Insights

Can a US rapid payment system take off?

Share this article

June 5, 2024 | By Mesirow Currency Management

Meanwhile, India and other Asian nations take a victory lap

Hugely popular in Asia, the United States lags in promoting a real-time, or rapid payment system. Rapid payments allow businesses and consumers to send or receive funds immediately, any time of day and any day of year.

India, among other nations, is taking advantage of its rapid payment success to position itself as leader of a booming service that has implications for global commerce, financial inclusion and foreign policy.

In the United States, where credit cards are preferred, real-time payments haven’t seen the same success as other nations. As of February 2024, over 500 (mostly local and regional) banks and credit units participate in FedNow, the US Federal Reserve’s real-time payments network (launched in July 2023). Unfortunately, 500 represents only 0.5% of the roughly 9,000 banks and credit unions in the US.

Unified Payments Interface

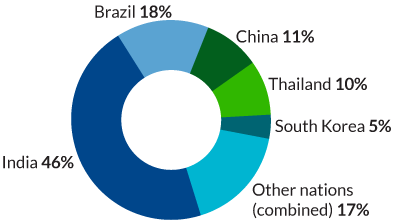

India’s payment system, Unified Payments Interface (UPI), manages payments between people and between people and businesses and has become the world’s rapid payments leader, handling 89.5 billion real-time transactions in 2022, more than three times the real-time transactions of second-place Brazil (although Brazil’s rate of transactions per adult is almost twice that of India).

Free to people and a low-cost service for businesses, UPI and Brazil’s Pix rapid payments systems represent 61% of global real-time transactions.

Figure 1: Percent of all global real-time transactions (195 billion) - 2022

Table 1: Top-5 real-time-payment-transactions 2022

| Country | Transactions (billions) |

| India | 89.5 |

| Brazil | 29.2 |

| China | 17.6 |

| Thailand | 16.5 |

| South Korea | 8.0 |

Source: ACI Worldwide, Prime Time For Real-Time Global Payments Report 2023

Table 2: Real-time payment transactions by region

| 2022 | 2027 (estimate) | |

| Middle East, Africa and South Asia | 95.7 | 249.8 |

| Asia Pacific | 49.2 | 96.2 |

| Latin America | 33.0 | 119.5 |

| Europe | 13.2 | 34.2 |

| North America | 3.9 | 13.0 |

Source: ACI Worldwide, Prime Time For Real-Time Global Payments Report 2023

Table 3: Real-time payments as share of regional electronic payments

| 2022 | 2027 (estimate) | |

| Middle East, Africa and South Asia | 72.20% | 79.30% |

| Asia Pacific | 11% | 12% |

| Latin America | 33% | 56% |

| Europe | 7% | 13% |

| North America | 2% | 5% |

Source: ACI Worldwide, Prime Time For Real-Time Global Payments Report 2023

UPI and Pix share common features that spurred adoption. Both nations have personal identification programs that make it easy to establish a bank account or a mobile wallet, a way to carry digital cash, and governments pressured banks to open accounts for millions who were previously unbanked, increasing financial inclusion.

Not to mention, India forced people to depend on digital money by removing 86% of bank notes in circulation. Brazil insisted that pandemic emergency payments be made through Pix; for 30 million previously unbanked Brazilians, it was their first digital payment. The systems in both countries are easy to use, making sending or receiving funds quick and painless. Pix and UPI are free for individuals and low cost for businesses.

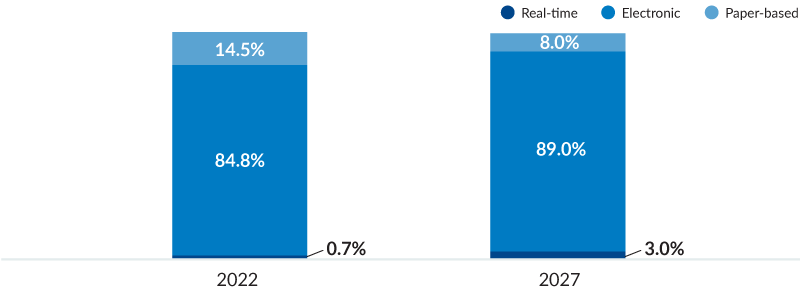

We’re keeping our cash-back cards

It is a much different situation in the United States. Rapid payment systems like Zelle and RTP are owned by associations of large US banks and play a tiny role in the US payments market. In 2022, paper-based payments and non-real-time electronic transactions were 98.8% of the payment mix, dwarfing rapid payments’ 1.2% share.

