Insights

Mesirow Currency Management | 3Q2024 Commentary

Share this article

US dollar worst G10 performer 3Q2024

US dollar was the worst performer in the G10 over the third quarter, pressured by the Fed’s 50bp.

At the Jackson Hole CB symposium Fed Chair Powell signaled that they would be lowering rates. Employment generally disappointed, with the latest nonfarm payrolls weaker than expected at 142K vs. 165K consensus, while unemployment came in a bit lower than before at 4.2% vs. 4.3% previously. Although the most recent headline inflation was slightly lower than consensus at 2.5% vs. 2.6% consensus, core CPI MoM was higher than expected at 0.3% vs. 0.2% consensus, easing some of the market pricing for a 50bp cut by the Fed.

The Fed ultimately cut rates by 50bps to 5.0%, sinking the US dollar at first before Powell's cautious tone allowed USD to recover. China’s fiscal support announcement near the end of the quarter raised risk sentiment and consequently drove the US dollar lower.

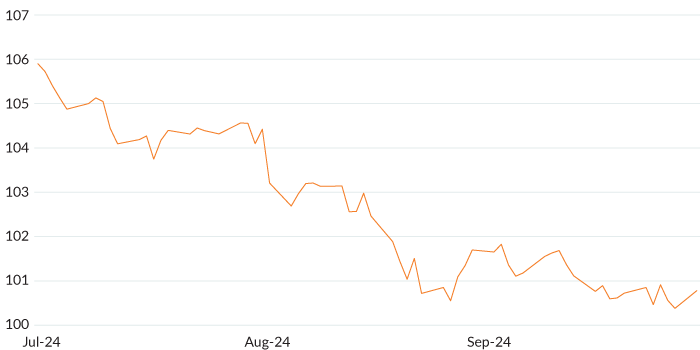

FIGURE 1: DXY – 3Q2024

Figure 1 shows a line chart of the US dollar index falling or depreciating between the periods of July 2024 and September 2024. The DXY began the quarter on July 1 at 105.901 and ended the quarter on September 30 at 100.779. The DXY’s low was 100.552 on August 27.

Source: Bloomberg

EUR | Euro was a middling performer in the G10 in Q3 as data was weak and the ECB cut rates. Data over the quarter indicated a softening of inflation, falling from 2.6%YoY in July to 2.2% in August. Germany and France both printed weak economic data in early September with industrial production contracting more than expected in both countries. The ECB cut rates at their September meeting in a widely telegraphed move, cutting the refinancing rate by 60bps to 3.65% from 4.25%. Towards the end of the quarter, Lagarde insinuated another cut as inflation approached the 2% target level in the Euro Area.

GBP | Sterling was a strong performer in Q3. A strong July was followed by an equally strong reversal in early August, ultimately recovering higher over the second half of the quarter as a landslide Labor general election win fueled hopes for a sustained recovery in the domestic economy. The BoE delivered a 25bps cut to 5% towards the end of July. The latest UK labour data was mixed, with employment surprising higher at 265K vs. 123K consensus and unemployment falling to 4.1% from 4.2%, while average weekly earnings disappointed at 4.0% vs. 4.1% consensus. After monthly GDP printed at 0.0% vs. 0.2% expected, Sterling found support towards quarter-end as services inflation remained elevated at 5.6% YoY, the BoE maintained rates at 5.0% with the vote at 8-1, and retail sales surprised higher.

JPY | Yen was the highest performer in the G10 by a wide margin in Q3. The BoJ’s hawkish stance on interest rates and subsequent hike by 15bps to 0.25% underpinned JPY. While BoJ Governor Ueda let the markets know that policymakers would raise rates again if needed, the BoJ kept rates unchanged at their most recent meeting. The latest Tokyo CPI printed at 2.2% YoY, from 2.6% the month before, retails sales came in at 2.8% YoY, while the jobless rate was a touch better at 2.5%. Shigeru Ishiba was declared Japan’s next prime minister towards the end of the month.

AUD | Australian dollar landed in the lower half of the G10 in Q3, as the RBA kept its policy rate unchanged at 4.35%, maintaining its hawkish stance with an emphasis on underlying inflation. August CPI printed as expected at 2.7% YoY, down from 3.5% the previous month. While unemployment remained at 4.2% in August, employment increased more than consensus and the participation rate matched consensus at 67.1%, maintaining its record peak. A strong September was supported by the announcement of a China stimulus package.

CAD | Canadian dollar was broadly weaker over the quarter, ending Q3 by underperforming the rest of the G10 in September. The BoC cut rates twice in the quarter for a total of 50bps, dropping their policy rate to 4.25%. Following the 2nd cut, Governor Macklem indicated the bank’s willingness to take a bigger step in the future if the data necessitates. The latest headline inflation came in under consensus at 2.0% vs. 2.1% expected and unemployment ticker higher to 6.6%, with Macklem noting downside risk in the labour market.

CHF | The Swiss franc performed well over the quarter, trailing only Yen in the G10. However, September was a relatively weaker month as the SNB cut rates by 25bps to 1%. Inflation numbers generally softened as August CPI registered lower than consensus, with YoY at 1.1% vs. 1.2% expected and MoM at 0% vs. 0.1% expected. However, recent GDP printed better than expected at 0.7% QoQ vs. 0.5% consensus. The SNB stated that further cuts may become necessary in the coming quarters to ensure price stability over the medium term.

