Strategic Fixed Income strategy output

Review of the broader macro environment helps inform and guide sector rotation and bottom-up security selection

The potential for market volatility is elevated with several upcoming market moving events as we enter November. The largest of these is the US election, and the market reaction thus far has been relatively subdued with risk assets doing well in the lead up to election day. Equities are near record highs and spread assets in fixed income are near post crisis tights across asset classes. Certainly, the rates market has demonstrated elevated volatility however that is largely due to continued strong growth in the US economy coupled with heightened inflation expectations versus an election trade. A Trump win and/or a sweep by either party have the potential for creating the most volatility with a rates sell off likely if either outcome were to occur. Post election there is no rest for the weary with the FOMC rate decision on Thursday followed by CPI releases the following Wednesday – both of which are very important as the market looks for clarity on monetary policy given the data dependent Fed.

We feel the risks for a shallower and shorter easing cycle continue to rise given the trends of the recent data. The November employment data, while weaker than expected was rife with noise from the Boeing strike and the hurricanes. The category of "The Category of Workers Unable to Work Due to Bad Weather" was 512,000 versus the 55,500 norm - so clearly the hurricanes had an impact on payrolls and is likely to be corrected higher as we move ahead. Given the continued resilience of the US economy including continued strength from the consumer and a still healthy labor market, the risks to a higher terminal rate keep growing. We still currently forecast one to two cuts to close out 2024 however if the positive momentum in data continues we could see a significant slow down in the length and pace of rate cuts in 2025.

Macro indicators roadmap

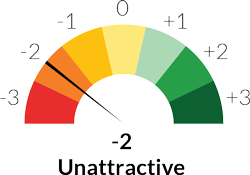

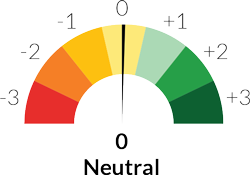

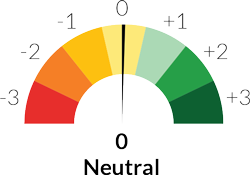

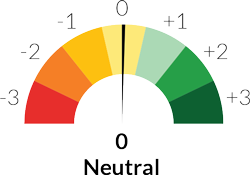

At a glance SCORING

A -3 to +3 range is utilized, with -3 being the most bearish (negative) and +3 being the most bullish (positive).

| Category | Description | Nov 2024 | Bearish (-3) | (0) | Bullish (+3) |

| Valuations Historical and current spreads | -2 | |||

| Rates / Duration Global yields | 0 | |||

| Macroeconomics Economic growth outlook | 0 | |||

| Monetary policies Global central banks | 0 | |||

| Geopolitics Identify global risks | -2 | |||

| Fundamentals Corporate leverage and outlooks | 0 | |||

| Technicals Demand factors | +2 | |||

| Source: Mesirow Strategic Fixed Income | Each category is scored on a monthly basis indicating the overall risk each macro indicator could have on markets. For informational purposes only, and does not contend to address the financial objectives, situation, or specific needs of any individual investor. Any information is for illustrative purposes only and is not intended to serve as investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. Results will vary, and no suggestion is made about how any specific solution or strategy performed in reality. Past performance is not necessarily indicative of future results. | ||||

Valuations

Spreads across most asset classes now sit within striking distance of year to date tights with the exception of Agency mortgages which have struggled recently given higher rate volatility. Since mid September, spreads in Corporates (-14bps), Taxable Municipals (-7bps), CMBS (-10bps) and ABS (-8bps) have all taken another leg tighter given a positive overall risk tone with the start of the Fed cutting cycle, as well as a supportive technical backdrop and attractive yields which have risen about 40 basis points over the last 4-5 weeks.

Valuations are now only a touch off the recent tights and certainly feel a touch heavy heading into November. However, even with spreads near the tights, favorable technicals continue to support the market and are keeping spreads from breaking out. Demand for high quality investment grade bonds remains strong with an impressive string of inflows over 12 of the last 13 weeks, bringing in over $24 billion into the asset class since early August. Further, yields remain well above historical norms which should keep institutional buyers involved while attractiveness for foreign buyers remains near the peaks of the year which should provide yet another backstop to spreads.

Finally, supply has been relatively muted and looks manageable into year end with forecasts for Corporates around $130-$140 billion for the remainder of 2024. This level of supply would be easily absorbed given this would only be around $35-$40 billion on a net basis based on estimates for maturities and coupons to close out the year. Despite tight valuations and heightened geopolitical risks, particularly with the upcoming US elections, we expect the technicals and attractive yields to continue to reign and will keep the market range bound through the US election.

Rates / Duration

The September FOMC meeting kicked off an easing cycle, which in hindsight came at a time of better-than-expected economic data and a slower decline in CPI. Rates markets bottomed around the meeting, with all rates up since the cut. Since the FOMC kicked off their easing cycle at the September meeting, rates are up 60-70 basis points across maturities, with about half of the rise coming from real yields and the other half from inflation expectations. Real yields were impacted by economic data and investors pricing out two to three of the central bank cuts forecasted over the next 18 months. Further, a spike in implied volatility weighed on rate-sensitive markets as the next 4 weeks includes the US election and top-tier economic data on the labor market and inflation.