Real-time payment growth is mainly hindered by the popularity of credit cards; most people like that form of payment. The lack of real-time infrastructure and the absence of government or central bank digital leadership also have stymied the growth of rapid payments.

Figure 2: Payments in the US for 2022 and 2027 forecast | Transaction type

Source: ACI Worldwide It’s Prime Time for Real-Time 2023

Figure 3: Payments in the us for 2022 and 2027 forecast | Transaction volume $

Source: ACI Worldwide It’s Prime Time for Real-Time 2023

In 2023, a decade late according to some critics, the US Federal Reserve launched FedNow, a rapid payment service. Derided as “FedYesterday”, FedNow allows participating banks and credit unions to make real-time payments. Unlike UPI or Pix, people can’t send or receive funds via FedNow unless their banks provide an interface.

FedNow doesn’t have a financial inclusion mandate, so those without bank accounts aren’t given access to the digital marketplace. Even with FedNow, analysts project that the share of rapid payments as a percentage of transactions will be just 3.8% by 2027.

Rapid Payment success

Rapid payments systems’ success and popularity with domestic users has some providers eyeing overseas markets. That market is enormous: Rapid payments are expected to grow from 195 billion transactions in 2022 to 511.7 billion in 2027, an increase of 162% . By 2027, rapid payments will represent 27.8% of all electronic payments globally.

India has made significant strides in expanding. The rapid payment leader is holding discussions with over 20 countries interested in connecting to the UPI. But that payment capability is just one part of a three-tiered set of services that includes electronic personal identification, payments, and secure access to documents like medical records and financial accounts. The crowning feature is transferring funds and personal information readily accessible by phone.

The ease of use and accessibility have been transformative to millions of merchants in India, who can more easily sell goods and services and collect payments.

Source: Getty Images

Welfare members can effortlessly receive benefits by phone, and even the government enjoys advantages from rapid payments: digital pandemic payments were promptly and efficiently distributed via UPI.

India wants to offer these services to developing nations. India sees itself as a leader of the developing world and urges other countries to follow its examples of financial inclusion, connectivity and economic growth. It has a compelling story to share.

US foreign policy confronts rapid payments

Some nations see India’s model as an attractive alternative to the West’s dominance of the global financial system. That dominance is led by the United States who uses control over SWIFT, the international payments system for financial institutions, as a foreign policy weapon against enemies such as Russia.

Nations, worried that they may end up on the United States’ blacklist and be excluded from participating in global commerce and investment, view India’s system as a way to elude the threat of US sanctions.

Sign us up

The benefits of rapid payments – financial inclusion, business growth, and connectivity – combined with shelter from economic sanctions and coercion have many nations interested in establishing a rapid payments system. In July 2021, neighboring Bhutan became the first country to adopt UPI’s standards for quick response codes, allowing Indians to transact in Bhutan and pay for items in rupees.

In February 2024, India linked with Singapore’s PayNow digital payments system. Indians can transfer funds to Singapore individuals or businesses using the Singapore user’s mobile number or virtual payment address. A Singapore resident can do the same when in India using the Indian user’s UPI identification number.

UPI has expanded to developed nations too: Indians can pay for Eiffel Tower visits using the UPI system. The UK’s TerraPay, a cross-border payments firm, signed an agreement to allow Indian customers and merchants to make and accept cross-border payments by using TerraPay’s infrastructure and India’s UPI.

A steep climb for the US

In the US, Mastercard, Visa and the large banks that enjoy high credit card fees and control over the two established rapid payment firms would be expected to mount a strong campaign against rapid payments. Changing consumer behavior will be no easy task, and it will be up to the US government or the Federal Reserve to encourage rapid payments and build or assist with rapid payment infrastructure, education, and marketing.

Explore more currency insights

Cryptocurrencies and Tokenization

Distributed ledger technology fosters digitization of just about everything.

Futures overlays for investors

Hedge Share Class Investors Grapple with Shorter (T+1) Security Settlement Cycle.

Spark

Our quarterly email featuring insights on markets, sectors and investing in what matters