Insights

GLP-1 obesity drugs: Key insights to maximizing Healthcare sector exposure

Share this article

By Mesirow Equity Management | Caleb Ezell, Senior Vice President, Research Analyst, and Leo Harmon, CFA, CAIA, Chief Investment Officer, Portfolio Manager

A catalyst for healthcare innovation and strategic investment opportunities

The emergence of GLP-1 (glucagon-like peptide-1) agonist drugs is driving a significant transformation in the treatment of obesity and type 2 diabetes. GLP-1 agonist drugs act on certain receptors in the body to lower serum glucose levels, slow digestion and curb appetite. While recognized for their efficacy in weight loss and glycemic control, these drugs are poised to have profound second-order and third-order consequences across the entire healthcare landscape. Understanding the implications of this innovation is critical in effectively positioning our healthcare portfolio for the next few years. Herein, we outline a strategic approach to leveraging insights into the GLP-1 revolution by adjusting exposure to key areas of the US Healthcare sector. By tailoring investments to consider and incorporate the evolving dynamics of this therapeutic category, our aim is to deliver competitive risk-adjusted returns for our clients.

Background: The rise of GLP-1 drugs

GLP-1 receptor agonists, initially developed as a novel treatment option for type 2 diabetes, have dominated global headlines for much of the past year since the landmark SELECT and SURMOUNT studies by Novo Nordisk and Eli Lilly demonstrated their effectiveness in treating obesity. Ozempic/Wegovy (Novo Nordisk) and Mounjaro/Zepbound (Eli Lilly) are being hailed as potential panaceas for an array of weight-related conditions. These drugs have demonstrated unprecedented clinical effectiveness, including 15–20% reduction in body weight on average, and significant improvements in glycemic control. These therapies have also shown an ability to meaningfully impact other conditions that are closely associated with obesity, including a 20% reduction in the risk of major cardiovascular events, a 94% reduction in the risk of diabetes progression in patients with prediabetes and a 20% reduction in mortality rates among patients with chronic kidney disease, underscoring their broader clinical potential.

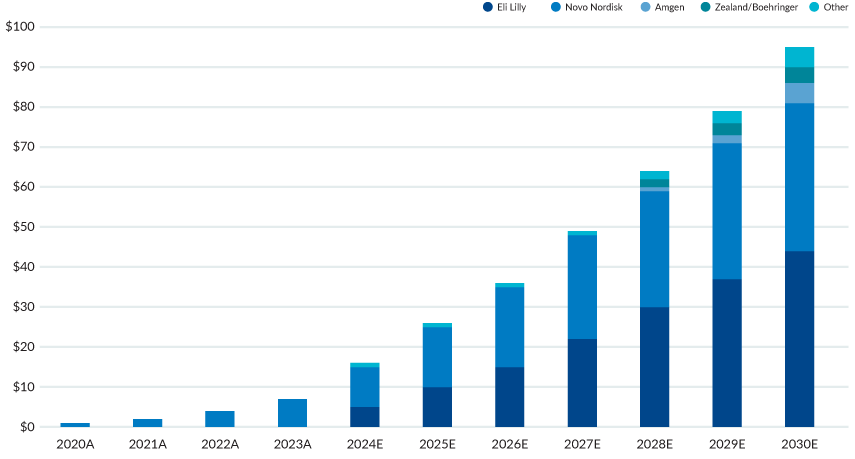

The number of US patients on GLP-1 therapies has seen substantial growth in recent years, yet there are significant opportunities for expansion. Based on analysis of prescription data from IQVIA, a leading provider of advanced analytics and clinical research services to the life sciences industry, it is estimated that more than seven million Americans are currently prescribed GLP-1 drugs. However, the estimated addressable market in the US could be as large as 105 million adults based on the number of adults currently living with obesity and obesity-related conditions, implying a 6% market penetration rate. We expect penetration to accelerate in the coming years, driven by increased public awareness, broader label expansion and improvements in supply chain stability, insurance coverage and affordability, with global GLP-1 sales potentially exceeding $100 billion by the end of the decade.

MARKET FOR GLP-1 AGONIST ($B USD)

Source: Company filings, Bloomberg Intelligence.

Barriers to adoption: Insurance coverage and affordability

Cost still remains the most critical barrier to access for most patients, with the annual cost of treatment often exceeding $10,000 a year at current list prices. The potential costs associated with broader coverage of GLP-1 treatment has been under intense scrutiny as of late, particularly for government-sponsored health plans. A recent study published in the “Annals of Internal Medicine” suggests that approximately 15 million Medicare beneficiaries in the US could be eligible for GLP-1 coverage based on updated coverage definitions, potentially costing Centers for Medicare and Medicaid Services (CMS) up to $145 billion annually – a remarkable increase from the $5.7 billion in GLP-1-related Medicare Part D claims for 2022. While we would not expect such broad coverage of Medicare beneficiaries to materialize in the near-term, this will likely remain an active area of political debate going forward, with heightened political pressure to reduce costs for patients through either Inflation Reduction Act drug price negotiations or a Most Favored Nations payment model.