Clarity on the election, or even just the event risk passing, should allow markets to return to pricing fundamental macroeconomic data. Although the much-anticipated recession seems delayed yet again while the markets are still deciding between a soft-landing or no-landing scenario. Growth has remained resilient, but the last leg of the normalization of inflation may prove to be trickier. Markets now expect overnight rates to settle around 3.50% by the end of 2025, up from 2.875% just a few weeks ago. Investors and corporations have been surprisingly quiet during this election cycle. However, expectations are for this to change after the polls have closed.

Macroeconomics

The summer softening in the labor markets and continued downward trend in CPI led the FOMC to cut rates by a larger than expected 50 basis points in September. Unfortunately for the Fed, it turns out this was the bottom in interest rates and in many instances, the low for weakening economic data in the US. Since kicking off the easing cycle, some measures of inflation have stabilized, while labor markets rebounded with an above expectations jobs print, declining initial jobless claims and continued low layoffs. China, which continues to slow by all measures, finally caught the attention of PBOC officials and more importantly, Prime Minister Xi. A large round of stimulus was announced to both arrest the decline in equity and housing markets, but also to boost consumer spending. A resilient US consumer and a potential increase in activity in China will be watched closely regarding future growth and inflation impacts while markets will also be digesting domestic policy implications post the election.

The labor market continues to cruise along with strength across most metrics. September payrolls beat nearly all expectations with a very strong +254K, after averaging only +140 over the prior three months. Further, initial jobless claims have been relatively steady with the 12-week average coming in at +231k, even with spikes from the hurricanes as well as strikes at the ports and Boeing. Job openings continue to fall, returning to a more normal relationship of 1:1, while the quits rate is also dropping signaling a tighter labor market. Away from labor, the housing market remains at multi-decade lows in turnover, as nearly 65% of homeowners are locked in lower rates which continues to crimp supply while affordability is as bad as it has been in over 40 years. Inflation continues its downward trajectory albeit at a slower pace than earlier this year. As of now, a return to the Fed’s 2% target is on track for the first half of 2025 but will be monitored closely as there are risks to the upside.

Monetary policies

The US economy continues to expand at a solid pace and has been able to do so with continued declining core inflation. US GDP grew at 2.8% in 3Q24 however inflation has continued its downward trend with goods prices falling, home prices still positive but slowing and services inflation steady. The continued downward trend in inflation as well a period of modest labor market weakness gave the FOMC comfort to begin the easing cycle with a stronger than expected 50 basis point cut in September.

As it turns out, the September FOMC was the low in yields and the peak in forecasted rate cuts. At the time of the meeting, the market had priced in 10 cuts through the end of 2025, including five to six cuts in 2024. However, since the September meeting the economic data has improved with better payroll data as well as a slower pace of CPI deceleration. This has led to a repricing of expectations where markets now forecast only four cuts in 2024 (to 4.375%) and a total of eight cuts through the end of 2025, bringing the rate to 3.625%.Treasury yields have risen nearly 60 basis points since the September FOMC meeting with about half due to a rise in real yields, given central bank policy and stronger growth, with the other half due to renewed inflation expectations. We feel the risks for a shallower and shorter easing cycle continue to rise given the trends of the recent data. It appears the market may have extrapolated one weaker labor report and focused on more blunt and simple market indicators such as the Sahm rule to build a growing rhetoric that the Fed may be behind the curve in their monetary policy approach. However, given the continued resilience of the US consumer which included the highest level of consumer spending since early 2023 as well a still healthy strong labor market, the risks to a higher terminal rate keep growing. We still currently forecast one to two cuts to close out 2024; However, if the positive momentum in data continues, we could see a significant slow down in the length and pace of rate cuts in 2025.

Geopolitics

Tensions between US-China continue to deteriorate and remain on a negative trajectory. US-China relations are unlikely to improve ahead of the presidential election, and the US is finalizing a series of new tariffs on Chinese products to go along with existing restrictions on investment in China. Independence of technology continues to be a priority for both, showing the deepening fragmentation between the two world powers. Additionally, Taiwan continues to be a volatile point between the two nations and would have a significant global economic impact.

Long-time tensions between Israel and Palestine have exploded into full scale armed conflict. The war is divisive across NATO, introducing spill-over impacts to other global conflicts particularly between the US and China-Russia. Additionally, there is risk of further spillover into the broader region, which accounts for roughly 1/3 of global oil production and would have negative inflationary impacts around the globe. While this has largely been contained as neither side seeks all-out war, Iran has indicated it will now retaliate directly against Israeli attacks in the region. This is expected to escalate with the expectation for an attack on Israel following an assassinations of Hezbollah military chief, Fuad Shukr, in Beirut and the killing of Hamas political chief, Ismail Haniyeh, in Tehran.