EM | EM currencies appreciated as the MSCI EM Currency index gained over 4% in Q3, promoted by a weaker US dollar. Chinese yuan strengthened as PBoC Governor Pan Gongsheng announced a package of interest-rate cuts, liquidity and support for the stock market. In contrast, Turkish lira performed poorly in the EM space, as foreign equity outflows weighed on the currency as second quarter earnings were lower than expected.

TABLE 1: USD-BASED AS OF SEPTEMBER 30, 2024

| FX Rate | Change 3M % | Change 1Y% | ||

| EUR-USD | 1.11605 | 4.13% | 5.41% | |

| GBP-USD | 1.134135 | 6.11% | 9.90% | |

| USD-JPY | 143.04 | 12.46% | 4.32% | |

| AUD-USD | 0.69375 | 3.88% | 7.49% | |

| USD-CAD | 1.35095 | 1.29% | 0.08% | |

| USD-CHF | 0.84355 | 6.53% | 8.45% | |

| Source: WM/Reuters | ||||

Currency for return

Currency Alpha

Mesirow Currency Management’s (MCM) Extended Markets Currency Alpha, Asian Markets Currency Alpha, Emerging Markets Currency Alpha and Systematic Macro strategy all enjoyed notable gains this quarter.

The Technical component of our strategies contributed gains during 3Q2024 while our Forward Rate Bias model, which uses prevailing interest rates to rank currencies, detracted somewhat from positive performance.

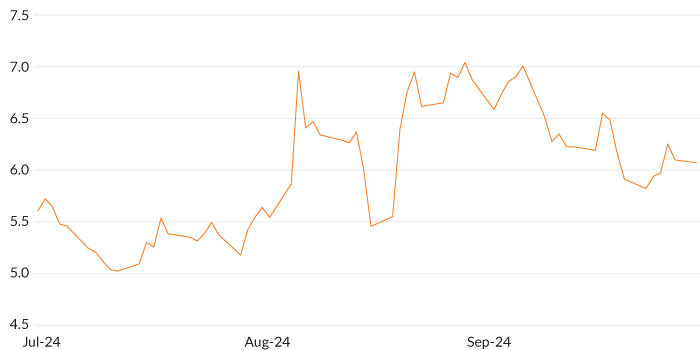

Volatility rose from July to late August then fell during the month of September (Figure 2).

FIGURE 2: MCM’S GLOBAL VOLATILITY INDICATOR*: JULY 2024 – SEPTEMBER 30, 2024

Figure 2 shows a line chart of MCM’s Global Volatility Indicator between July 2024 and September, 2024. The GVI’s low is on July 12 (5.02) and reaches a high on August 29 (7.04).

Source: Bloomberg | * The GVI is an internal proprietary model utilizing one month at-the-money (ATM) volatility for G10 currencies, including crosses plus BIS liquidity report weightings.

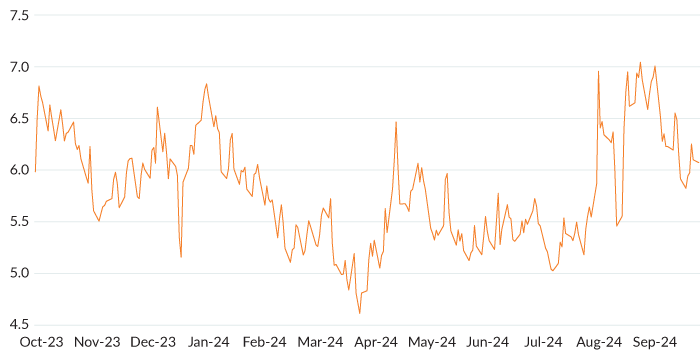

FIGURE 3: MCM’S GLOBAL VOLATILITY INDICATOR*: OCTOBER 2023 – SEPTEMBER 30, 2024

Figure 3 shows a line chart of MCM’s Global Volatility Indicator between October 1, 2023 and September 30, 2024. The GVI falls between October 2023 and April 2024, reaching a low on March 28 (4.609). Volatility then rises April through September 2024 and reaches a high on August 29 (7.04).

Source: Bloomberg | * The GVI is an internal proprietary model utilizing one month at-the-money (ATM) volatility for G10 currencies, including crosses plus BIS liquidity report weightings.

Intelligent Multi-Strategy Currency Factor

MCM’s Intelligent Multi-Strategy Currency Factor detracted -0.88% (gross) of value in the third quarter, with a weak July partially offset by a productive September to end the quarter. July was challenged by a falling US dollar as both short Swiss franc and Yen signals were heavily penalized as the safe-havens outperformed over the month. September recovered as long Euro, Sterling, and Yen positioning gained against a falling US dollar. While Value outperformed over the quarter, Carry was punished heavily by weaker USD, with Momentum detracting only modestly.

Latest MCM viewpoints

The US national debt level is approaching its 1946 historic high. Will it take a collapse in the bond or FX market before we take action?

Rapid payments speed money through the financial system; economic growth follows

Contact us

To learn more about Mesirow Currency Management’s custom currency solutions, please contact Joe Hoffman, CEO Currency Management at joseph.hoffman@mesirow.com.

Explore currency solutions

Passive and Dynamic Risk Management

Customized solutions to manage unrewarded currency risk in international portfolios.

Currency for Return

Strategies that aim to profit from short and medium-term moves in the currency market.

Fiduciary FX

Trading solution for asset managers and owners with focus on reducing transaction costs, improving transparency and enhancing efficiency.

Spark

Our quarterly email featuring insights on markets, sectors and investing in what matters