LIST PRICES OF DRUGS USED FOR WEIGHT LOSS IN THE US AND PEER NATIONS

| Ozempic (semiglutide, injection) | Rybelsus (semiglutide, tablets) | Wegovy (semiglutide, injection) | Mounjaro (tirzepatide, injection) | ||

| US | $936 | $936 | $1,349 | $1,023 | |

| Japan | $169 | $69 | – | $319 | |

| Canada | $147 | $158 | – | – | |

| Switzerland | $144 | $147 | – | – | |

| Germany | $103 | – | $328 | – | |

| Netherlands | $103 | $203 | $296 | $444 | |

| Sweden | $96 | $103 | – | – | |

| United Kingdom | $93 | – | – | – | |

| Australia | $87 | – | – | – | |

| France | $83 | – | – | – |

Source: Peterson-KFF Health System Tracker, KFF analysis of country websites (see Methods section). Note: List prices in $USD based on web searches as of 8.15.2023. Prices are for one-month supply of Ozempic 1mg, Rybelus 7mg, Wegovy 2.4 mg and Mounjaro 15mg. Some drugs are not available in all countries and prices were unable to be found in other countries. Some drugs are approved for diabetes and prescribed off-label for weight loss.

From injectable to oral: Reducing barriers to access and accelerating uptake

One of the most significant developments on the GLP-1 horizon is the transition from injectable to oral formulations, which could occur as soon as 2026 based on current development timelines. This shift is expected to be a game-changer in terms of reducing barriers to adoption and accelerating the global uptake of GLP-1 therapies for several reasons:

Enhanced patient compliance: Injectable medications, while effective, often face resistance from patients due to the discomfort and inconvenience associated with regular injections.

Broadened patient demographics: Oral formulations are expected to appeal to a broader demographic, including those who are needle-averse or who have difficulty managing injectable treatments.

Accelerated market penetration: The ease of use associated with oral medications is anticipated to drive faster market penetration. As oral GLP-1 drugs become available, healthcare providers are likely to prescribe them more readily, especially for patients who were previously hesitant to start on injectable therapies.

Improved coverage and affordability: The transition from injectable to oral GLP-1 formulations is also expected to have a substantial impact on pricing dynamics and insurance coverage. Oral formulations are anticipated to enter the market at a 10–20% lower price point compared to injectables, which, coupled with broader insurance coverage, will increase accessibility for a larger patient population. Further competition in the marketplace will likely reduce pricing pressure as well, especially if new therapies are able to demonstrate similar efficacy to those already on the market today.

Investment strategy: Adjusting sector exposure to capitalize on emerging trends

Over the past year, we have tailored our portfolio to better align with the anticipated impacts of GLP-1 drugs across several key subsectors. Within our investable universe of small and small-mid cap companies, we have found the greatest immediate opportunity within Medical Technology (MedTech) and Healthcare Services, given the sizable dislocation in valuations resulting from the broad sell-off in the summer of 2023, which has since led to an attractive stock picker’s market, with significant divergence in performance between winners and losers in recent quarters. However, we continue to actively monitor opportunities within the Healthcare Technology, Life Science Tools and Distributor subsectors that support the innovation, development and administration of these therapies.

Healthcare Services and Providers: We maintain a preference for Healthcare Services companies that are exposed to secular growth themes in the ambulatory surgical environment, as well as providers with concentrated exposure to non-GLP-1 impacted market segments (e.g., behavioral health, radiology, reproductive health and senior living). One current investment is Surgery Partners Inc. (SGRY), a leading pure-play operator of ambulatory surgical centers in the US. SGRY continues to benefit from a shift in site of care from traditional hospital operating rooms to outpatient surgical centers due to a combination of lower costs and higher patient satisfaction.

Medical Devices and Diagnostics: We took advantage of the broad GLP-1-driven sell-off in MedTech last summer to increase exposure to stocks with idiosyncratic catalysts, new product launches, durable pricing power and/or margin expansion opportunities at attractive relative and absolute valuations, while avoiding names with material near-term thematic and fundamental risks associated with ongoing clinical trial results and potential label expansion into additional indications (e.g., bariatric surgery, heart disease, sleep apnea, kidney disease, etc.). One such investment is Globus Medical Inc. (GMED), which recently merged with NuVasive (NUVA) to become the second-largest global spine company. We believe that GMED’s business is insulated from broader GLP-1 pressures and valuations during the broad sell-off in the second half of 2023 were not reflective of GMED’s competitive positioning in the global spine market and its strong underlying fundamentals.

