Insights

Mesirow Currency Management | 2Q2024 Commentary

Share this article

US dollar ends second quarter in strong position

US dollar cycled throughout the quarter, recovering in June after a large drop in May, buoyed by a hawkish adjustment to the Fed outlook along with political uncertainties in Europe and the US.

Strong labor prints supported the dollar with the most recent nonfarm payrolls and hourly earnings surprising higher, at 272K vs. 180K expected and 0.4% MoM vs. 0.3% expected, respectively. Although inflation printed on the dovish side, the Fed held rates while hawkishly updating the dot plot to one cut in 2024.

The risk related to the snap election in France and the first presidential debate in the US collectively contributed to the US dollar's strength at the end of the quarter.

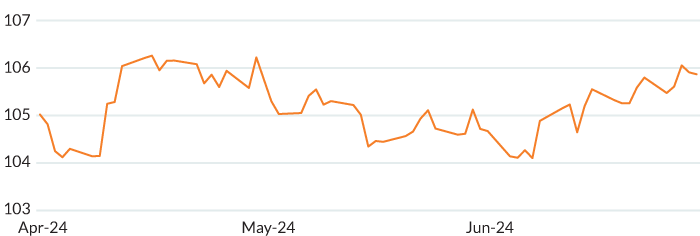

FIGURE 1: DXY – 2Q2024

DXY rises April to the beginning of May, falls May to early June, then rises again during June 2024.

Source: Bloomberg

EUR | Euro landed in the lower end of the G10 in the second quarter, only outperforming a severely depressed Yen and slightly besting a similarly behaving Canadian dollar. Soft Eurozone data and political uncertainties in France weighed on the common currency. The ECB began its cutting cycle in June, lowering rates by 25bps to 4.25% as expected. With price pressures remaining elevated, the central bank indicated a continued data-dependent approach. French President Macron called a snap election following right-wing party gains, with the market pressuring Euro as a result.

GBP | Sterling was a middling performer among the G10 in the second quarter, ending slightly ahead of US dollar as mixed economic data kept GBP cycling in Q2. While the most recent labour and wage data surprised higher, inflation tracked lower for May, reaching the BoE’s inflation target of 2.0% YoY. The BoE voted 7-2 to keep interest rates on hold at 5.25%. While the pause in policy was expected, the “finely balanced” decision pressured Sterling following the announcement. Towards quarter-end, stronger retail sales and consumer confidence were more than offset by disappointing preliminary PMIs. Prime Minister Sunak called a general election to be held in early July.

JPY | Yen lagged the rest of the G10 in Q2 as intervention rhetoric ramped up, with USDJPY reaching 161.27 on the last day of the quarter, a level not seen since 1986. Real-term wage growth remained negative as the slow increase in wages had not yet surpassed the level of inflation. The BoJ left rates unchanged as expected while voting to reduce bond purchases, but deferred the announcement of a detailed plan until the next meeting at the end of July.

AUD | Australian dollar was the high performer of the G10 for the quarter. Recent employment numbers surprised towards the upside, rising 39.7K vs. 30K consensus. The RBA left rates unchanged at 4.35%, with the market pricing in potential hikes by year-end. May CPI printed 4.0% YoY, beating the expected 3.8% number.

CAD | Canadian dollar weakened over the quarter, besting only the severely depressed Yen. The BoC cut rates by 25bps to 4.75%, as expected, stating that it was reasonable to expect further cuts if inflation continued toward the 2% target. However, inflation printed higher at 2.9% YoY for May vs. 2.6% expected. Governor Macklem noted that the labor market was closer to being in balance and that wages tended to lag adjustments in employment. Unemployment moved up a tenth to 6.2% in May although employment increased 26.7K, favoring part time workers.

CHF | Swiss franc landed in the middle of the G10 in Q2. Following a low inflation number for March at 1% YoY, the next two prints increased to 1.4%. The SNB cut rates by 25bps as expected, following a similar move in March, lowering the rate to 1.25%. The central bank noted a decrease in underlying inflationary pressure and the strength of CHF as reasons for the rate cut. Swiss franc was supported towards quarter-end through political turmoil in France and the rise of far-right parties in European Parliament elections, prompting a flight to safety.

EM | MSCI EM Currency Index ended Q2 relatively flat, down -0.09% though cycling throughout the quarter. South African rand performed well against US dollar as global elections encouraged investors as the African National Congress Party and Democratic Alliance, along with a number of smaller parties, formed a coalition “Government of National Unity”. Mexican peso notably lagged US dollar as the market reacted poorly to Claudia Sheinbaum’s election as president and her Morena party’s super majority in the lower house of congress, raising the prospect of institutional weakening if Morena is able to pass constitutional and judicial reforms.

TABLE 1: USD CROSSES AS OF June 30, 2024

| FX Rate | Change 3M % | Change 1Y% | ||

| EUR-USD | 1.07175 | -0.76% | -1.76% | |

| GBP-USD | 1.2641 | 0.07% | -0.57% | |

| USD-JPY | 160.86 | -5.92% | -10.15% | |

| AUD-USD | 0.66785 | 2.37% | 0.33% | |

| USD-CAD | 1.36835 | -1.10% | -3.30% | |

| USD-CHF | 0.8986 | 0.23% | -0.44% | |

| Source: WM/Reuters | ||||

Currency for return

Currency Alpha

Mesirow Currency Management’s (MCM) Asian Markets Currency Alpha, and Systematic Macro strategy made gains this quarter while our Extended Markets Currency Alpha and Emerging Markets Currency Alpha strategies, unfortunately, suffered losses.

Intelligent Multi-Strategy Currency Factor

MCM’s Intelligent Multi-Strategy Currency Factor generated +1.14% (gross) of value in the second quarter, with a strong April, a productive May, and a relatively flat June. Yen weakness over the quarter allowed for profitable long US dollar positioning, with JPY signals accounting for the majority of gains in Q2. Carry consistently outperformed over the quarter, with a strong April driving the factor performance. Momentum netted positive from productive returns in April and June, while Value partially offset the strategy profits with negative returns in April and June.

Latest MCM viewpoints

Contact us

To learn more about Mesirow Currency Management's custom currency solutions, please contact Joe Hoffman, CEO Currency Management at joseph.hoffman@mesirow.com.

Explore currency solutions

Passive and Dynamic Risk Management

Customized solutions to manage unrewarded currency risk in international portfolios.

Currency for Return

Strategies that aim to profit from short and medium-term moves in the currency market.

Fiduciary FX

Trading solution for asset managers and owners with focus on reducing transaction costs, improving transparency and enhancing efficiency.

Spark

Our quarterly email featuring insights on markets, sectors and investing in what matters