tariffs and other economic factors. The Economist considers retaliatory tariffs and the dampening effect they would have on US exports; the result is a smaller tariff revenue value compared to CRFB’s estimate.

Vice President Harris offers some of the same fiscal benefits as former President Trump. But unlike the Republican candidate who has all his revenue eggs (tariffs) in one basket, the Vice President has several revenue sources to partially offset the costs. Those sources encompass a higher corporate tax rate, increased capital income taxes and reform of international tax rules, among other funding sources.

Donald Trump continues to add to his proposed tax breaks targeted to specific voter groups, telling the Detroit Economic Club on October 10th that he wants to make car-loan interest payments tax deductible while proposing to offset those costs by charging a 100% tariff on Mexican-made Chinese cars.

Like Halloween, these budget deficit and national debt numbers are frightening. While the presidential candidates shrug off worries about these deficits, debt repayment (CBO estimates net interest will be $1.7 trillion in 2034) will surely haunt the nation.

Explore more currency insights

The US national debt burden

The debt level is approaching its 1946 historic high. Will it take a collapse in the bond or FX market before we take action?

US debt is headed to unimaginable levels

Since 1990, debt crises have erupted periodically, but the next one may not be so easy to dismiss. Is a financial reckoning coming?

Spark

Our quarterly email featuring insights on markets, sectors and investing in what matters