Russia’s war with Ukraine is now entering its 32n month and tensions remain high. There has been a clear escalation in recent weeks as North Korea deployed troops to Russia to support their war in Ukraine. Further, Russian lawmakers ratified a pact with North Korea to provide support using “all means” if either party is attacked. Political and economic conflicts between the West and Russia remain elevated, keeping the risk of an escalation with NATO and Russia elevated. The G7 recently acted to free up additional support for Ukraine while Russia is receiving significant military support from Iran and North Korea as well as major financial backing from China. A ceasefire or diplomatic solution is unlikely with the conflict expected to run into next year.

Fundamentals

Investment grade corporate credit quality remains stable as the segment continues to experience overall positive ratings trajectory. The 2Q earnings cycle saw positive revenue and EBITDA growth, and we have seen more of the same thus far for the 3Q24 earnings releases. About 40% of companies have reported 3Q data which has seen a +8.6% YoY earnings growth for core public US investment grade issuers, ex. Energy and Finance, which is above expectations. Revenue and EBITDA growth continue trend positively for a second straight quarter, debt levels rose at a slower pace while leverage ratios have largely improved or stabilized. Certainly, revenue growth and operating margin expansion has partially offset rising interest expense and anchored credit metrics at historically healthy levels despite moderation from an abnormally strong post-Covid peak. However, we now find ourselves at the inflection point from which we turn more cautious with respect to fundamentals.

As pricing-driven topline growth stalls while companies simultaneously continue to issue at higher rates to refinance debt, fund capex and share repurchases, we expect broader deterioration in credit quality. While high quality credits will be relatively more insulated, we see pockets of elevated risk born of shifts to aggressive financial policy and M&A in an effort to buoy shareholder sentiment. This reinforces our view that active credit selection will return as the primary driver of excess returns across the rating spectrum going forward.

Technicals

There continues to be strong demand for high quality bonds with 38 out of 44 weeks seeing positive mutual fund flows bringing in over $67 billion to the asset class year to date. The demand for investment grade has been propped up by attractive yields, which remain well above historical levels and sit at the highest level since July after the latest sell off in rates. However, higher yields can be of a double-edged sword for spread products.

On the positive side, higher yields are more attractive to buyers and tend to discourage issuers from coming to mark resulting in lower supply. However, it can also be accompanied by a pick up in rate volatility which tends to keep investors on the sidelines - which is undoubtedly the case this time as rate volatility currently sits at the highest level in over a year. Away from Corporates, ABS technicals remain supportive with market demand easily supporting the uptick in supply. ABS spreads have performed well and look modestly more attractive given their high quality and remain further off the recent tights than competing asset classes. Mortgage technicals remain mixed with lower supply battling a continued lack of traditional buyers although some relief in regulatory changes at banks could free up some capital as we move ahead. Spread products are likely range bound in the near term as we approach the US election, with risks for greater volatility should either party sweep.

Asset class scoring

A -3 to +3 range is utilized, with -3 being the most bearish (negative) and +3 being the most bullish (positive).

| Rates / Duration | Agency / Supranationals | Municipals | MBS | ABS | CMBS | Corporates | High Yield | ||||||||

| Asset class view | |||||||||||||||

| 0 | -1 | +1 | 0 | +1 | +1 | 0 | -1 | ||||||||

| Source: Mesirow Strategic Fixed Income | |||||||||||||||

Portfolio impact

| Monthly impact | Sector | Overall position | Comments |

| Rates / Duration | Overweight | Duration neutral to benchmark post the Fed's aggressive cut; labor and inflation data will continue to drive rates as the FOMC remains data dependent; we have likely reached a peak in rate and any selling of spread sectors will be invested in Treasuries | |

| Agency / Supranationals | Underweight | Valuations remain rich; however, we would look to add on widening or primary issuance at a concession; minimal change, if any | |

| Municipals | Overweight | Spreads have moved back near the tights; valuations are full but we favor the higher quality/safe-haven nature of the asset class and will maintain our overweight to the sector | |

| MBS | Neutral | Neutral agency mortgages given the mixed negative technical backdrop; currently an unattractive entry point with spreads near the tights; as the market gains clarity on the Fed rate path we would add as it would likely result in lower volatility and tighter spreads | |

| ABS | Overweight | Heavy supply in ABS has been met with decent demand although we expect the supply calendar to remain full; the consumer remains in decent shape, and we remain overweight given the high-quality nature of AAA ABS | |

| CMBS | Underweight | Remain underweight with continued headline risk and uncertainty around e-financing risk in many commercial real estate sectors; falling 10Y rates would create some relief and create potential opportunities in the coming months | |

| Corporates | Overweight | Remain modestly overweight but will continue to reduce positions that have reached valuation targets and offer little upside; focus will be on companies with stronger balance sheets and lower event risk as we forecast slowing growth in 2H24 | |

Source: Mesirow Strategic Fixed Income. The material is for information purposes only. It is not intended for and should not be distributed to, or relied upon by, members of the public. It is not intended to be a forecast, research or investment advice, and is not a recommendation, or an offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are subject to change. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be and should not be interpreted as recommendations. Reliance upon information in this material is at the sole risk and discretion of the reader. The material was prepared without regard to specific objectives, financial situation or needs of any investor. Past performance is not a reliable indicator of current or future results. | |||