Biopharma: Currently, opportunities for direct investment into the biopharma companies commercializing GLP-1-related therapies remain relatively limited given that the space is dominated by large pharma companies such as Ely Lilly and Novo Nordisk (LLY, NVO) and smaller biotech companies that have no earnings, and in many cases, do not even have revenues. However, given the tremendous size of the market opportunity, we will continue to monitor for in-licensing opportunities for companies within our investable universe, as well as potential biosimilar pipeline opportunities as we move into the latter part of the decade.

Healthcare Technology: While large pharmacy benefit managers (PBMs) and distributors might face cost pressures, we believe smaller, technology-driven companies that provide niche services, such as personalized patient management platforms or cost-containment solutions tailored to GLP-1 therapies, provide potential investment opportunities. These companies are more agile and can carve out specialized roles in the evolving healthcare system. Additionally, we have seen ongoing supply shortages drive near-term opportunities for companies that are able to provide access to compounded forms of GLP-1 agonists, although we expect this opportunity to materially diminish over time as manufacturing capacity catches up with demand in coming quarters.

R&D and Innovation: We are exploring opportunities within the Life Science Tools subsector with firms that offer valuable and unique R&D and manufacturing services to the biopharma companies that are developing and commercializing GLP-1 therapies. Given the rapid and robust growth in demand for these products, we are seeing notable investments being made in identification and development of new pipeline candidates, as well as the build out of manufacturing capacity for both active pharmaceutical ingredient (API) and fill-finish capabilities.

Conclusion

The rise of GLP-1 drugs marks a significant shift in the treatment of metabolic diseases, with profound and far-reaching implications for the Healthcare sector. The transition from injectable to oral GLP-1 formulations will likely accelerate adoption and expand the overall market, creating substantial opportunities within the small and small-mid cap market. By focusing on companies poised to benefit from these developments, our investment strategy aims to deliver competitive outcomes for our clients. Identifying and investing in the most promising opportunities within this dynamic space remains a key priority for our team.

For more information on Mesirow Equity Management please visit us at mesirow.com/equity or contact our Portfolio Specialist at 312.595.7300.

Explore more from Mesirow Equity Management

Investing in the growth of AI

Identifying value in an overheated market requires human ingenuity.

Past performance is not necessarily indicative of future results. | Mesirow Equity Management is a division of Mesirow Institutional Investment Management, Inc., an SEC-registered investment advisor. | FOR INSTITUTIONAL, EDUCATIONAL AND INFORMATIONAL PURPOSES ONLY

As of 9.30.2024, Mesirow Equity Management owned shares of Surgery Partners and Globus Medical. | For institutional use only. Please note that this paper contains information that is strictly limited to the intended recipients. It is not for use with the general public and may not be distributed. Mesirow Financial refers to Mesirow Financial Holdings, Inc. and its divisions, subsidiaries and affiliates. The Mesirow Financial name and logo are registered service marks of Mesirow Financial Holdings, Inc. © 2024. All rights reserved. Effective 7.01.2022, Mesirow Equity Management (“MEM”) became a division of Mesirow Institutional Investment Management (“MIIM”) an SEC-registered investment manager. Prior to 7.01.2022, MEM was a division of Mesirow Financial Investment Management, Inc., (“MFIM”). This paper is for institutional use only and may contain privileged and/or confidential information. It is intended solely for the use of the addressee. If this information was received in error, you are strictly prohibited from disclosing, copying, distributing or using any of this information and are requested to contact the sender immediately and destroy the material in its entirety, whether electronic or hardcopy. Nothing contained herein constitutes an offer to sell or a solicitation of an offer to buy an interest in any Mesirow Financial investment vehicle. The information contained herein has been obtained from sources believed to be reliable but is not necessarily complete and its accuracy cannot be guaranteed. Any opinions expressed are subject to change without notice. It should not be assumed that any ecommendations incorporated herein will be profitable or will equal past performance. Model, theoretical or hypothetical performance information and results do not reflect actual trading or asset, or fund advisory management and the results may not reflect the impact that material economic and market factors may have had, and can reflect the benefit of hindsight, on MEM’s decision-making if MEM were actually managing client’s money. Any chart, graph, or formula should not be used by itself to make any trading or investment decision. Mesirow Financial Investment Management, Inc., and its affiliated companies and/or individuals may, from time to time, own, have long or short positions in, or options on, or act as a market maker in, any securities discussed herein and may also perform financial advisory or investment banking services for those companies. Mesirow Financial does not provide tax or legal advice. Securities offered through Mesirow Financial, Inc. member FINRA, SIPC.

Spark

Our quarterly email featuring insights on markets, sectors and investing in what matters