Insights

4Q2019 Packaging Perspectives

Share this article

Year-end review

Primary influences on the sector

Active participation by private equity firms continues to shape the packaging sector. Until relatively recently, publicly-traded strategic buyers would nearly always outbid private equity firms. That no longer seems to be the case. The sector has seen many examples of a company being sold by a family, or divested by a corporation, with the prevailing buyer being a private equity firm willing to pay premium valuations.

In addition, whereas private equity firms 5-10 years ago were requiring a 20% internal rate of return, in today’s lower overall return environment, firms are content to pay more, accept a lower rate of return, and work to grow the company.

Tariffs on materials sourced in China also continue to have an effect. For the most part, companies have been able to pass increased costs on to customers. But firms are scrambling to find alternative sources in Asia, Latin America or Europe. If tariffs continue, they may find it difficult to maintain margins.

Sustainability remains a powerful trend. With consumers loudly voicing concern about packaging waste, Amazon responded by requiring vendors to meet waste efficiency standards or pay a fee. Given Amazon’s outsized influence on the sector, firms are likely to focus on materials science and chemistry to make packaging more recyclable and reusable.

And finally, e-commerce continues to drive box volume at the expense of retail packaging such as high quality bags and boxes.

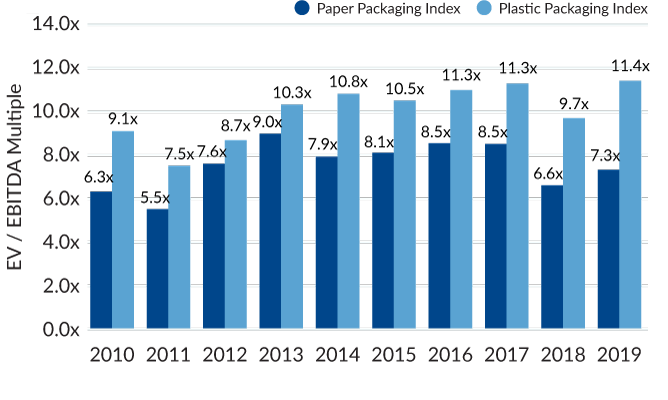

CHART 1: PUBLIC PACKAGING COMPANY AVERAGE EBITDA MULTIPLES

Source: Mesirow Financial, FactSet.

Spark

Our quarterly email featuring insights on markets, sectors and investing in what matters